Air travel and protection providers AAR CORP (NYSE: AIR) will certainly be reporting incomes tomorrow after the bell. Below’s what to anticipate.

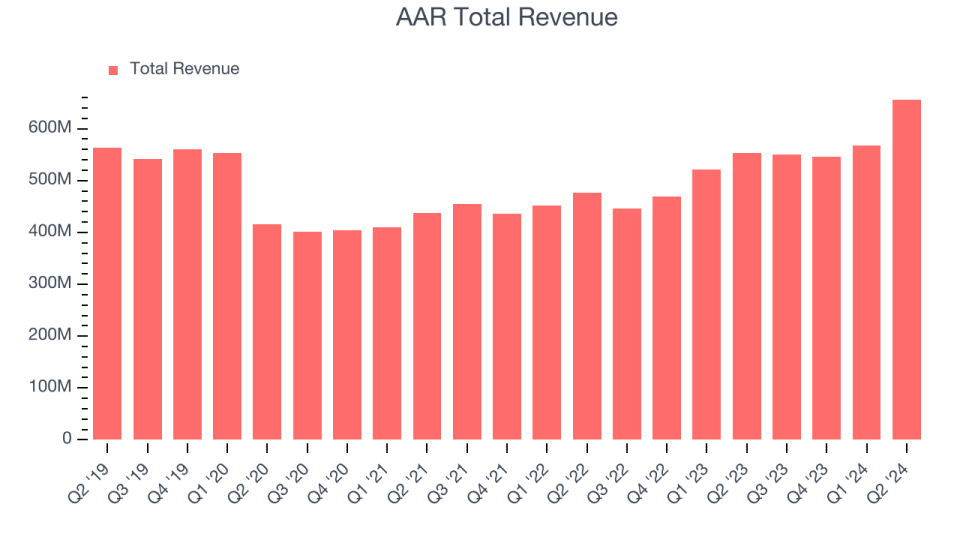

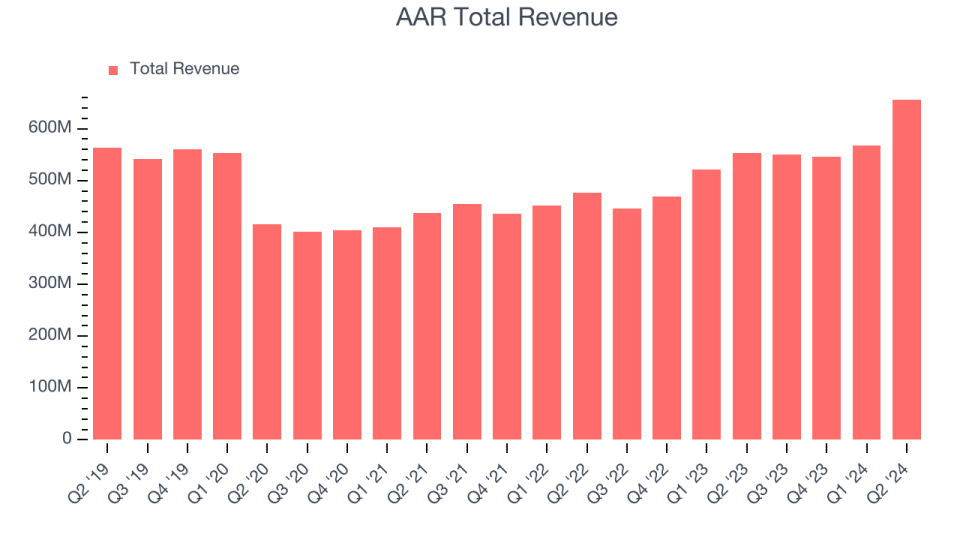

AAR satisfied experts’ income assumptions last quarter, reporting profits of $656.5 million, up 18.7% year on year. It was an adequate quarter for the business, with a strong beat of experts’ operating margin and EPS quotes.

Is AAR a buy or offer entering into incomes? Read our full analysis here, it’s free.

This quarter, experts are anticipating AAR’s income to expand 17.6% year on year to $646.6 million, reducing from the 23.2% rise it videotaped in the very same quarter in 2015. Readjusted incomes are anticipated ahead in at $0.82 per share.

Most of experts covering the business have actually reconfirmed their quotes over the last 1 month, recommending they prepare for business to persevere heading right into incomes. AAR has actually missed out on Wall surface Road’s income approximates 4 times over the last 2 years.

With AAR being the very first amongst its peers to report incomes this period, we do not have anywhere else to seek to obtain a mean just how this quarter will certainly untangle for aerospace and protection supplies. Nevertheless, financiers in the section have actually had consistent hands entering into incomes, with share costs level over the last month. AAR is up 7.4% throughout the very same time and is heading right into incomes with a typical expert rate target of $83.75 (contrasted to the existing share rate of $69.28).

Below at StockStory, we definitely comprehend the possibility of thematic investing. Varied victors from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Beast Drink (MNST) might all have actually been determined as encouraging development tales with a megatrend driving the development. So, because spirit, we have actually determined a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.