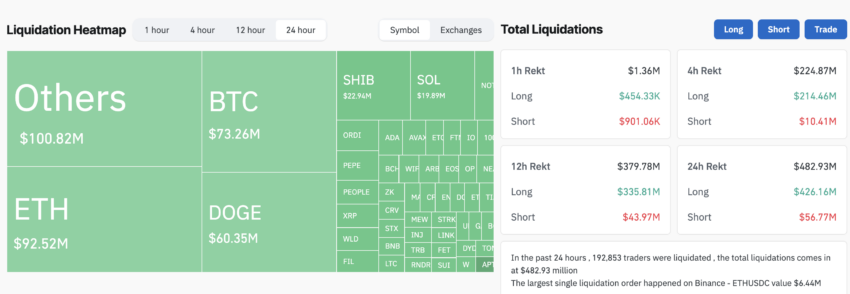

In a significant 24-hour duration, the crypto market saw an extreme decline, eliminating virtually half a billion bucks from investors’ profiles because of forced liquidations. Bitcoin (BTC) plunged to $64,569, and Ethereum (ETH) went down to $3,355, causing over $482 million in liquidations.

This effect was most extreme on lengthy settings.

Crypto Investors Hypothesize That it is The Last Dip

Throughout this market turmoil, mainstream and arising electronic possessions alike endured. The complete variety of investors impacted gotten to 192,853.

Information from CoinGlass revealed Ethereum as the hardest struck, with liquidations amounting to $92.52 million. It was adhered to by Bitcoin and Dogecoin (DOGE), with $73.26 million and $60.35 million in liquidations, specifically.

Find Out More: Exactly How To Profession Crypto on Binance Futures: Whatever You Required To Know

The biggest solitary liquidation occasion happened on Binance, where an investor shed $6.44 million on Ethereum long profession. This highlights the unpredictable and speculative nature of the crypto market, specifically in times of market stress and anxiety.

Regardless of these difficulties, Bitcoin showed strength, a little recuperating to $65,500. Ethereum additionally revealed some recuperation, trading at $3,440. This fast bounce-back is particular of the crypto market, mirroring its volatility and the quick activities of its financiers.

Experts and investors have actually blended sights on the marketplace’s instructions. Crypto Vagabond, a kept in mind expert, suggested that a rise to $73,000 for Bitcoin can sell off over $10 billion simply put settings. At the same time, investor ChimpZoo anticipated a significant market turnaround.

” This is the last dip. This is the dip to lure every bear right into the marketplace. What follows will certainly be a liquidation candle light to send out bears back right into the darkness world,” ChimpZoo strongly stated.

Discharges from Bitcoin exchange-traded funds (ETFs) better make complex the marketplace situation. According to Farside Investors, noteworthy discharges were taped from numerous funds. Integrity’s Wise Beginning Bitcoin Fund taped discharges of $92 million, and the ARK 21Shares Bitcoin ETF taped discharges of $50 million.

Find Out More: Exactly How To Profession a Bitcoin ETF: A Step-by-Step Technique

Alternatively, the Bitwise Bitcoin ETF handled a small inflow of $2.9 million, showcasing a combined capitalist belief throughout various financial investment cars. At the same time, BlackRock’s iShares Bitcoin Trust fund (IBIT) is yet to launch Monday’s circulation information.

Leaving Out IBIT, all the ETFs taped a mixed discharge of $145.9 million on Monday.

Please Note

In adherence to the Trust fund Job standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to offer precise, prompt details. Nonetheless, viewers are recommended to validate realities individually and seek advice from an expert prior to making any kind of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.