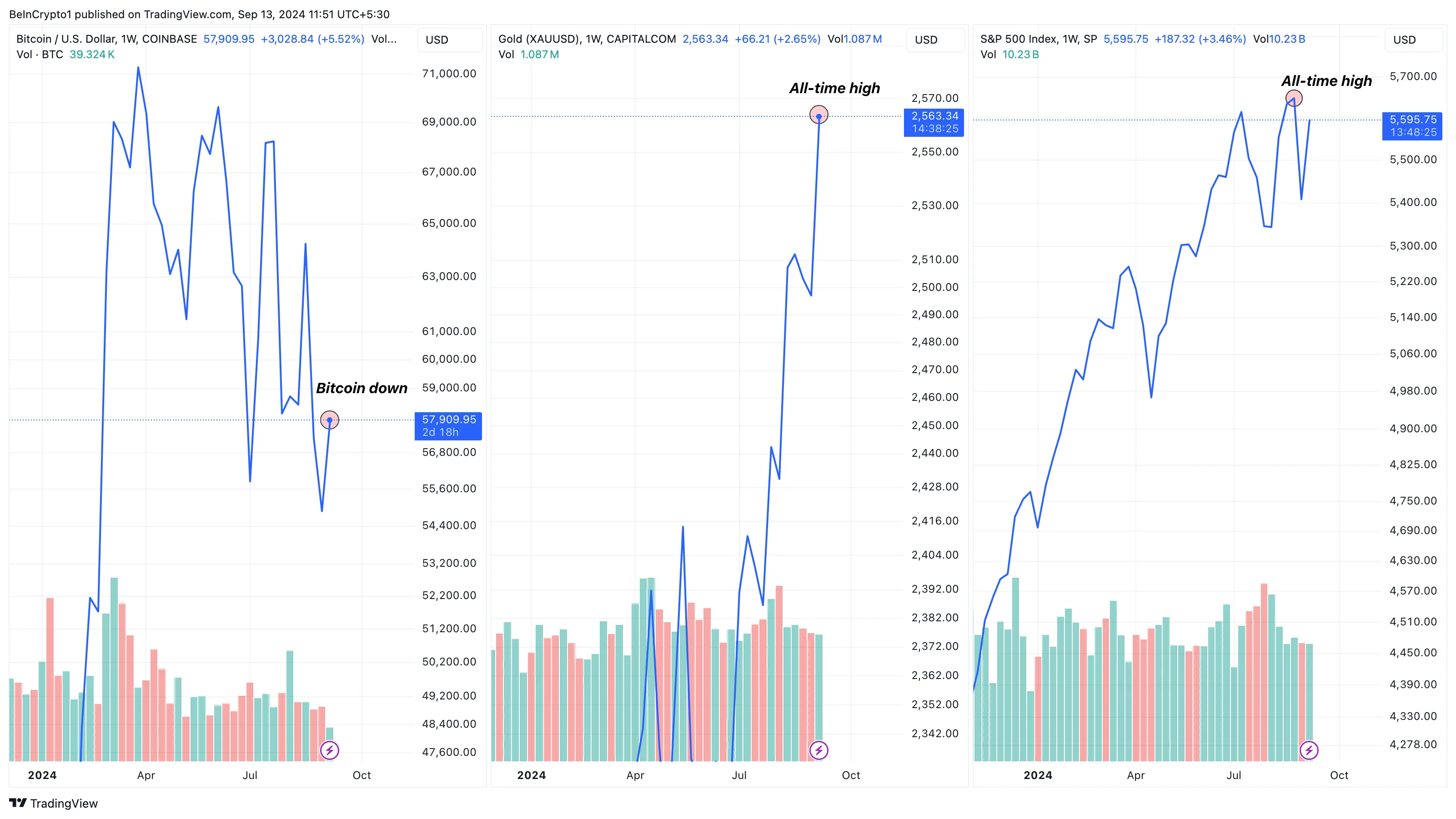

Standard properties, consisting of gold and the S&P 500, have actually gotten to brand-new all-time highs. On the other hand, Bitcoin (BTC) has actually decoupled and proceeded its underwhelming efficiency, which has actually lasted practically 6 months.

Because of this, financiers are wondering about whether cryptocurrency still works as a bush versus rising cost of living contrasted to standard properties. This on-chain evaluation checks out thoroughly whether BTC will certainly remain to hang back or if its condition as a safe house continues to be undamaged.

Bitcoin Falls Behind Gold, Others

Bitcoin’s rate is $58,166, down 21% from its all-time high in March. Gold, on the various other hand, has actually lately gotten to a brand-new all-time high, with its worth at $2,564. The popular S&P 500 additionally did the very same while exceeding $5,650, with Silver on the edge of doing the very same.

