China is taking into consideration infusing one trillion yuan ( concerning $ 142 billion) right into its biggest financial institutions to assist sustain its slowing down economic situation. This funding increase is targeted at reinforcing the financial institutions’ capability to offer and promote development, as the nation comes to grips with weak financial efficiency.

The considerations come soon after the United States Federal Book carried out a 50 basis factors price cut.

China Strategies $1 Billion Resources Shot To Financial Institutions

Bloomberg reported the considerations, pointing out individuals knowledgeable about the issue. Based upon the record, China will certainly resource the financing from brand-new sovereign bonds. Once it takes place, it will certainly note the very first time because the worldwide dilemma in 2008 that Beijing has actually infused such a substantial amount right into huge financial institutions.

These strategies come as the Chinese economic situation remains to battle. As necessary, financial institutions have actually currently carried out treatments, such as considerable home loan price decreases and reducing essential plan prices.

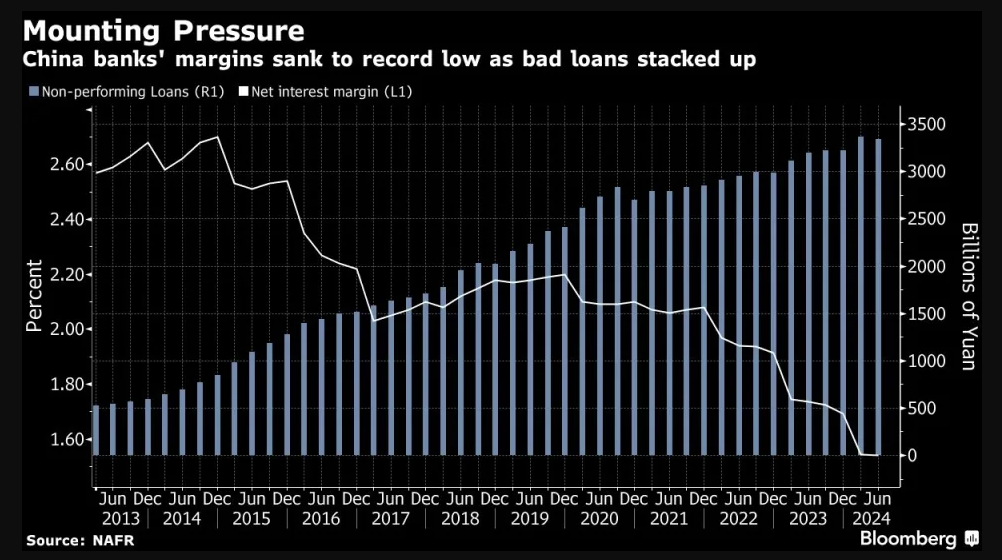

While these treatments have actually seen the leading 6 financial institutions develop their funding degrees past demands, the Industrial & & Commercial Financial Institution of China Ltd. and the Financial Institution of China Ltd., which had actually been generated as loan providers to sustain the economic situation, currently withstand document reduced margins, diminishing earnings, and climbing uncollectable bill.

Find Out More: Exactly how to Secure Yourself From Rising Cost Of Living Making Use Of Cryptocurrency

As necessary, the basic assumption is that the $1 billion funding shot will certainly go a lengthy means in raising the financial institutions’ capability to sustain the nation’s economic situation.

” This is a various kind of stimulation. If done with unique bond issuance it is a monetary stimulation and can support the financial institutions as building rates remain to decrease. It will certainly make sure that the financial institutions’ loaning ability will not be influenced,” Bloomberg reported, pointing out Grow Financial investment Team head economic expert Hao Hong.

Chinese regulatory authorities have actually likewise been contacting the nation’s huge financial institutions to sustain the having a hard time economic situation. They appeal for more affordable finances to dangerous customers, which might play well for risk-on possessions like Bitcoin (BTC).

Without a doubt, more affordable and, consequently, much easier finances, which basically indicates lower rates of interest, might assist promote investing and financial investment. This raised liquidity can profit riskier possessions like Bitcoin and supplies, which frequently see gains when obtaining prices decline.

Su Zhu, the creator of the now-defunct 3 Arrows Resources, likewise noted the feasible ramification of financial help. He insinuated that crypto rates might take advantage of the funding shot.

Find Out More: Bitcoin (BTC) Price Prediction 2024/2025/2030

These comments and spells of positive outlook come as Bitcoin’s rate has a performance history of being very closely linked to worldwide liquidity. This, according to economic expert Lyn Alden, suggests that the Chinese stimulation bundle might motivate a worth rise for crypto.

At The Same Time, it is difficult to ignore China’s crypto restriction in 2021 after an aggressive position versus electronic possessions going back to 2013. Causes varied from economic criminal offense, financial instability, and funding trip from its markets as customers bypassed standard limitations. Versus this background, some concern whether the $1 billion financial help might impact crypto.

” What does China infusing cash in their financial institutions involve Bitcoin? They are not enabled to acquire Bitcoin keeping that cash afaik [as far as I know],” one X customer said.

Nonetheless, there is supposedly an uprising versus this restriction, with Chainalysis reporting a $75.4 billion bank on Bitcoin from Chinese investors. Over-the-counter crypto brokers in China remain to tape expanding inflows, rising to $20 billion every three months. In the last 9 months, they saw a total amount of $75.4 billion in inflows.

Please Note

In adherence to the Depend on Job standards, BeInCrypto is dedicated to objective, clear coverage. This newspaper article intends to give exact, prompt details. Nonetheless, viewers are encouraged to confirm realities individually and speak with an expert prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.