Liquidity is forecasted to rise right into the crypto market in the 4th quarter of the year, producing a desirable setting for a possible allegorical rally in both Bitcoin (BTC) and altcoins. This increase of funding might drive costs higher as financiers seek to profit from the expected energy.

Today, Bitcoin’s rate rose previous $65,000, noting a substantial turning point. Nevertheless, according to a current record, this surge is simply the start of a possibly large rate boom. The expected rise is most likely sustained by the return of retail financiers and an increase of billions of bucks from the Chinese market.

Extra Resources Method Extra Upside for Bitcoin, Alts

Bitcoin’s current dive might be credited to the 50 basis factor Fed price Cut previously this month. Nevertheless, the top cryptocurrency is not the only possession taking advantage of the choice.

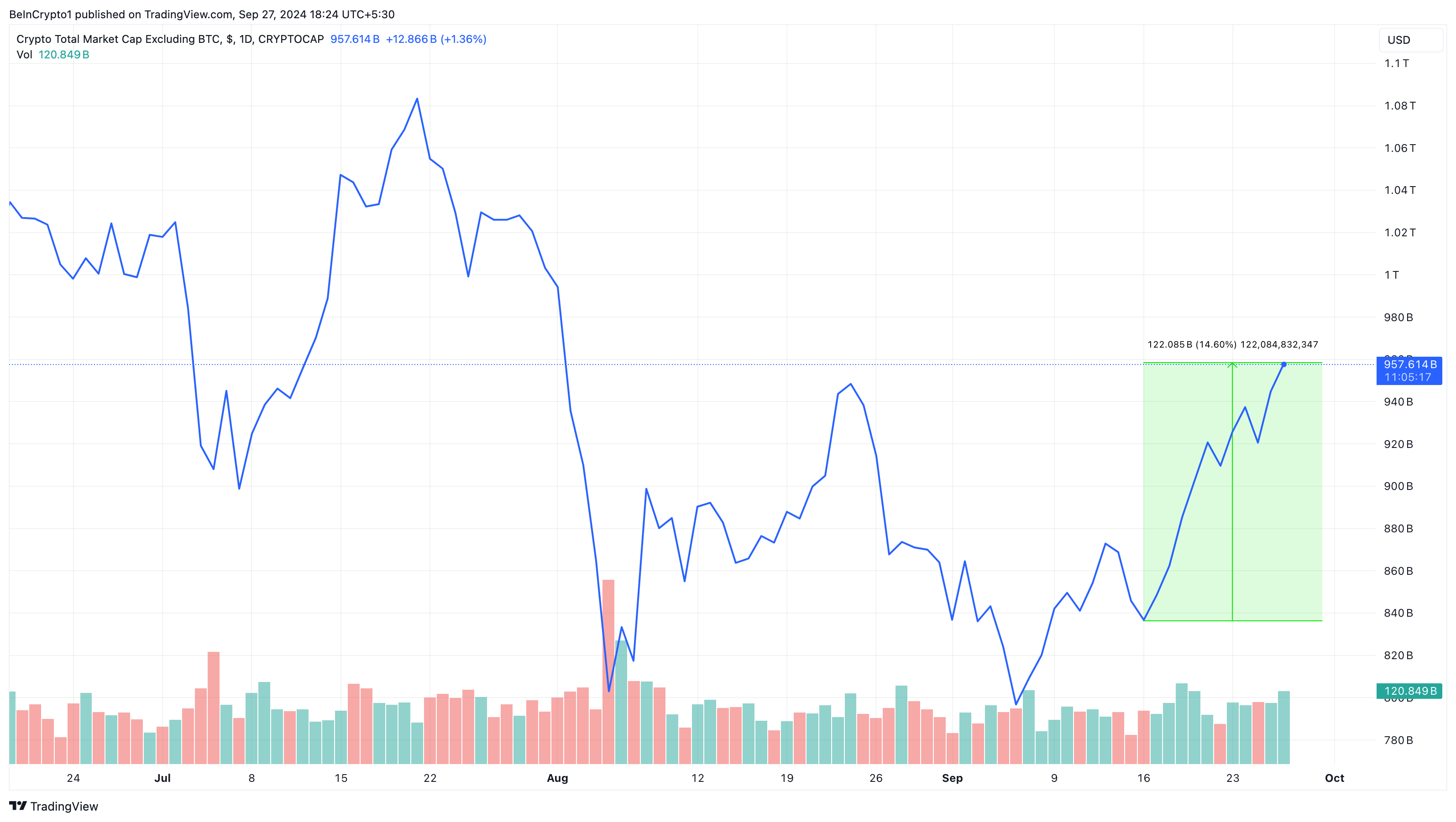

Because the price cut, altcoins, which sustained a long term drop for the last 2 quarters, have actually currently taken pleasure in substantial rallies. In spite of the better market problem, 10x Research study, led by expert Markus Thielen, thinks the current gains are absolutely nothing contrasted to what’s being available in Q4.

” Altcoins are blowing up. Additional advantage shows up most likely as stablecoin minting increases and Chinese OTC brokers report billions in inflows. With Bitcoin damaging over $65,000, we prepare for a speedy approach $70,000, complied with by brand-new all-time highs in the close to term,” Thielen said in the September 26 record.

