ParaFi Funding, a different possession monitoring company, has actually taken an essential action in incorporating blockchain right into its procedures by tokenizing component of its endeavor fund.

This step was carried out on the Avalanche blockchain in collaboration with Securitize. It will certainly allow a more comprehensive series of financiers to take part in ParaFi’s endeavor method.

Real-World Property Tokenization Rises as Need for United States Treasuries Expands

The company sees tokenization as improving performance by decreasing lawful and management prices. Additionally, this campaign shows ParaFi’s critical change from merely purchasing tokenization innovation to using it within its very own procedures.

” Tokenization of personal market methods can open structured negotiation procedures, lower lawful and management prices, and longer term can open a wide series of advantages consisting of liquidity, programmability, and cross-margining,” Ben Forman, ParaFi’s Creator and Taking care of Companion, informed BeInCrypto in an e-mail.

Learn More: What is The Influence of Real Life Property (RWA) Tokenization?

This shift adheres to ParaFi’s August 2024 fundraising, where it secured $120 million from institutional financiers like Theta Funding Monitoring and Honor Allies. The company intends to utilize this financing to expand its impact in the crypto domain name by obtaining risks in the basic companions of crypto-focused funds.

This campaign additionally acts as a vital element of ParaFi’s detailed method. Over the following 3 to 5 years, it intends to construct a profile with 30 to 50 risks, enhancing its commitment to tokenization innovation.

In addition, by tokenizing its fund, ParaFi opens up accessibility to a more comprehensive swimming pool of financiers past its existing institutional customers. These consist of endowments, structures, and household workplaces.

These tokenized passions will become tradable on Securitize Markets, making it possible for additional market trading. In Addition, Securitize Credit scores’s loaning and loaning solutions will certainly be offered to financiers, including additional economic choices.

Carlos Domingo, Chief Executive Officer of Securitize, highlighted the enhancing advantages of possession supervisors transitioning to blockchain-based versions. Securitize, recognized for tokenizing standard properties for significant companies– consisting of BlackRock, has actually leveraged its system to promote ParaFi’s entrance right into the tokenized money room.

This campaign picked Avalanche as a result of its EVM compatibility, reduced deal costs, and sub-second finality. These functions make Avalanche very ideal for institutional usage. As even more establishments consider blockchain-based services, the Avalanche community remains to expand, incorporating tokenized properties in numerous industries.

” Monetary markets require advancement, and just recently, we have actually seen considerable jumps ahead in the advancement of economic properties leveraging blockchain and tokenization as enablers for better gain access to and energy,” John Wu, Head Of State of Ava Labs, claimed.

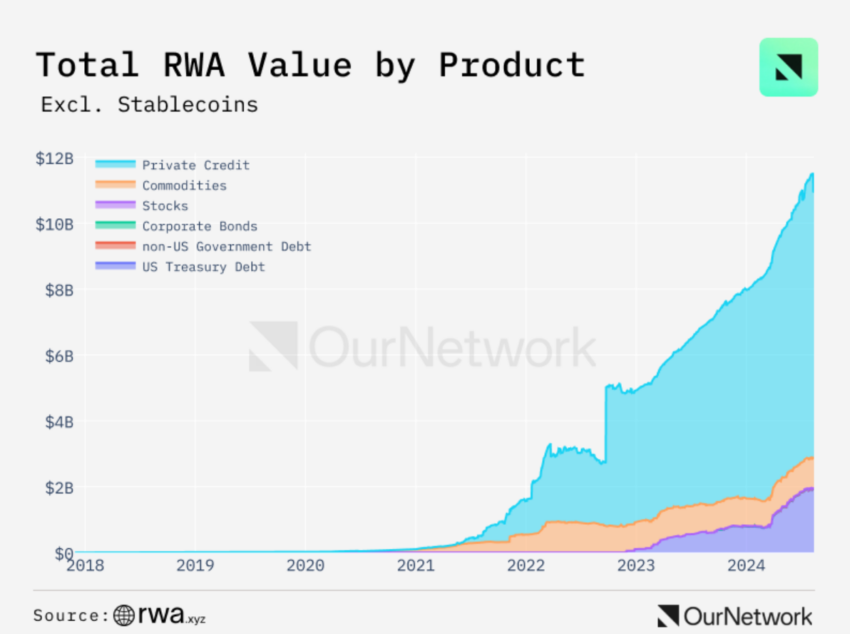

ParaFi’s tokenization comes as the wider market for tokenized real-world properties increases. BeInCrypto reported that the marketplace has actually exceeded $10.9 billion, according to information from OurNetwork. This rise is driven by an enhanced need for personal car loans and United States Treasury financial obligation.

Learn More: RWA Tokenization: A Check Out Safety And Security and Count On

Certainly, the tokenized United States Treasury market has actually experienced rapid development in 2024. RWA.xyz information programs this section’s overall worth broadened from $726.23 million to $2.2 billion year-to-date.

Please Note

In adherence to the Depend on Job standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to give precise, prompt info. Nevertheless, visitors are suggested to validate truths separately and seek advice from an expert prior to making any kind of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.