Based upon BeInCrypto’s searchings for, this rise is attributable to the favorable United States CPI record launched previously today. On the other hand, the difference in between BTC and these standard properties resembles the scenario the cryptocurrency experienced in Might 2021.

Throughout that duration, Bitcoin’s rate came by 36%. The present problem is additionally comparable to the efficiency in November 2021, when the coin arrived of the last booming market.

Concerning this issue, CryptoQuant, in its regular record, described that financiers appear to favor much less high-risk properties.

” A duration of unfavorable relationship in between Bitcoin and Gold, with Gold boosting and Bitcoin lowering, usually indicates a risk-averse setting where financiers prefer standard safe-haven properties like Gold over speculative properties like Bitcoin,” the record highlighted.

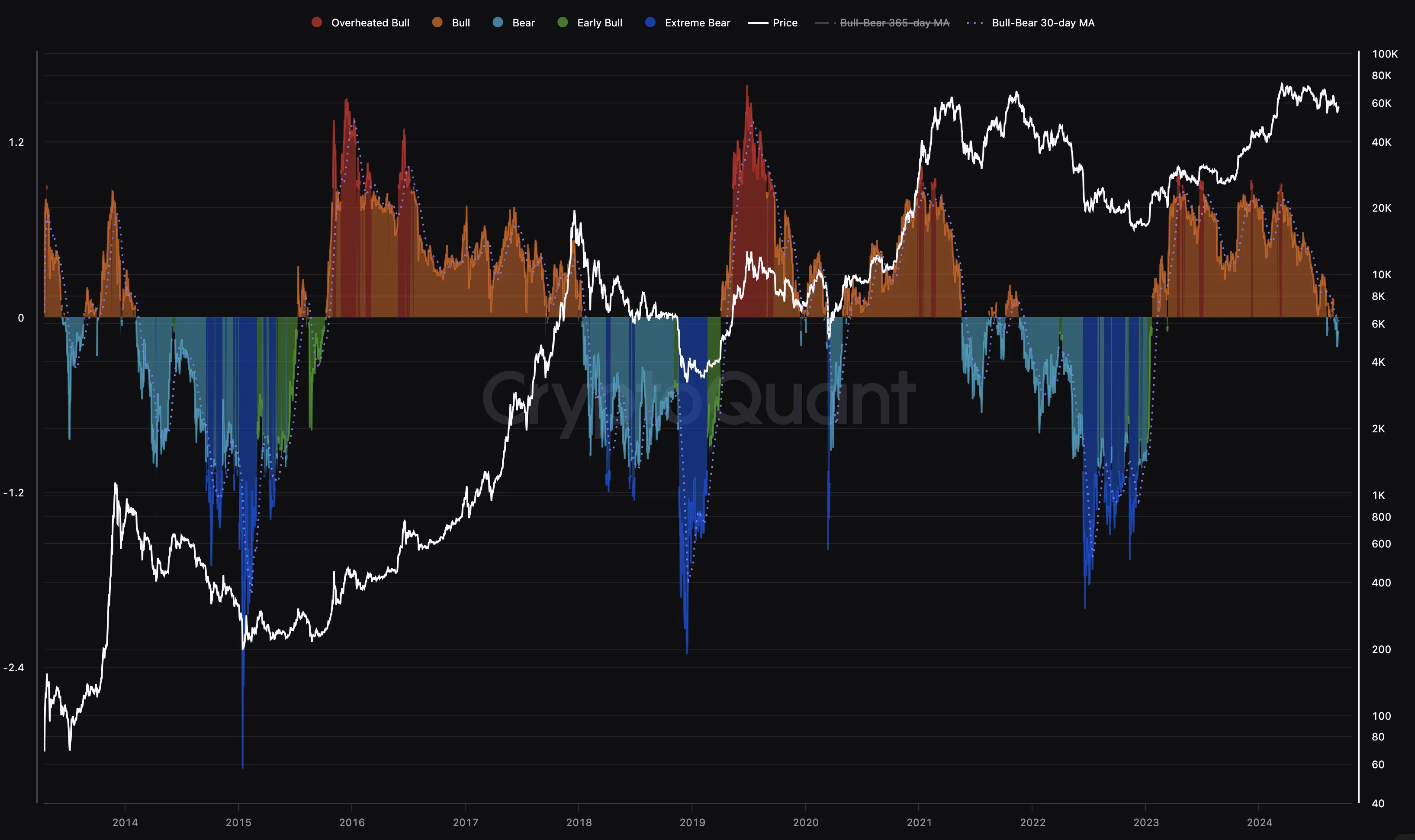

Complying with these turning points, Bitcoin may remain to remain in a greatly bearish stage. One factor for this predisposition is the present condition of the Bull/Bear Cycle. This energy statistics actions the distinction in between the revenue and loss index and the coin’s 365-day relocating standard.