While Bitcoin’s supremacy has actually dropped, the overall market cap of altcoins has actually boosted by 15% because September 17.

Nevertheless, the current decrease in BTC’s supremacy does not suggest that the coin rate will certainly remain to reduce. In 10x Research study’s record, Theieln pointed out that Bitcoin might acquire from a fresh $278 billion funding shot from the Chinese market in Q4.

” The $278 billion Chinese stimulation strategy might stir up an allegorical rally in cryptocurrency costs, sustained by raising international liquidity,” the record mentioned.

If that occurs, after that Bitcoin’s rate might get to $70,000 prior to October, famously called “Uptober,” shuts. One more fascinating spin to the issue is the climbing involvement of retail financiers.

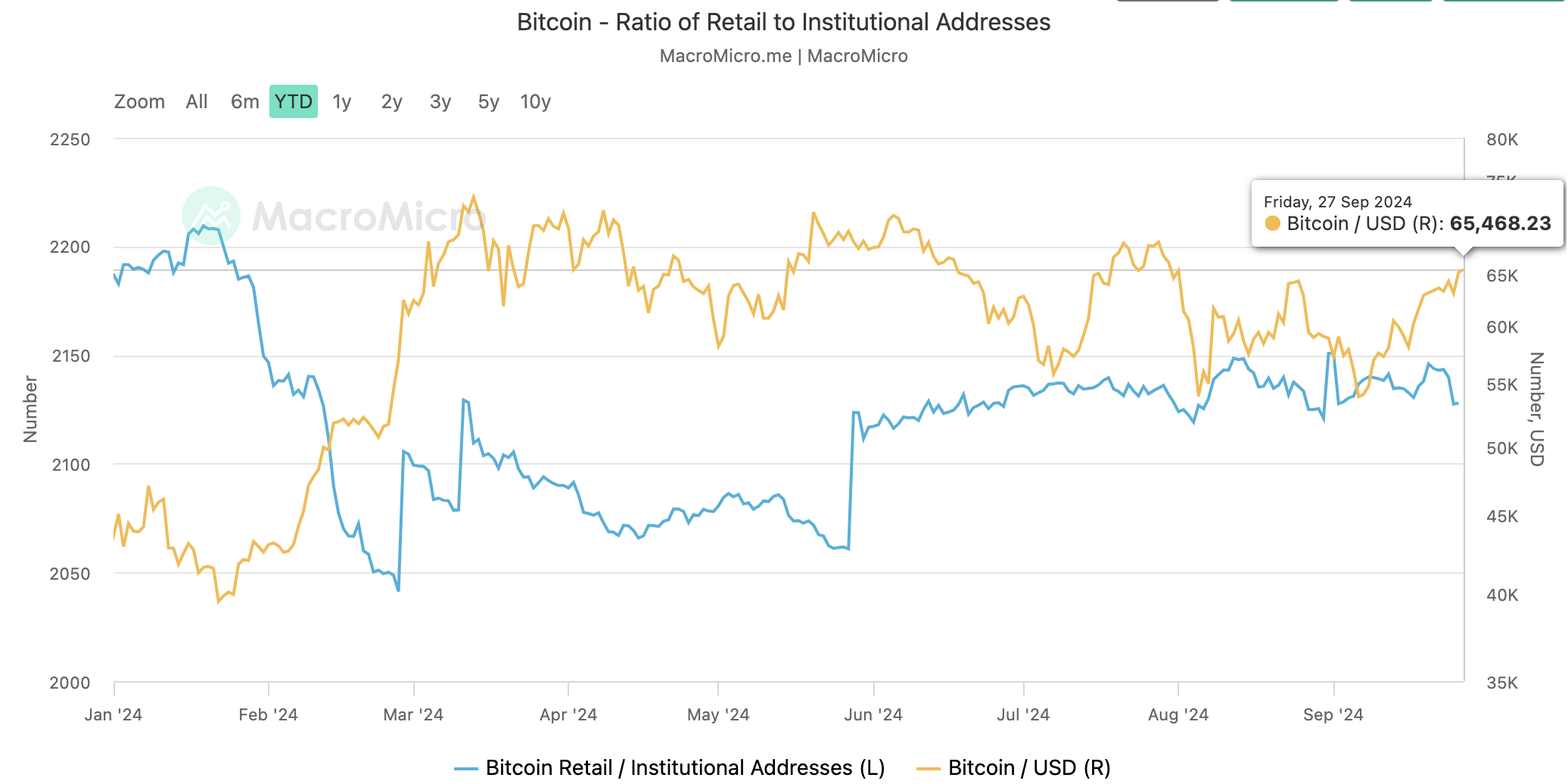

For a lot of this year, retail financiers have actually depended on the sidelines as institutional financiers have actually pressed BTC’s rate to its all-time high (ATH). Nevertheless, since this writing, points have actually transformed as the retail to institutional addresses have actually boosted.

