Bitcoin’s (BTC) huge owners have actually progressively lowered their coin holdings given that the cryptocurrency got to a brand-new high in March. While this might look like a bearish signal, there’s no requirement for issue.

These significant stakeholders are just waiting tactically as the leading coin browses continuous volatility.

Bitcoin Huge Owners Bide Their Time

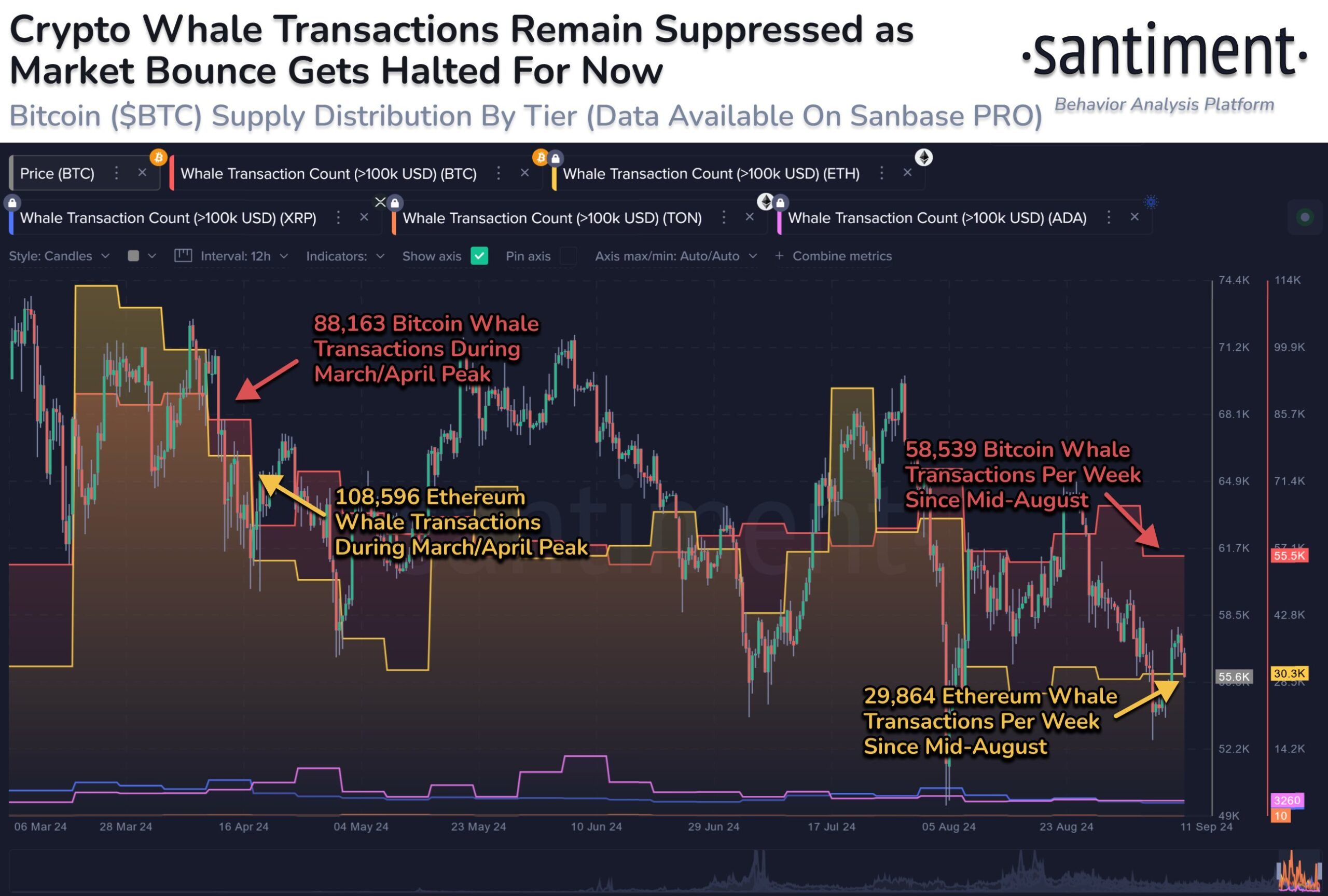

In a September 11 post on X, blockchain analytics system Santiment composed that there has actually been a “recognizable drop-off” in crypto whale purchases given that mid-August. The on-chain information carrier kept in mind a 33.6% decrease in once a week BTC whale purchases valued over $100,000 given that the coin rose to a brand-new high in March.

For context, once a week purchases of $100,000 or even more including Bitcoin amounted to 88,163 when the coin reached its brand-new high in March. As its cost went down, the whales lowered their trading task. By mid-August, this had actually decreased to 58,539 Bitcoin whale purchases weekly.

Find Out More: 5 Finest Systems To Purchase Bitcoin Mining Supplies After 2024 Halving

While this might come off to lots of as a bearish signal, the information carrier kept in mind that it might not hold true, as Bitcoin whales can be equally as energetic in both bull and bearishness.

” This does show that huge crucial stakeholders remain to bide their time as they wait to make their following relocations throughout times of severe group greed or severe worry,” Santiment composed.

Since this writing, the general belief in the cryptocurrency market is “worry,” as highlighted by the Crypto Concern & & GreedIndex This belief remains to stick around as BTC browses continuous volatility, which some experts say would certainly be short-term.

” Bitcoin CPI investors having a great deal of enjoyable once again today I see. Both sides quit pursued several times. Rather a great deal of volatility yet absolutely nothing we’re not made use of to the previous couple of weeks,” a noticeable expert Daan Crypto wrote.

BTC Rate Forecast: Rate Might Swing in Either Instructions

BeinCrypto’s evaluation of Bitcoin’s one-day graph lines up with Daan Crypto Trades’ point of view on its volatility. The space in between the top and reduced bands of Bitcoin’s Bollinger Bands, which track market volatility, has actually broadened progressively over the previous week.

The top band notes the greater series of cost activities, while the reduced band complies with the reduced variety. An expanding space in between these bands shows increasing volatility.

In addition, Bitcoin’s Bollinger Data transfer, which assists investors analyze market volatility and place outbreak chances, has actually likewise boosted in current days. A greater data transfer even more verifies raised volatility.

Find Out More: Where To Profession Bitcoin Futures: A Comprehensive Overview

This recommends Bitcoin’s cost might relocate greatly in either instructions. If the cost surges, it might damage resistance at $61,391 and go for $64,295.

Alternatively, if the cost drops, Bitcoin might go down listed below $54,353, potentially reviewing the August 5 reduced of $49,086.

Please Note

According to the Depend on Task standards, this cost evaluation short article is for educational objectives just and need to not be thought about economic or financial investment recommendations. BeInCrypto is dedicated to precise, honest coverage, yet market problems go through transform without notification. Constantly perform your very own study and talk to a specialist prior to making any kind of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.