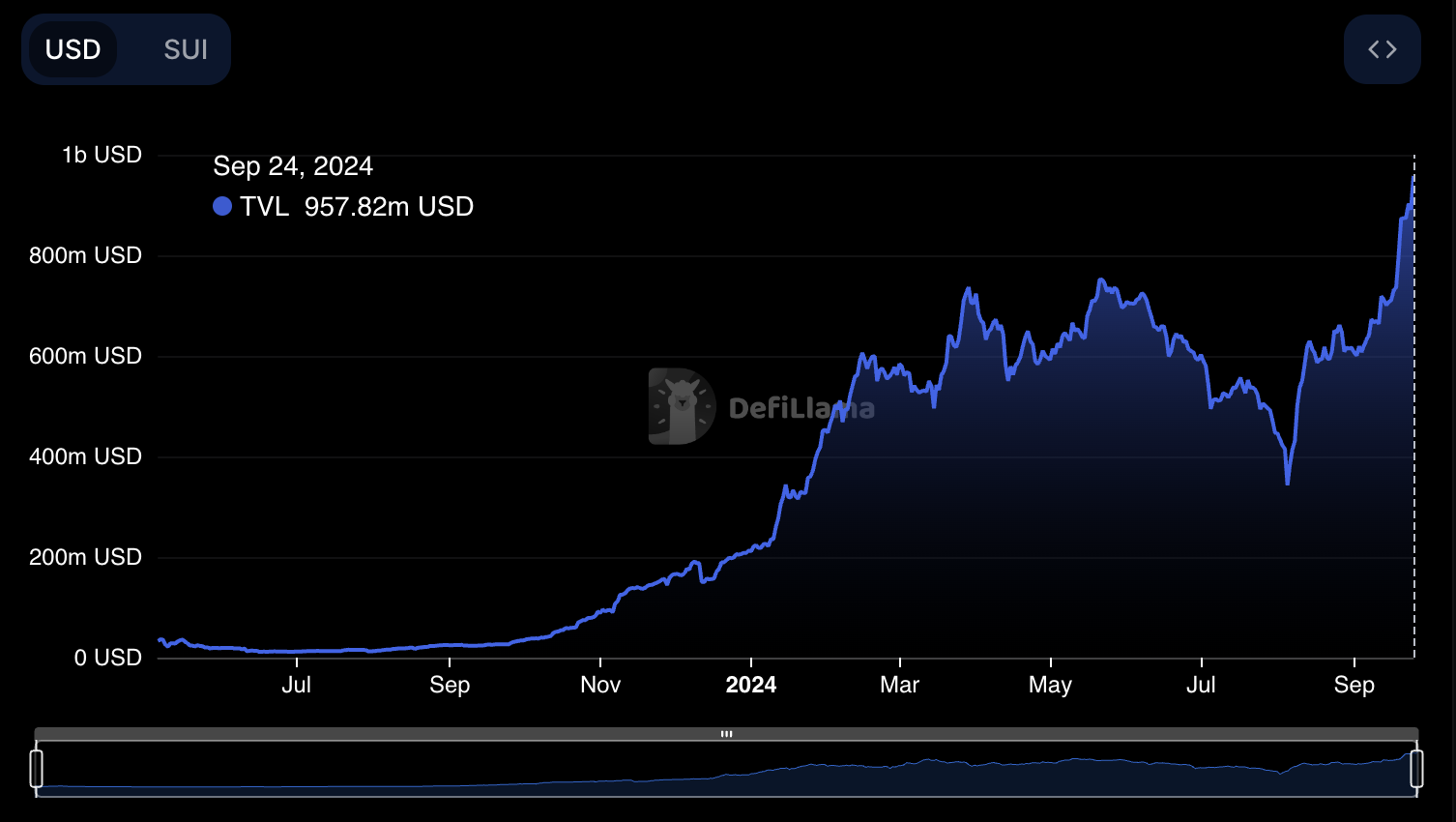

SUI rate has actually gotten on a solid higher pattern, catching the focus of the crypto area as it nears considerable resistance degrees. With Overall Worth Secured (TVL) rising previous $957 million, the network’s basics have actually enhanced, indicating boosting capitalist self-confidence.