When the statistics is over no, it’s a bull cycle. An analysis listed below no, on the various other hand, suggests a bearish market. Since this writing, the Bull/Bear Cycle sign has actually dropped listed below the limit, recommending that Bitcoin’s rate may have gone into a bear setting.

Find Out More: That Has one of the most Bitcoin in 2024?

BTC Rate at risk Unless Fresh Funding Goes Into the marketplace

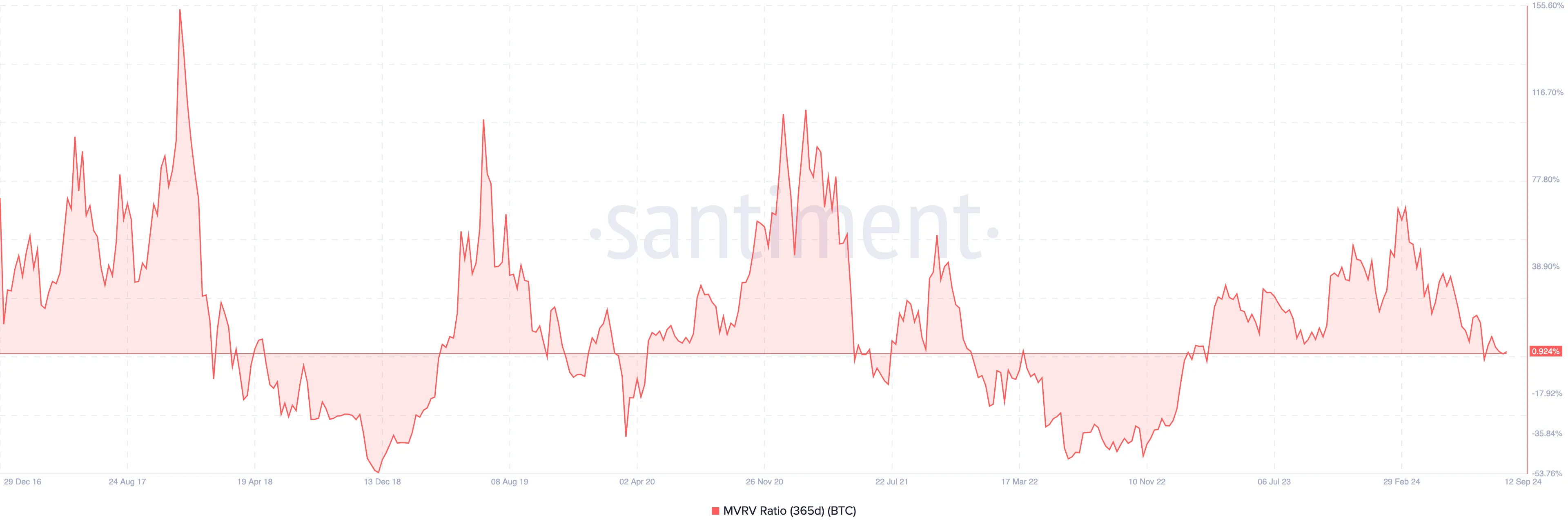

One more statistics sustaining this bearish predisposition is the 365-day Market Price to Understood Worth (MVRV) proportion. This proportion demonstrates how much or close Bitcoin’s rate is from the Understood Rate, the typical rate at which every coin owner acquired the cryptocurrency.

High worths of the MVRV proportion suggest overvaluation. Reduced worths, on the other side, recommend undervaluation.

According to Santiment, Bitcoin’s 365-day MVRV proportion is much less than 1%, showing that the cryptocurrency might be based on bearish pressures. As seen in the graph below, when BTC slides to the unfavorable region, it ends up being difficult to go back to the benefit.

For That Reason, if the proportion ultimately goes down listed below the environment-friendly area, Bitcoin’s rate may go down to $45,000, and this bull cycle may ultimately change to the bear cycle.

