Chinese supplies are rising after China introduced a brand-new stimulation strategy, and the China-focused Franklin FTSE China ETF (FLCH) might have a lot of upside in advance.

We declared on FLCH previously this year and the ETF has actually carried out well ever since, yet I remain to think there is even more advantage in advance. I’m favorable on FLCH based upon the freshly introduced stimulation for the Chinese market, the small evaluation of its holdings, its diversity, and its reduced charges.

What is the FLCH’s Approach?

According to Franklin Templeton, FLCH “offers accessibility to the Chinese stock exchange, enabling financiers to exactly obtain direct exposure to China at an inexpensive.”

FLCH is an index fund that buys large-cap and mid-cap Chinese supplies.

Why are Chinese Supplies Skyrocketing?

Today, China’s reserve bank introduced its biggest financial stimulation given that the COVID pandemic. Not just is China’s reserve bank decreasing its benchmark rate of interest by 0.2%, it is likewise decreasing the degree of cash money that Chinese financial institutions are needed to keep in get and providing cash money to Chinese banks to make sure that they can increase their acquisitions of Chinese equities.

While some onlookers really feel a lot more requires to be done, the actions need to aid to enhance China’s economic situation and offer a lift to Chinese supplies. Other TipRanks author Sheryl Sheth offered a checklist of very ranked Chinese supplies a couple of months earlier.

