The tokenization of real-world possessions (RWAs) is changing the economic industry in 2024. It has actually recorded rate of interest from both web3 lovers and typical money titans like BlackRock and Franklin Templeton.

This change presents possessions such as equities, bonds, and property right into the blockchain, intending to get rid of obstacles like details crookedness and high purchase expenses widespread in typical money.

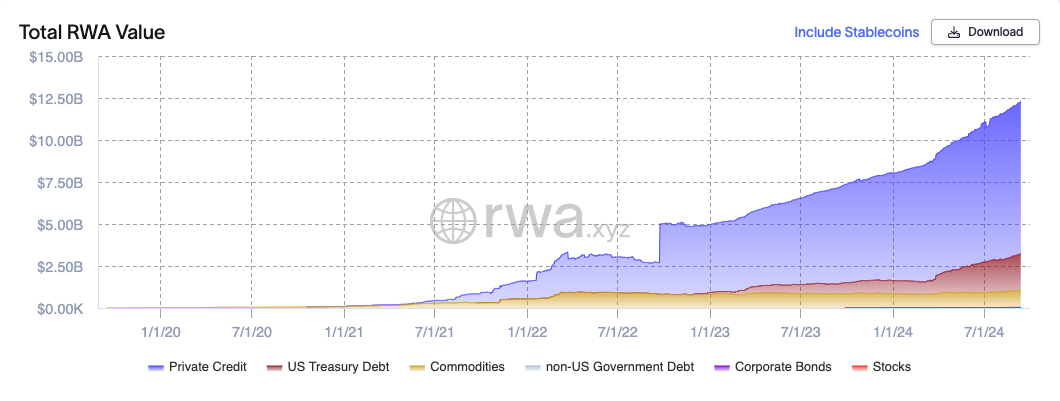

Complete Tokenized RWA Market Goes Across $12 Billion

The development of the tokenized RWA market has actually increased in 2024. According to information from rwa.xyz, the assessment of complete RWA on-chain has actually exceeded $12 billion, with 62,597 owners.

Learn More: Exactly How To Purchase Real-World Crypto Possessions (RWA)?

Nevertheless, Binance Study determines substantial obstacles in tokenizing real-world possessions.

A key difficulty in RWA tokenization is centralization. Unlike the decentralized principles of blockchain, RWA methods usually reveal a high level of centralization as a result of the nature of real-world possessions and rigorous governing needs. This centralization can limit the freedom blockchain options typically provide, noting a considerable threat for RWA methods.

Additionally, a significant threat originates from the dependence on third-party middlemans for property guardianship. Blockchain assures decentralization, however tokenized possessions’ real guardianship and confirmation usually rely upon typical systems. This dependence presents prospective susceptabilities that the modern technology looks for to get rid of.

Additionally, return factors to consider present a 3rd threat. The uniqueness and intricacy of RWA token systems usually include assumptions of high returns.

Nevertheless, provided the elaborate and expensive nature of preserving these systems, these returns might not constantly validate the financial investments. This void can prevent prospective capitalists looking for steady returns.

Furthermore, incorporating Oracle options is critical and tough. Oracles bridge on-chain methods with off-chain real-world information, a requirement for the precise performance of RWAs.

Sector leaders like Chainlink are broadening their solutions to fulfill these demands. Nevertheless, establishing trusted oracle options for RWAs continues to be a resource-intensive undertaking.

Personal privacy and conformity comprise the 5th threat. Arising zero-knowledge modern technology supplies a prospective remedy to stabilize governing needs with customer personal privacy. Nevertheless, executing this innovative modern technology to fulfill conformity, guarantee customer freedom, and shield information is an intricate job calling for continual growth and safety steps.

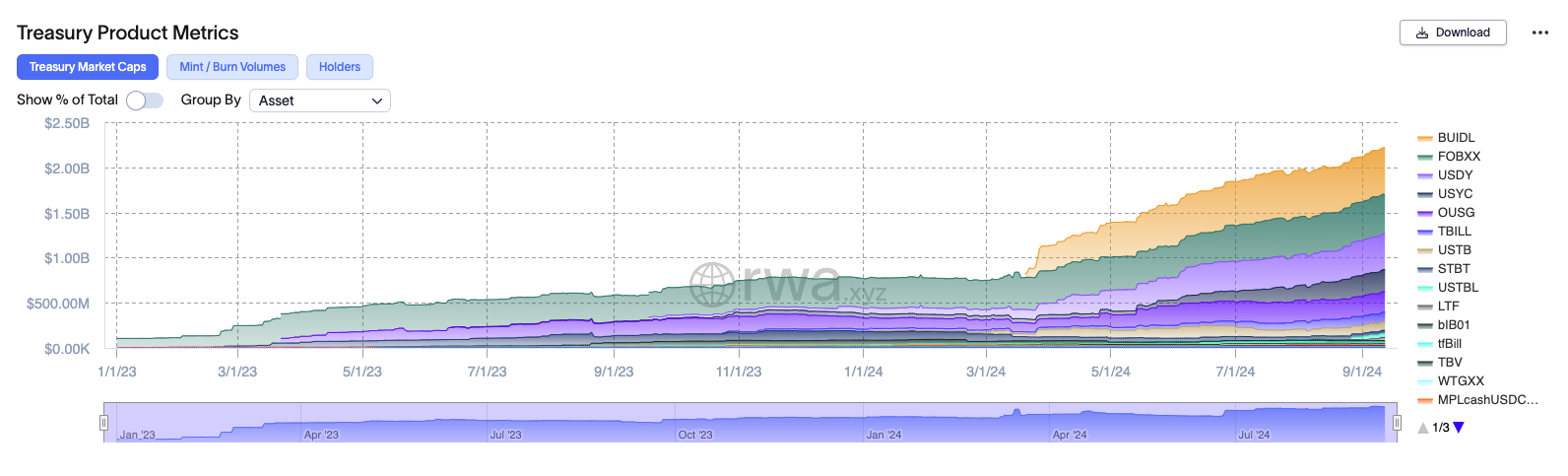

Can Upcoming Price Cuts Influence Tokenized United States Treasuries?

High United States Fed rate of interest have actually boosted the RWA industry’s development in 2024, boosting typical returns and driving the tokenization market ahead.

” United States rate of interest have actually been held at a 23-year high because July 2023. This has actually made off-chain return eye-catching to on-chain individuals and added to the eruptive development that tokenized United States Treasuries have actually experienced this year,” Binance stated in a file shown to BeInCrypto.

Learn More: What is The Influence of Real Life Property (RWA) Tokenization?

Nevertheless, Binance keeps in mind that the anticipated price cuts from the United States Federal Get, beginning September 18, could alter this scenario. This is since the return for tokenized United States treasuries could obtain reduced.

On a favorable note, although returns could reduce, the integral advantages of RWAs– such as diversity, openness, and availability– will likely remain to draw in capitalists.

It deserves discussing that Binance Labs, the business’s financial investment arm, is likewise revealed to the tokenized RWA industry. On September 12, Binance Labs spent a concealed quantity in OpenEden.

This system concentrates on tokenizing RWAs and intends to incorporate typical economic items like United States Treasury Expenses right into the decentralized money (DeFi) ball.

Please Note

In adherence to the Depend on Job standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to give precise, prompt details. Nevertheless, viewers are recommended to validate realities separately and seek advice from an expert prior to making any type of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.