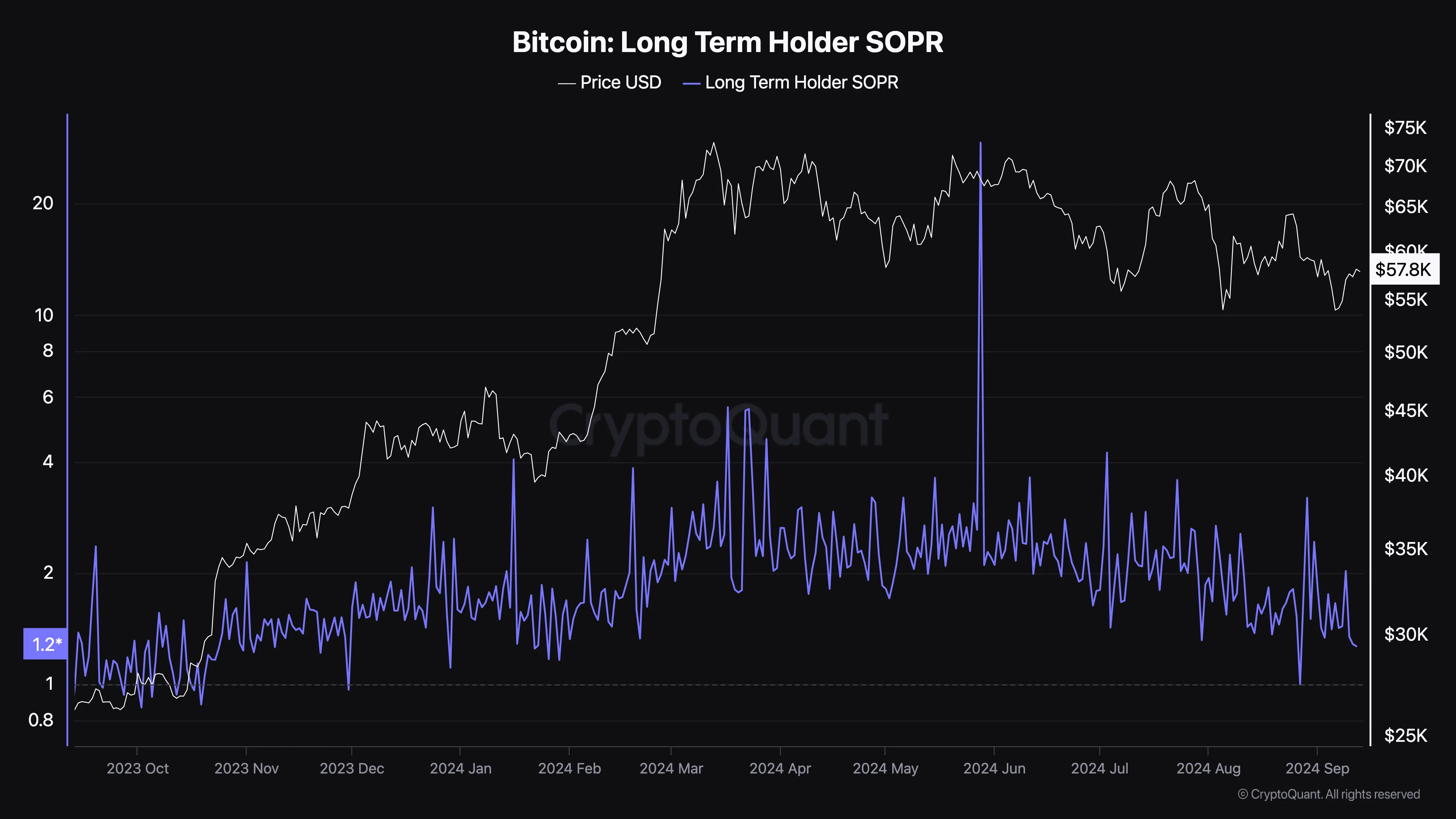

On top of that, the Long-Term Owner (LTH) Used Result Revenue Proportion (SOPR) has actually been decreasing considering that July. A boost in LTH-SOPR suggests that owners are costing a greater revenue, making it simpler for BTC to draw in fresh need.

The continuous decrease, subsequently, recommends that lasting owners are costing reduced earnings. This might make it challenging for Bitcoin to produce the greater need essential to drive a rate rise.

Find Out More: 7 Finest Crypto Exchanges in the United States for Bitcoin (BTC) Trading

Nevertheless, Bitcoin might begin climbing up towards its all-time high if benefit from standard properties circulation right into BTC and various other cryptocurrencies.

Right now, Bitcoin is seeing an expanding wave of favorable view, which is linked to the current turning points attained by gold and various other properties. According to Santiment, a substantial degree of uncertainty might be essential for BTC to make a solid press towards its all-time high.

” When the group starts communicating uncertainty once more, BTC will absolutely start evaluating its March all-time high market price,” the on-chain analytics system said on X.

Please Note

According to the Count on Task standards, this rate evaluation write-up is for educational functions just and ought to not be thought about monetary or financial investment suggestions. BeInCrypto is devoted to exact, impartial coverage, however market problems undergo alter without notification. Constantly perform your very own research study and talk to a specialist prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.