A Take a look at FLCH’s Holdings

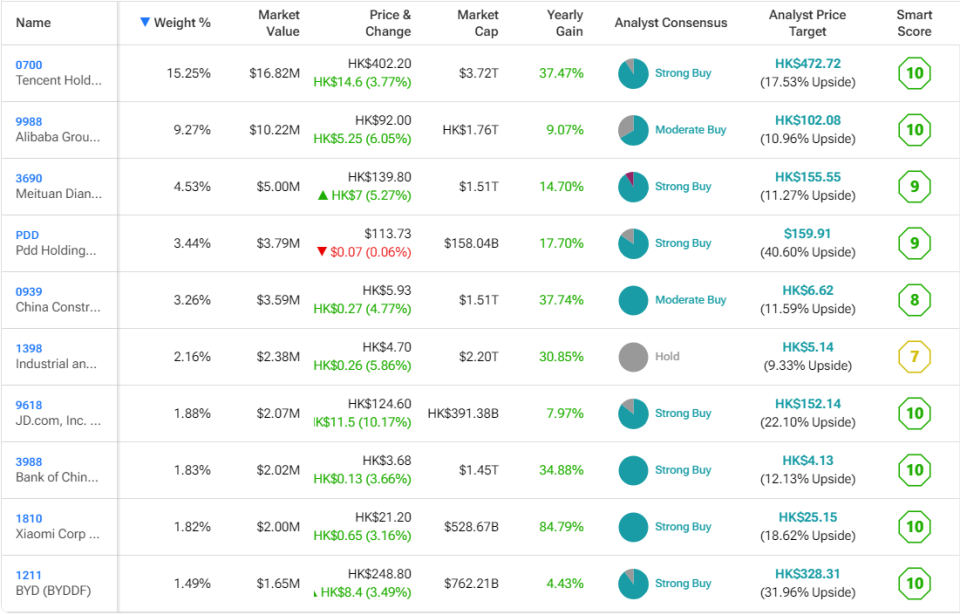

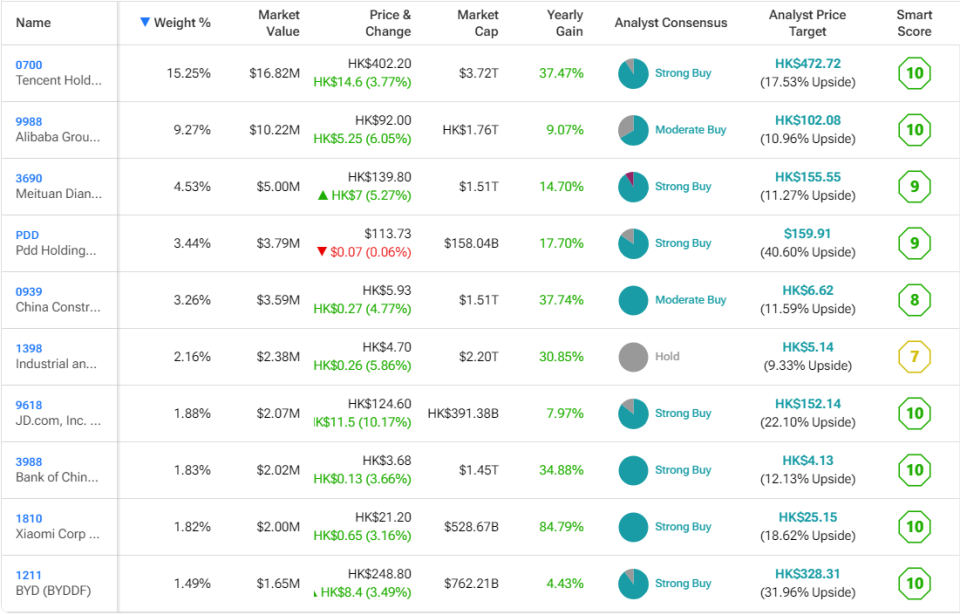

FLCH provides financiers solid diversity. The fund holds 952 supplies, and its leading 10 holdings represent a practical 44.9% of possessions. You can look into a review of FLCH’s leading 10 holdings from TipRanks’ holdings device listed below.

It deserves keeping in mind is that while the fund is typically well-diversified, it has fairly a big direct exposure to its leading holding, Tencent (TCEHY), which brings a big weighting of 15.3% as a result of that business’s huge dimension.

Along with Tencent, the fund’s leading holdings consist of a lot of the various other large-cap Chinese net and ecommerce supplies that have actually ended up being house names to lots of united state financiers such as Alibaba (BABA), PDD Holdings (PDD), and JD.com (JD). The fund is rather branched out when it pertains to the markets it has direct exposure to, as customer optional comprises the biggest weighting (30.0%), adhered to by interactions solutions (19.9%) and financials (17.9%).

The Rally has Area to Run

The main reason that I think that FLCH and its holdings need to have a lot of space to run, also after the current rally, is fairly just as a result of what I view as low-cost appraisals. Chinese supplies have actually encountered many difficulties throughout the years, yet FLCH’s profile professions at simply a puny 11.7 x tracking 12-month incomes, much less than half the evaluation of united state supplies– the S&P 500 ( SPX) professions for a much greater 27x tracking incomes.

Contrasting several of FLCH’s leading holdings to their united state peers truly hammers this factor home. This isn’t an apples-to-apples contrast, as Chinese technology titans frequently deal with a lot more regulative obstacles than their united state peers, yet the numbers places points right into viewpoint.

Tencent professions at simply 15.9 x agreement December 2024 incomes price quotes. At the very same time, Alibaba, which has had an off-cycle , professions at an also less costly 11x March 2025 incomes price quotes also after its current run greater. For contrast, Amazon (AMZN) professions for 41.1 x agreement 2024 incomes price quotes while Microsoft (MSFT) professions for 32.6 x June 2025 agreement price quotes.

Great Smart Ratings

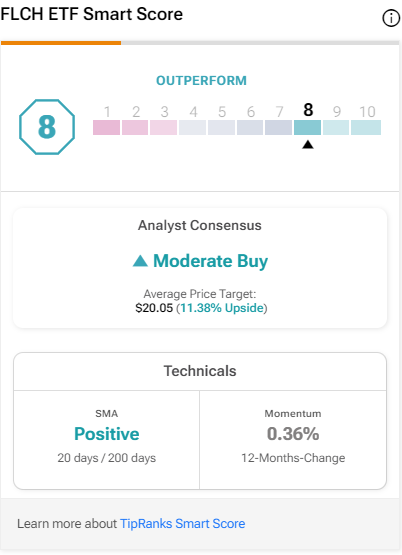

An additional point that FLCH’s leading 10 holdings share is a superb collection of Smart Ratings. The Smart Rating is a measurable supply racking up system produced by TipRanks. It ratings supplies from one to 10, based upon 8 essential market variables. Ratings of 8, 9, or 10 are thought about equal to an Outperform score.

9 out of FLCH’s leading 10 holdings include Outperform-equivalent Smart Ratings of 8 or above, and extremely, 6 out of the leading 10 have best 10 Smart Ratings. You can look into a checklist of TipRanks’ various other Leading Smart Rating supplies right here.

Furthermore, FLCH itself gains an Outperform-equivalent ETF Smart Rating of 8.