Learn More: 10 Finest Altcoin Exchanges In 2024

Retail Returns and Institutions Can Wager Even More

This rise is helpful not just to Bitcoin yet likewise to altcoins. For instance, the costs of altcoins like Shiba Inu (SHIB) have actually rallied by 41% in the last 7 days. SEI’s rate has actually leapt by 31%, and similarly– Wormhole (W).

Surprisingly, 10x Research study likewise concurs, keeping in mind that the relocation appears to be beginning with South Korea. With this advancement, it shows up that the Chinese $278 liquidity, along with substantial market involvement from the Oriental area, might play a big duty in the forecasted increase for the remainder of the year.

” Retail crypto trading task in South Korea sustains this fad, with day-to-day trading quantities currently floating around $2 billion. Although still listed below the shocking $13 billion seen in very early March 2024– when crypto quantities were dual that of the regional securities market, and Shiba Inu, sold Korea, alone got to virtually 40% of the securities market’s quantity– altcoins have actually controlled trading in the previous week, going beyond Bitcoin,” 10x Research study created.

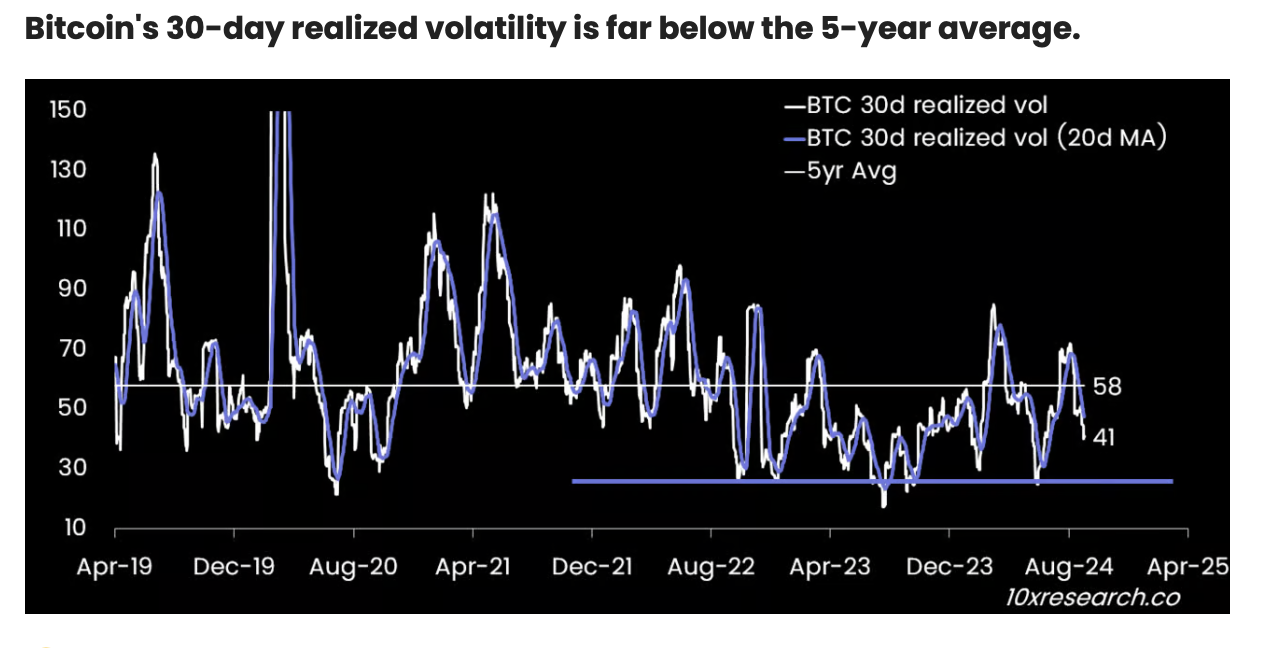

On top of that, Bitcoin has actually signed up a decrease in its 30-day recognized volatility. This decrease suggests that institutional financiers can raise their placement dimension, as a result bring about BTC and the boundary market to greater worths.

BTC Rate Forecast: It’s Seemingly a Favorable Cycle

From a technological perspective, Bitcoin has actually ultimately damaged over the coming down network. Because July, this bearish pattern has actually limited the coin from climbing previous $65,000.

Nevertheless, with assistance at 62,825, BTC effectively breached the area. According to the day-to-day graph, Bitcoin’s rate could currently deal with resistance at $68,253, which is a significant sight. Damaging this difficulty might be essential to climbing towards $73,095.

If that occurs, after that BTC could get to a brand-new ATH prior to Q4 ends, with prospective targets beginning with $76,075.

Learn More: Just How To Purchase Bitcoin (BTC) and Whatever You Required To Know

Nevertheless, the denial of $68,253 might revoke this forecast. Must that take place and the crypto market liquidity falls short to grab, Bitcoin’s rate could go down to $58,188.

Please Note

According to the Count on Task standards, this rate evaluation write-up is for informative objectives just and must not be taken into consideration economic or financial investment suggestions. BeInCrypto is dedicated to precise, objective coverage, yet market problems undergo alter without notification. Constantly perform your very own study and seek advice from an expert prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.