This quick development is placing SUI as a prospective principal amongst “Ethereum awesome” prospects, outmatching rivals like Sei, Mantle, and Aptos. As SUI approaches its all-time high, its favorable technological signs recommend the opportunity of additional gains, gave it can get over future resistance factors.

SUI TVL Rise: The Roadway to $1 Billion and Beyond

Overall Worth Secured (TVL) in the SUI community rose to $957 million since September 24, 2024, a substantial boost from $338 million on August 3. TVL stands for the quantity of funding transferred in decentralized financing (DeFi) procedures within a particular network, including properties associated with tasks like laying, borrowing, and liquidity stipulation.

An expanding TVL is frequently viewed as a favorable sign since it mirrors boosting count on and involvement in the network’s procedures, increasing the energy and need for the indigenous token. When extra properties are secured right into SUI’s community, it recommends that individuals want to devote their funding, lowering the distributing supply of the token and possibly causing higher rate stress.

Learn More: Whatever You Required to Understand About the Sui Blockchain

In Addition, when TVL comes close to significant landmarks, such as the brewing $1 billion TVL mark for SUI, it often tends to stand out from a more comprehensive series of capitalists. Reaching this limit signals solid advancement and liquidity in the community. This can cause higher market self-confidence, a favorable comments loophole of rate development, and additional funding inflows.

As TVL remains to climb, the community’s total wellness enhances, improving liquidity for decentralized applications, boosting deal quantities, and most likely causing continual rate development for SUI. With even more combinations, like Circle introducing USDC on SUI, its TVL can proceed expanding in the following months.