Returns is an Included Incentive

While it’s not the main factor to purchase the ETF, FLCH likewise provides a returns return of 2.7%, which is a wonderful included bonus offer for financiers. Additionally, this return is two times that of the S&P 500, which presently produces just 1.3%.

Best-in-Class Cost Proportion

An additional standout function of FLCH is its reduced cost proportion of simply 0.19%. This indicates that a capitalist designating $10,000 right into FLCH will certainly pay simply $19 in charges on a yearly basis. This is an extremely practical charge for a worldwide ETF, which typically have greater cost proportions than residential ETFs.

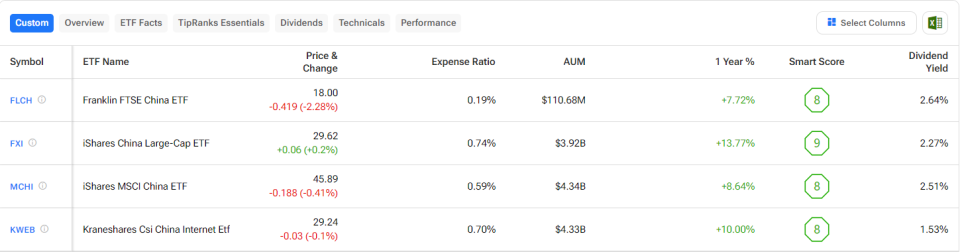

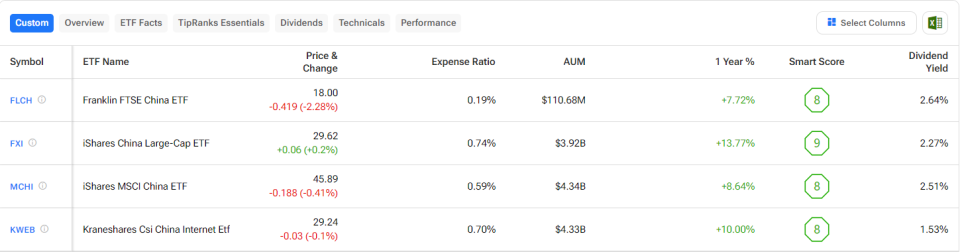

FLCH’s rivals, several of the biggest China ETFs, function a lot greater cost proportions. For instance, the iShares China Big Cap ETF (FXI) has a dramatically greater ETF cost proportion of 0.75%, while the iShares China MSCI ETF (MCHI) bills 0.59% and the KraneShares CSI Web ETF (KWEB) bills 0.70%.

Financiers can check out a contrast of FLCH versus these peers utilizing TipRanks’ ETF Contrast Device. The reality that FLCH is a lot smaller sized than any one of these ETFs yet includes a dramatically reduced cost proportion makes it a real covert treasure for financiers.

FLCH Has Lagging Tool Efficiency

One word of advising among the positive outlook is that FLCH (and Chinese supplies and ETFs a lot more typically) has actually published underwhelming efficiency before the current run, so a financial investment revealed to China is largely a bank on a rebound. Chinese equities stay significantly listed below degrees from a couple of years earlier.

Over the previous 5 years, FLCH supply has actually created a frustrating annualized overall return of -3.5%, significantly underperforming united state market returns. For contrast, the wide market Lead S&P 500 ETF (VOO) created a much remarkable 15.9% annualized return over the very same five-year amount of time.

That stated, I think the previous underperformance develops a chance for brand-new financiers today. Offered the economical appraisals of Chinese supplies and China’s noticeable need to stimulate development (based upon the huge stimulation plan), it appears practical to think that the FLCH ETF can remain to relocate greater.

Is FLCH Supply a Buy, According to Experts?

FLCH gains a Modest Buy agreement score based upon 160 Buy scores, 783 Hold scores, and 10 Market scores designated in the previous 3 months. The typical FLCH supply cost target of $21.48 suggests concerning 12% upside possible from present degrees.

FLCH Is an Excellent Selection for Getting Direct Exposure to China

FLCH and the Chinese supplies it holds obtained a shock from information of China’s current stimulation strategy. Nonetheless, I think these supplies have a lot of space to run based upon their economical appraisals. FLCH’s profile of supplies professions for simply under half the price-to-earnings several of the S&P 500. In addition, its excellent diversity and best-in-class cost proportion make it a terrific option for united state financiers wanting to use China. I’m favorable on FLCH.

Disclosure

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.