-

SoftBank creator Masayoshi Boy has actually invested his life placing strong bank on the future of innovation.

-

A brand-new publication graphes the trip of the Japanese entrepreneur from social castaway to the peak of the technology field.

-

BI talked to Lionel Barber, the writer that rose near Silicon Valley’s best disruptor.

On a night at the turn of the centuries, Masayoshi Son had a stimulating message for the business owners that crowded to Tokyo’s Roppongi area.

” Japan is undergoing its largest social turmoil because the Meiji Reconstruction,” he claimed with particular grandiosity. “Allow’s make it to make sure that a millennium from currently, individuals will certainly review our time and keep in mind that the type of culture they’re staying in was produced by us today.”

SoftBank, the media-technology empire Boy established twenty years prior, was riding high up on the magnificence it obtained in the dot-com boom. Boy himself had actually quickly seen his riches go beyond that of Costs Gates in the age’s craze; he was the globe’s wealthiest individual for 3 days. Currently, he prepared to see a brand-new generation imitate his success.

It’s a tale that Lionel Barber, the previous editor of The Financial Times, states in his brand-new publication “Gaming Male: Bush Experience of Japan’s Masayoshi Boy.” Over 335 web pages, he graphes the trip of the 67-year-old– recognized to numerous as Masa– from a life in hardship to an excessive profession wagering all of it on innovation.

From his very early years dispersing software program, he would certainly take place to develop a telecommunications realm and mint a near-$100 billion investment fund that would certainly sprinkle cash on every little thing from Uber to WeWork.

For Barber, that has actually stood in person with leaders like Vladimir Putin at the Kremlin and Barack Obama in Washington, the appeal of Boy was basic. “This is a tale of our times,” he informed Service Expert. “The economical cash, utilize, innovation– he’s ridden this wave right from when he began with software program circulation, which has actually permeated every facet of culture.”