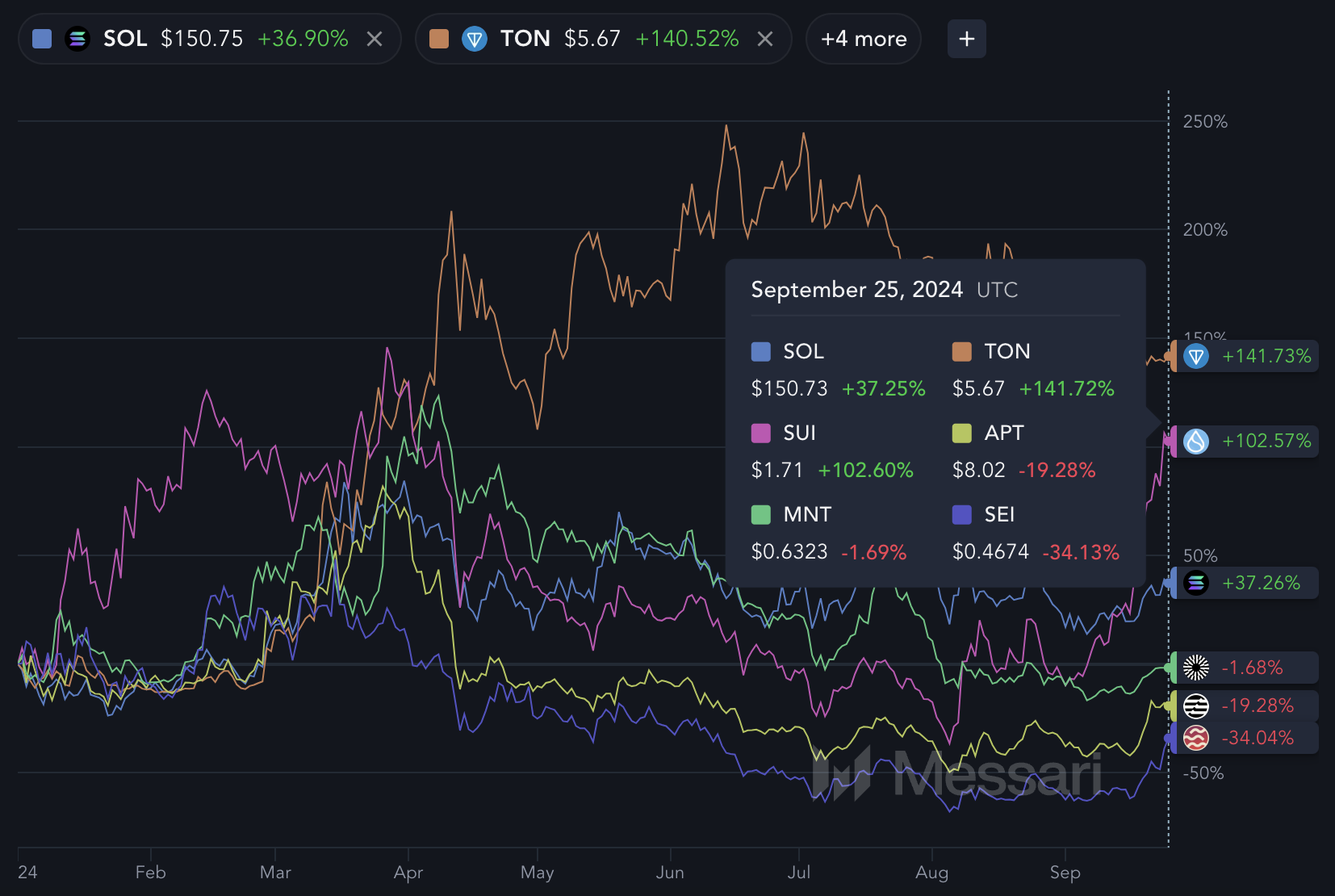

SUI Is Outpacing Various Other “Ethereum Killers”

When taking a look at the efficiency of “Ethereum awesome” prospects, Solana continues to be the clear frontrunner. It presently has a rate of $150.75 and a 37.25% boost year-to-date. Its prominence is well developed, with a large market cap of around $70 billion.

Nonetheless, bunch is additionally obtaining considerable focus, flaunting a 140.52% boost and a market cap of $14 billion. Regardless of these 2 titans, there appears to be area for an additional significant gamer in the area.

Amongst the competitors, Sui stands apart, particularly when contrasted to various other promising chains like Sei, Mantle, and Aptos. Sei and Mantle reveal adverse returns (-34.13% and -1.69%, specifically). Aptos has actually seen a substantial decline (-19.28%).

On the various other hand, Sui has actually handled to greater than dual in worth, expanding by 102.60% YTD.

Crypto can conveniently suit an additional “Ethereum awesome” with a market cap going beyond $10 billion. With Solana currently much past that degree and bunch at $14 billion, SUI energy recommends maybe the following chain to cross this considerable limit.

Its solid development metrics and boosting fostering prices put it in a prime setting to complete on the very same degree as Solana and bunch, possibly coming to be a principal in the multi-chain future of decentralized applications.

SUI Rate Forecast: $2.20 By October?

SUI is presently trading around $1.70, still 28% behind its all-time high of $2.18. Its rate has actually gotten on a solid higher trajectory lately, with a number of EMA lines piling in a favorable arrangement. Rapid relocating standards are trend-following signs that offer even more weight to current rate activity.

In this graph, the EMAs are plainly straightened in a favorable pattern, with shorter-term EMAs over longer-term EMAs. This sort of placement shows solid up energy on the market.

Learn More: An Overview to the 10 Finest Sui (SUI) Pocketbooks in 2024

If SUI can proceed its present pattern and break above crucial resistance degrees at $1.95 and $2.07, the rate can be positioned to test its previous all-time high of $2.18 and possibly relocate also greater, targeting $2.20 or even more.

Nonetheless, a failing to damage these resistance degrees can cause a pullback. Because instance, the nearby assistance degree is around $1.41, where the rate can maintain prior to trying an additional higher step.

Please Note

In accordance with the Depend on Job standards, this rate evaluation post is for informative objectives just and must not be taken into consideration monetary or financial investment suggestions. BeInCrypto is dedicated to precise, impartial coverage, however market problems go through alter without notification. Constantly perform your very own study and talk to an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.