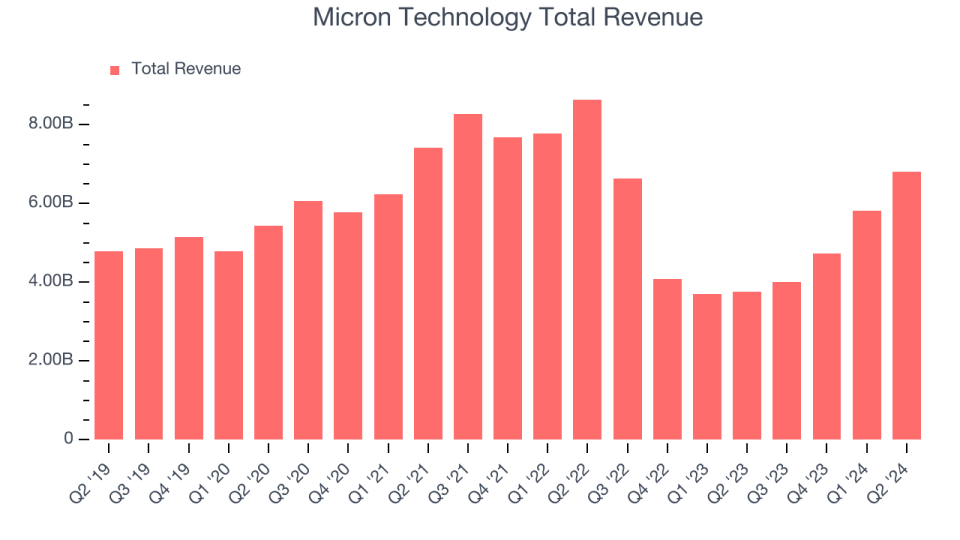

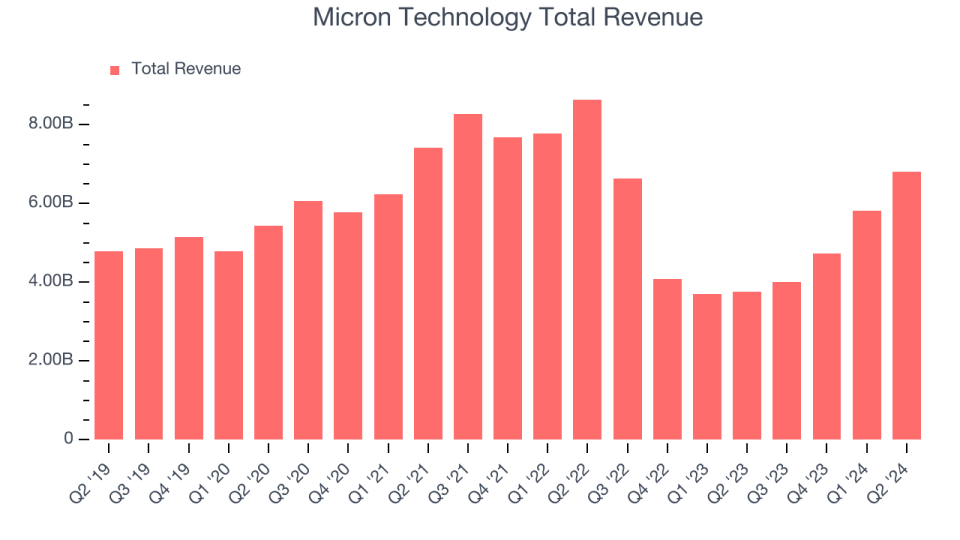

Memory chips manufacturer Micron (NYSE: MU) will certainly be reporting revenues tomorrow mid-day. Below’s what to anticipate.

Micron Modern technology defeated experts’ income assumptions by 2% last quarter, reporting incomes of $6.81 billion, up 81.5% year on year. It was an extraordinary quarter for the business, with a substantial enhancement in its gross margin and an excellent beat of experts’ EPS quotes.

Is Micron Modern technology a buy or offer entering into revenues? Read our full analysis here, it’s free.

This quarter, experts are anticipating Micron Modern technology’s income to expand 90.5% year on year to $7.64 billion, a turnaround from the 39.6% decline it taped in the exact same quarter in 2014. Readjusted revenues are anticipated ahead in at $1.11 per share.

Most of experts covering the business have actually reconfirmed their quotes over the last thirty days, recommending they expect business to persevere heading right into revenues. Micron Modern technology has actually missed out on Wall surface Road’s income approximates 3 times over the last 2 years.

With Micron Modern technology being the very first amongst its peers to report revenues this period, we do not have anywhere else to aim to obtain a mean exactly how this quarter will certainly unwind for semiconductors supplies. Nonetheless, financiers in the section have actually had rather constant hands entering into revenues, with share costs down 1.3% generally over the last month. Micron Modern technology is down 4.9% throughout the exact same time and is heading right into revenues with an ordinary expert rate target of $147.37 (contrasted to the present share rate of $94.05).

Today’s young financiers likely have not review the ageless lessons in Gorilla Video game: Selecting Victors In High Modern Technology due to the fact that it was created greater than two decades earlier when Microsoft and Apple were very first developing their superiority. Yet if we use the exact same concepts, after that venture software program supplies leveraging their very own generative AI abilities might well be the Gorillas of the future. So, because spirit, we are thrilled to provide our Unique Free Record on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.