As FTX relaxes its large Solana (SOL) holdings, records recommend the insolvent exchange still has more than $1 billion well worth of symbols to unload.

This considerable variety of symbols can press Solana’s market evaluation, as on-chain information indicate decreasing rate of interest.

Solana Marketing Stress Might Surge as FTX Steps Symbols

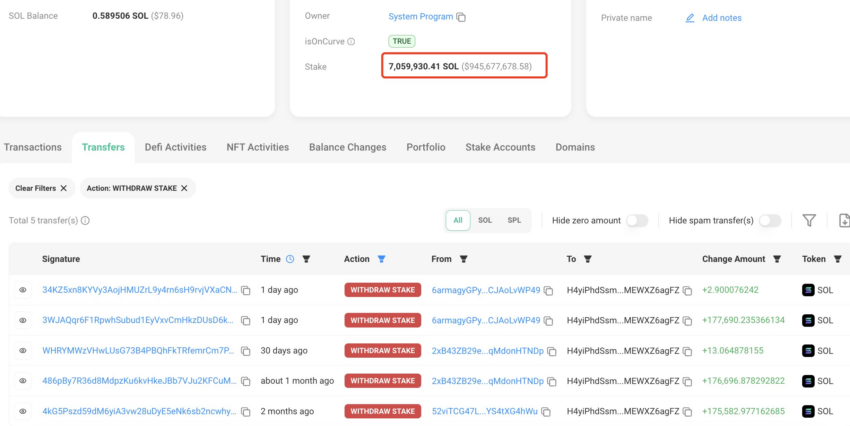

According to blockchain analytics strong LookOnChain, FTX and its sibling firm, Alameda Research study, have currently unstaked considerable sections of their Solana symbols. In the previous 3 months, they unstaked 530,000 SOL, worth about $71,000, with month-to-month standards getting to 176,700 SOL, or $23.5 million.

Regardless of these purchases, 7.06 million SOL, valued at $945.7 million, continues to be bet.

FTX’s connection with Solana was especially solid prior to the exchange’s collapse in November 2022. Following its failure, SOL costs plunged to as reduced as $8, worsening the volatility in the wider crypto market.

FTX has actually been gradually marketing its Solana properties ever since, and a few of these sales might have occurred over the counter (OTC) to lessen cost effect.

FTX’s continuous liquidation of its crypto properties comes amidst increased examination from government authorities. Caroline Ellison, previous chief executive officer of Alameda and previous companion of Sam Bankman-Fried, will certainly deal with sentencing on September 24 for her participation in the exchange’s collapse. Ellison formerly approved all costs versus her as component of an appeal offer.

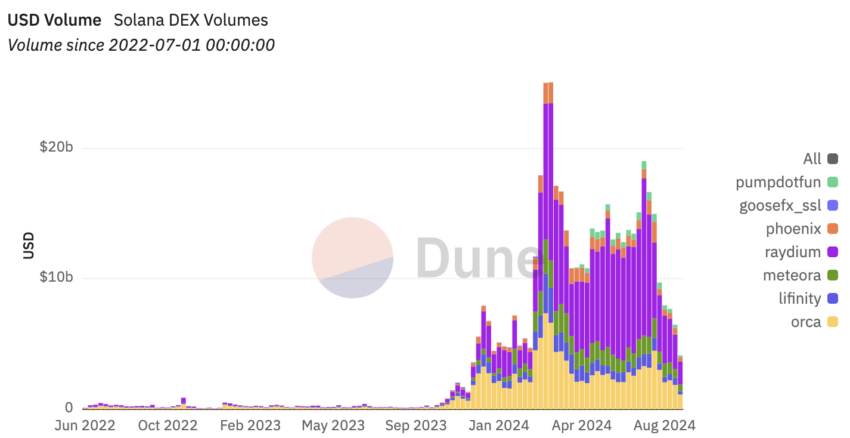

While Solana continues to be connected to FTX’s liquidation procedure, the blockchain has actually seen a decrease in on-chain task. Recently, the community recorded a six-month reduced in once a week decentralized exchange (DEX) quantities at $7.7 billion, according to Dune.

This is a sharp comparison to the network’s March quantities, which were 50% greater than Ethereum’s at the time.

From a technological viewpoint, Solana’s cost is dealing with a zero hour. After shedding its 200-day rapid relocating standard (EMA) assistance, the cost floats near $127.

Experts warn that a decrease listed below $126 can result in additional losses, possibly pressing the cost towards the $92 to $110 array.

Find Out More: Solana (SOL) Rate Forecast 2024/2025/2030

As FTX remains to unload its Solana symbols, market individuals stay careful, waiting for the following relocate this unraveling phase of the exchange’s liquidation procedure.

Please Note

In adherence to the Count on Job standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to give exact, prompt info. Nonetheless, visitors are suggested to confirm truths separately and seek advice from an expert prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.