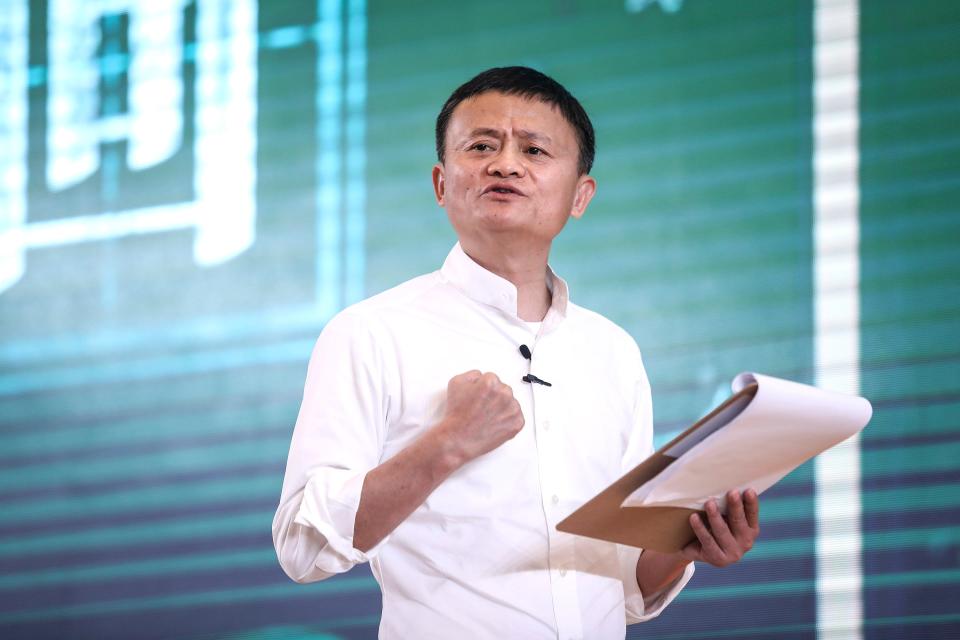

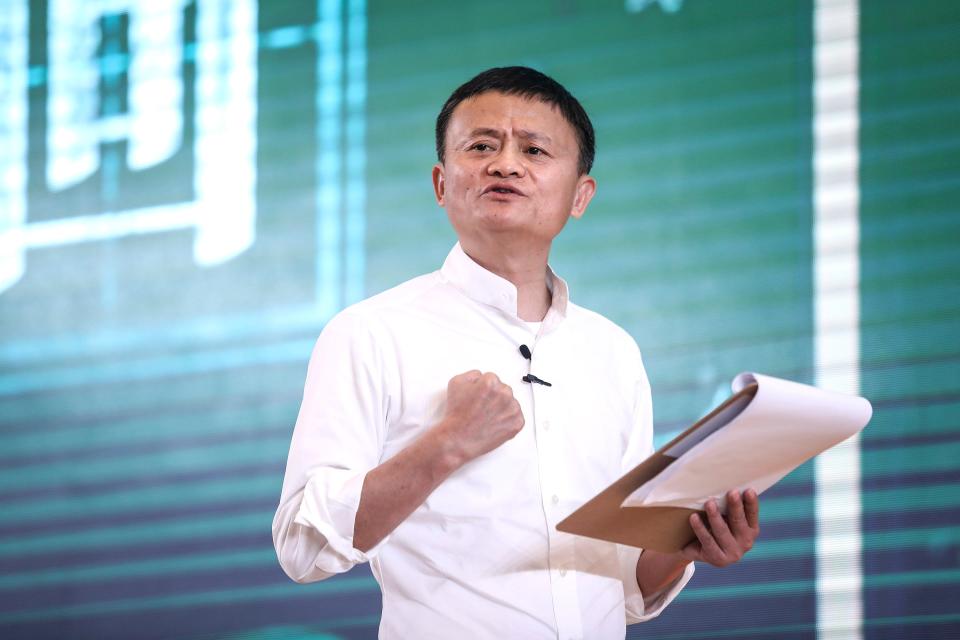

As background programs, the hopes and fantasizes the SoftBank creator shared for the future that night 24 years earlier would certainly collapse back to truth days later on. Having actually made a murder from an early $20 million bet on Jack Ma’s Alibaba and taking a share in Yahoo, Boy will see a quantum leap in lot of money as SoftBank’s supply collapsed.

By March 2000, the dot-com bubble would certainly break completely.

That claimed, Boy’s embarrassment then would certainly not quit him from going after visions of remarkable range over and over, also if it implied difficult drops were ahead again. This is the profession of a guy whose passion has actually taken him to the verge and back.

And indicators recommend he’s refrained from doing right now.

Social pariah to innovation dreamer

Son’s rise to what Barber calls a “area at the actual peak of the worldwide plutocracy” was rarely ensured.

Though he’s currently worth practically $17 billion, possesses a manor compared to Batman’s Wayne Estate, and areas himself amongst a colleagues of Napoleon Bonaparte, Genghis Khan, and Qin Shi Huang, the very first Emperor of China, Boy was birthed in August 1957 to Koreans “on a dust track without any name” on the Japanese island of Kyushu, according to guide. It states that “Masa’s earliest memories were the scent of pigs and the noise of vapor trains burping residue and smoke which loaded his makeshift home.”

Discrimination belonged of his youth, as well, with postwar Koreans staying in Japan identified “Zainichi”– a term made use of as a pejorative to classify the ethnic minority as second-class people. For Boy, being birthed in hardship implied his very early years included a pariah-like experience.

Nevertheless, as Barber notes, the more youthful Boy would certainly take place to appreciate a future audience with the 45th President of the United States and court royals in Riyadh. He would certainly, a lot more notably, play a crucial duty in changing the innovation field from a particular niche rate of interest of computer system obsessives right into a worldwide pressure that transforms the globe economic situation.

