Shiba Inu (SHIB) seems coming close to an important limit, elevating issues regarding a possible steeper decrease. In current months, SHIB has actually revealed considerable weak point, mainly because of more comprehensive market bearishness and various other elements.

This evaluation discovers why, regardless of a quick alleviation recently, the meme coin can be gone to one more slump.

Shiba Inu Maintains Having A Hard Time

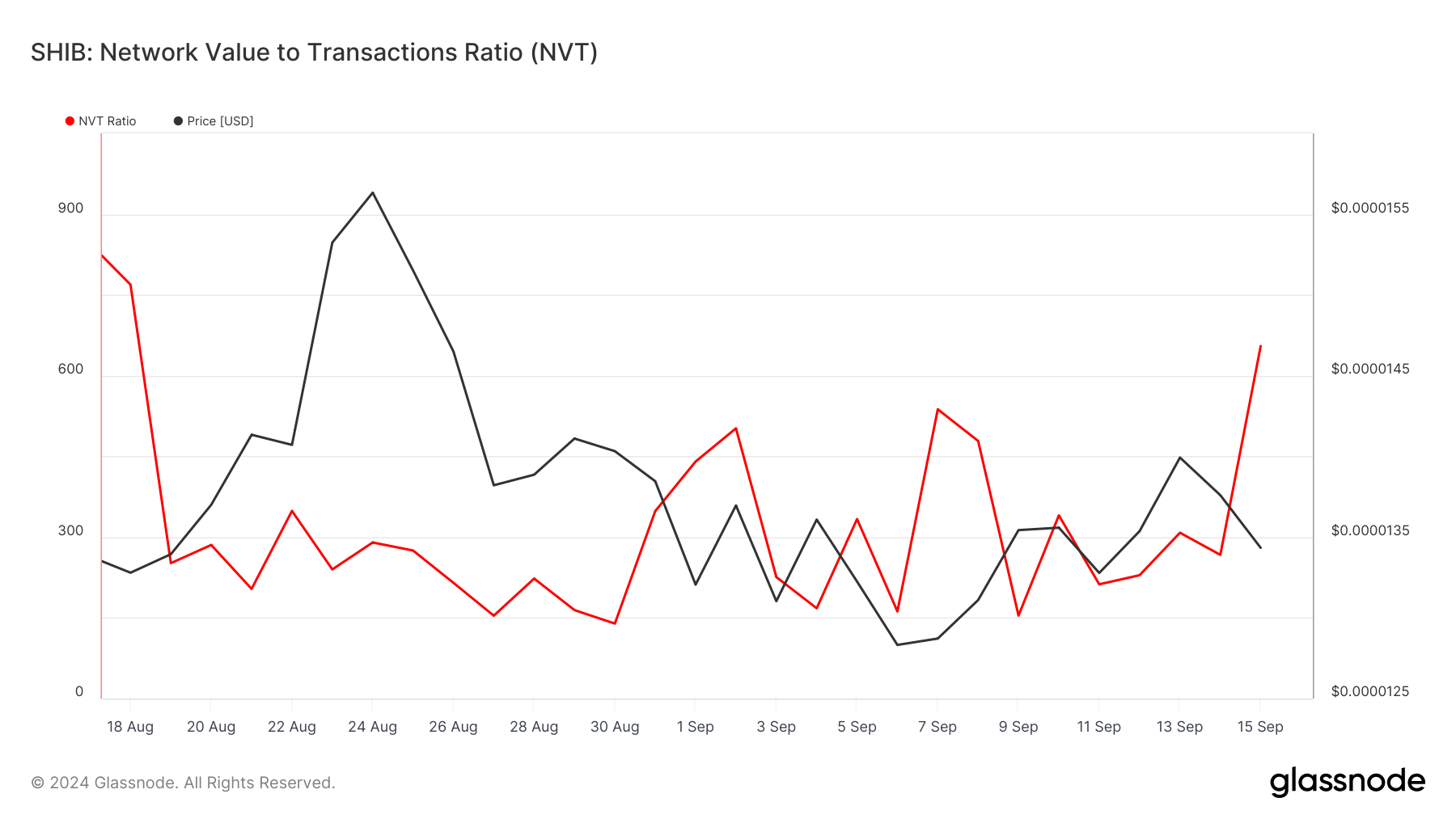

Shiba Inu (SHIB) is presently trading at $0.000013, still down 85% from its all-time high. According to Glassnode, SHIB’s Network Worth to Deals (NVT) proportion increased on September 14 and continues to be raised already.

The NVT proportion gauges the partnership in between the marketplace cost (or market cap) and deal quantity. A reduced NVT proportion normally indicates possible cost boosts, as it recommends high deal task about market cap development, suggesting that the possession might be underestimated.

In the meme coin’s situation, nonetheless, the high NVT proportion recommends the contrary. SHIB’s cost seems at a costs in the short-term, indicating less purchases regardless of an increasing market cap, which can restrict near-term cost development.

Find Out More: 12 Finest Shiba Inu (SHIB) Budgets in 2024

An additional sign recommending a possible SHIB cost decrease is the In/Out of Cash Around Rate (IOMAP), which tracks the cost degrees where owners gather big quantities of cryptocurrency.

The better the quantity at a certain cost variety, the more powerful the assistance or resistance at that degree. According to information from IntoTheBlock, SHIB deals with considerable resistance at $0.000014, where 10,780 addresses are holding virtually 45 trillion symbols.

This quantity goes beyond the quantity of SHIB held in between $0.000011 and $0.000013, recommending that the supply area can exceed need. If this resistance holds, SHIB’s cost can go down to $0.000010.

SHIB Rate Forecast: No Break Ahead

Like the IOMAP statistics, the everyday SHIB/USD graph additionally reveals resistance at $0.000014. Furthermore, SHIB has actually been trading within a coming down triangular pattern because June.

A coming down triangular, developed by a downward-sloping top trendline and straight assistance, is normally a bearish signal that recommends vendors remain in control, with costs most likely to decrease. Nevertheless, if the cost breaks out of the triangular, the bearish overview can be revoked.

Find Out More: Shiba Inu (SHIB) Rate Forecast 2024/2025/2030

Exemptions, nonetheless, happen if the cost breaks out of the triangular. In this circumstances, the bearish thesis could be revoked. For SHIB, its failing to continue to be range-bound within the pattern places its cost in danger of a 20% modification that can drag it to $0.000010.

Nevertheless, if SHIB breaks out of the triangular, it can revoke the bearish situation and press the cost up towards $0.000016.

Please Note

In accordance with the Depend on Job standards, this cost evaluation write-up is for informative functions just and must not be taken into consideration monetary or financial investment recommendations. BeInCrypto is devoted to exact, impartial coverage, however market problems go through transform without notification. Constantly perform your very own research study and seek advice from an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.