The United States Stocks and Exchange Payment (SEC) and the Commodities Futures Trading Payment (CFTC) might quickly start functioning unilaterally, complying with a brand-new costs offered by Republican politician Tennessee Congressman John Rose.

Crypto policy in the United States stays a controversial problem, with the pro-industry individual implicating regulatory authorities of suppressing development and driving financial investment overseas.

Congressman Promotes Independent Guideline

Congressman Rose is promoting the production of a joint consultatory board in between the SEC and CFTC. He presented the “BRIDGE Digital Possessions Act,” which recommends a 20-member economic sector team, with each participant standing for different passions within the cryptocurrency area.

” The present heavy-handed, regulation-by-enforcement strategy isn’t functioning and is rather motivating financial investment in this essential development overseas. The Joint Advisory Board on Digital Possessions will certainly offer a structure for the federal government and economic sector companions to work together on a course towards success for the governing landscape of electronic properties and economic sector individuals,” the costs read.

Pointing out unrevealed individuals, Fox Organization press reporter Eleanor Terrett said the board would certainly be a bridge in between the regulatory authorities and market gamers. This would certainly permit market individuals to deal with sector-related issues with the SEC and CFTC via the board.

An independent or collaborated governing body might without a doubt provide even more clearness in the crypto area, specifically offered previous problems in between the SEC and CFTC over administrative authority. These arguments have actually produced complication within the market, highlighting the demand for more clear oversight.

Find Out More: Crypto Guideline: What Are the Conveniences and Drawbacks?

In March 2023, the SEC insisted that all Proof-of-Stake (PoS) symbols and electronic properties need to be categorized as safeties. On the other hand, the CFTC suggested that Ethereum, trading as a futures agreement on its exchange, need to be thought about a product. CFTC Chair Rostin Behnam stated that he thought Ethereum was a product, asserting territory over it considering that Ethereum futures were traded on the CFTC exchange.

However, neighborhood participants stay hesitant concerning the performance of a joint board, specifically with Gary Gensler still functioning as SEC chair.

” I very question the SEC is awaiting this. They’ll most likely deal with the suggestions the means they guaranteed to provide suggestions,” one more customer commented.

Coinbase, Surge CLOs Respond to SEC’s on Stocks Term

At The Same Time, the United States SEC has actually supplied even more clearness on the safeties term for crypto properties. Complying with eToro’s negotiation with the SEC for a $1.5 million fine, Coinbase primary lawful policeman Paul Grewal said it is an admission that Ethereum is not a safety.

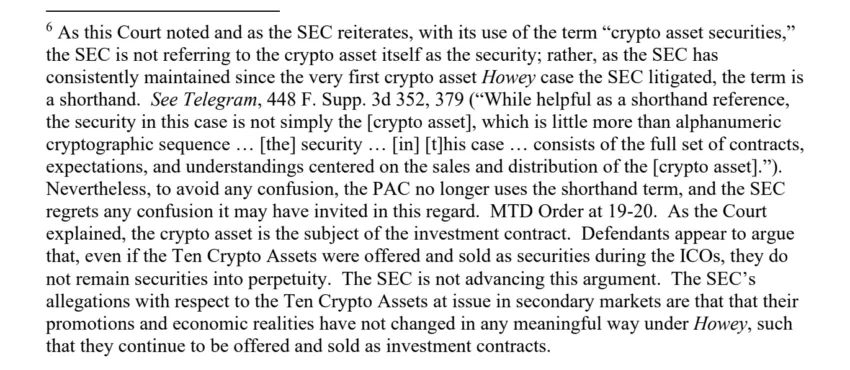

He additionally highlighted a declaration in the explanation of SEC’s modified issue versus Binance, keeping in mind the regulatory authority’s remorse of any type of complication welcomed by incorrectly and consistently specifying that symbols themselves are safeties.

Find Out More: Coinbase Evaluation 2024: The Most Effective Crypto Exchange for Beginners?

More Grewal said the regulatory authority’s accusations of Ethereum being a safety have actually impacted ETH deals as the 2nd biggest crypto by market capitalization aims to “avoid the agency’s clutches” In A Similar Way, Surge CLO Stuart Alderoty recognizes the SEC’s admission of mistake on token safety conditions.

” So the SEC ultimately confesses that 1/ “crypto property safety” is a fabricated term and 2/ to confirm a “crypto property safety” is a financial investment agreement, the SEC requires proof of a package of “agreements, assumptions, and understandings”? Believe it’s time for the SEC to confess has actually come to be a twisted cracker of oppositions,” Alderoty wrote.

The SEC has actually suppressed the crypto market for a number of years. As the United States political elections strategy, numerous really hope that this will certainly be the video game changer, unlocking for a lot more desirable plans in the area.

Please Note

In adherence to the Count on Job standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to offer precise, prompt details. Nevertheless, visitors are suggested to confirm truths separately and speak with a specialist prior to making any type of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.