In Barber’s informing, a couple of essential variables drove Boy down this course. His inaugural check out to the United States, where he went to Berkeley, accompanied the microprocessor transformation. Like Microsoft’s Gates, he asserts to have had a revelation after seeing the Intel 8080 microprocessor for the very first time in a duplicate of the Popular Electronic devices publication; he visualized a future in which the globe might someday be powered by silicon.

Nevertheless, self-conviction in his very own “brilliant” seems most importantly. Incorporated with his outsider standing, Boy was a boy with a chip on his shoulder. Going to Boy’s dad, Mitsunori Boy– designer of a gambling business built on arcade pachinko machines— at their household home, Barber remembered exactly how it seemed like a temple dedicated to their child. “He was dealt with like a princeling from the first day and acted like a princeling. He was informed he was unique,” Barber informed BI.

The very early years are essential to recognizing exactly how Boy came to be busied with unwieldy passion that would certainly take him as well near the sunlight time after time. He made his very first significant bank on his very own brilliant when he established SoftBank in 1981. It was the begin of a two-decade phase specified by prominent experiences with the similarity Rupert Murdoch, Larry Ellison, and Jack Welch, procurements amounting to billions of bucks, and an all-or-nothing perspective towards development.

Back then, Boy belonged to an “arm-waving web prophet,” Barber claimed, that designed the concept of dispersing software program. Years later on, when Japan’s economic situation started to collapse, he swiftly navigated a go back to the United States, where he purchased huge possessions such as the then-popular technology trade convention Comdex, getting to the deep Silicon Valley networks that featured it.

Though it finished with an amazing collision, Boy balanced out the damages that left SoftBank “practically damaged” by functioning 18-hour days, 7 days a week, to bring the high-speed broadband transformation to Japan in the 2000s.

