Ethena Labs has actually revealed the upcoming launch of UStb, a brand-new stablecoin that will certainly be backed by the BlackRock USD Institutional Digital Liquidity Fund (BUIDL).

BlackRock’s BUILD is a tokenized fund on the Ethereum blockchain, placing it at the leading edge of the real-world possession (RWA) transformation.

Just How UStb May Fix Drawbacks of USDe

UStb intends to mirror the security of standard stablecoins, including an unique strategy by securing its worth in BUIDL. This fund makes up United States bucks, temporary United States Treasury expenses, and redeemed contracts. Remarkably, because its launch in March, BUIDL has actually built up over $513 million in possessions, developing itself as the biggest tokenized United States Treasuries fund.

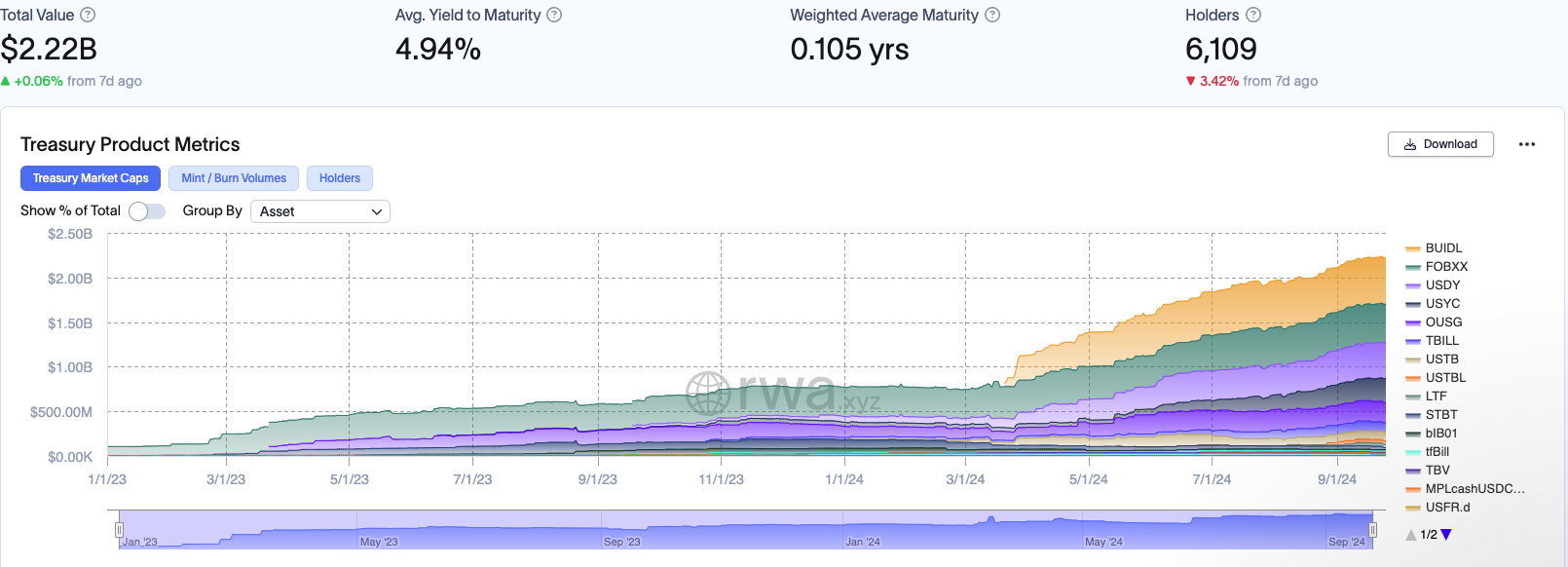

The marketplace for tokenized federal government protections has actually increased substantially, currently exceeding $2.22 billion. This development highlights the increasing self-confidence in blockchain-enabled economic services.

Learn More: An Overview to the most effective Stablecoins in 2024

Working Together with Securitize, Ethena prepares to boost the stablecoin market. Securitize presently supervises greater than $950 million in tokenized financial investments and has actually played an important function in tokenizing funds for BlackRock.

Distinctly, UStb provides a various danger account contrasted to Ethena’s existing USDe stablecoin. Released previously this year, USDe swiftly reached come to be the fifth-largest stablecoin by market cap, with an existing supply of $2.55 billion.

As Opposed To USDe, which relies upon a mix of cryptocurrencies and acquired methods for security, UStb gives a fairly much safer financial investment option by backing it straight with low-risk, fluid possessions. USDe had some difficulties, such as the danger of shedding the secure if the financing price transforms adverse for an extended amount of time.

With this brand-new stablecoin, Ethena Labs intends to address several of the drawbacks of USDe.

” If administration regards it essential and suitable in adverse financing problems Ethena can shut hedging settings and re-allocate those backing possessions to UStb to more relieve danger related to adverse financing price atmospheres,” Ethena Labsexplained

This advancement comes to a transformative minute for Ethena. Adhering to the stablecoin’s expose, Ethena’s indigenous token, ENA, saw a 13.29% rise in worth, mirroring favorable market function.

Learn More: What Is Ethena Procedure and its USDe Synthetic Buck?

Ethena Labs, the driving pressure behind UStb, safeguarded $14 million in a tactical financing round previously this year. It attained an appraisal of $300 million in a round led by Dragonfly and Uproar.

Please Note

In adherence to the Trust fund Job standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to give exact, prompt info. Nonetheless, visitors are encouraged to validate truths individually and talk to a specialist prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.