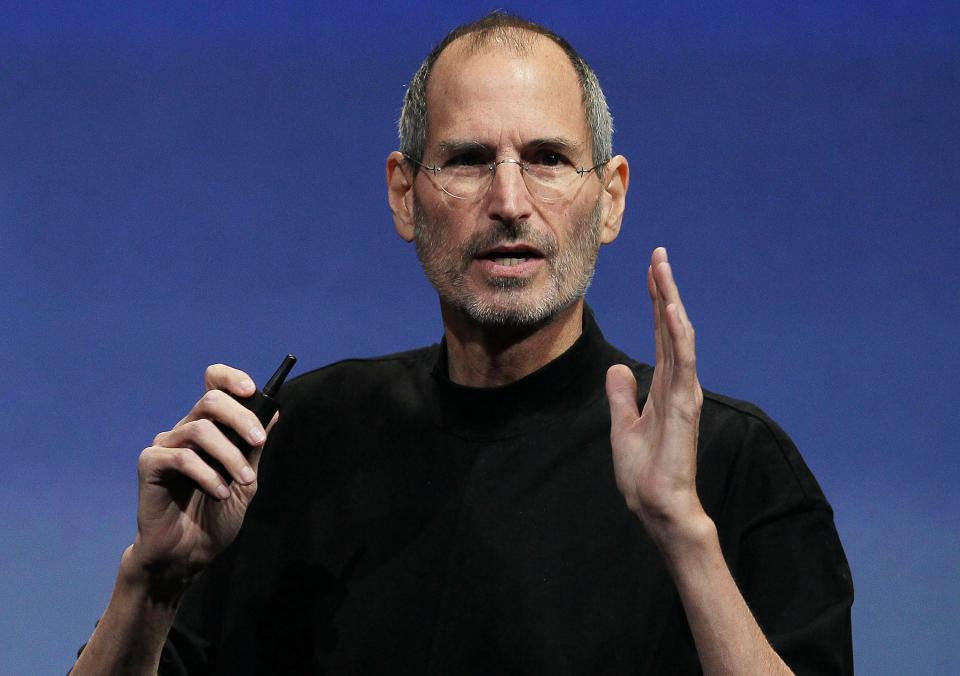

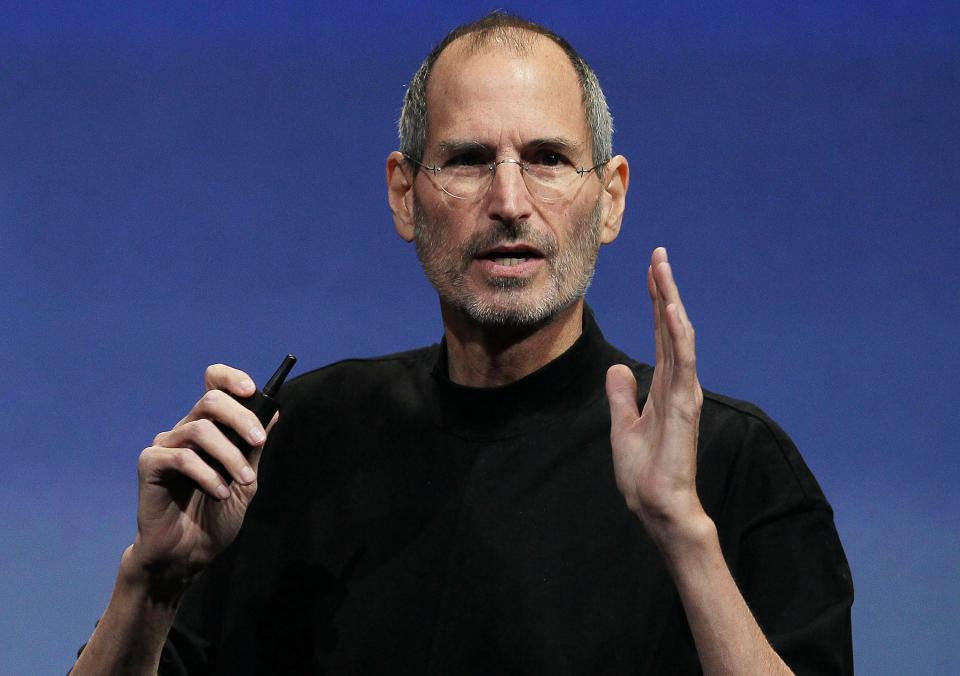

An aiding hand from Steve Jobs, that he initially fulfilled at the Comdex profession fair in Las Las vega in the 1980s, additionally came as SoftBank struck an unique service provider sell Japan for the apple iphone from 2008 to 2011. It offered him a pole position to the mobile phone boom.

This cycle of fluctuate has actually made an interested reappearance throughout Boy’s profession. As Barber places it, Boy is a casino player, which suggests his life has actually adhered to an acquainted pattern that goes something similar to this: “A snowstorm of concepts adhered to by extreme excitement and emphasis, bring about overreach, failing, and attrition– till the entire procedure began again once again.”

He is additionally a person Barber regards callous, a competitor with a fondness for the “insane” that rests up in arms with the picture of an extra reluctant and uneasy leader that the billionaire has actually commonly provided to the general public.

No place have actually these aspects revealed themselves greater than they have actually carried out in Boy’s management over SoftBank 2.0.

A betting guy with $100 billion to have fun with

In 2010, as the globe was choosing itself up from the economic collision, Boy invested a great deal of time thinking of 2040. He needed to know exactly how innovation would certainly form culture in thirty years’ time.

He wrapped up that the tech-enabled details transformation ought to indicate “joy for everybody.” Back then, however, Boy was obtaining burnt out of being a driver– it was time to be a “grand financier.” In Barber’s analysis, this is a duration in Boy’s life that demonstrates how he’s “fairly with the ability of severe hardball” to obtain what he desires while leaving himself totally prone to those that could risk to fantasize as huge as he does.

Go Into the Vision Fund. Rajeev Misra, a former trader at Deutsche Bank that benefited from a massive brief wager versus the subprime home loans at the facility of 2008’s economic disaster, was generated to aid lead Boy’s financial investment fee. So, as well, was Nikesh Arora, a “fast-talking” previous Google exec retreated from a $50 million-a-year bundle.

In the context of conventional Japanese business life, these hires were overall abnormalities. Yet Boy’s choice to bring them aboard indicated the strong press he prepared to make. Buoyed by the reputation obtained from the 2014 IPO of Chinese e-commerce giant Alibaba, Boy touched Misra’s connections to riches funds in the center East to increase a consolidated $60 billion from Saudi Arabia’s Public Mutual fund and Abu Dhabi’s Mubadala.

Specifically, for Mohammed container Salman, Saudi Arabia’s ruler-in-waiting that led talks with SoftBank, Boy’s suggestion offered him the possibility he looked for to offer himself in the house as a royal prince with a strong prepare for the future. “He intends to be viewed as the terrific modernizer changing this petrostate right into a genuinely contemporary economic situation where innovation goes to the leading edge,” Barber informed BI.

At some point, practically $100 billion was elevated for a start-up spending car referred to as the Vision Fund, which brought unimaginable mayhem to the innovation field. Silicon Valley’s largest funds prior to after that were no larger than a couple of billion bucks, and SoftBank prepared to outbid them all to lead smash hit financial investment rounds. Michael Moritz, lead companion at Sequoia Funding at the time, compared Boy’s toolbox of resources to Kim Jong Un’s global ballistic rockets. Did Boy care? Barber assumes not.

Yet as previous cycles in Boy’s life determine, the flurry of excitement is commonly adhered to by failing. Though he confirmed himself to be callous in the $32 billion procurement of chip developer Arm in 2016– its shares are up practically 200% because being re-listed in 2014– he would certainly drop victim to the beauties of WeWork cofounder Adam Neumann.

The Israeli business owner, that Boy welcomed right into the rear of a taxi while en course to see Donald Trump, would at some point create him difficulty. Billions of bucks of financial investment were melted as the workplace firm impersonating as a technology one crumbled. A SoftBank bailout of WeWork cost $9.5 billion in 2019.

It had not been the only error. SoftBank-backed Wirecard imploded after the Financial Times revealed massive fraudulence at the German repayments service provider. Greensill Funding, a supply chain money company that crumbled, compelled the Vision Fund to make a note of a $1.5 billion financial investment.

Safeguarding his record in 2020, Son said Jesus was misunderstood.

As the misfires have actually installed, movie critics have actually placed Boy’s effective wagers throughout the years to good luck. In Barber’s sight, the image is a lot more complex. He informed BI that he sees an “smart mind planning ahead, expecting,” however additionally a careless impulse to “place a chip on every board.” There is a visionary that co-exists with a “gaming addict.”

Barber’s publication comes with a vital time. Considering That the launch of ChatGPT, the innovation sector has actually made expert system its main emphasis, with an arms race underway amongst worldwide firms wishing to make smarter variations of the innovation. For Boy, an AI compulsive long prior to the present age of generative AI chatbots, it’s a minute that appears custom-made to his needs. Yet he has actually been sluggish to match that with the strong wagers he has actually ended up being recognized for.

While SoftBank looked after Arm’s IPO in September 2023 and gotten chip company Graphcore in July, it has actually not yet purchased firms establishing the huge language versions powering the present boom, such as OpenAI or Anthropic. In 2019, it discarded its almost 5% risk in Nvidia, the chip titan currently worth over $3 trillion.

Still, it’s difficult not to see a splurge coming quickly. In June, the SoftBank manager informed investors past financial investments were “simply a workout” for the AI age. It’s not a surprise to Barber, that sees Boy as never ever pleased.

” He’s certainly obtained one more act,” Barber claimed. “There’s no doubt.”

‘ Gaming Male: Bush Experience of Masayoshi Boy’ by Lionel Barber is released by Allen Lane on October 3 in the UK, and Atria/One Signal Publishers in January 2025 in the United States.

Check out the initial write-up on Business Insider

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.