On Tuesday, Bitcoin exchange-traded funds (ETFs) obtained inflows amounting to around $117 million. Leading this rise, Integrity’s Bitcoin Fund (FBTC) recorded around $63 million in internet inflows.

Subsequently, FBTC’s eight-month overall inflows currently stand at $9.5 billion.

BlackRock’s Bitcoin ETF Yet to Document Inflows

On the very same day, Grayscale’s Bitcoin Mini Depend on (BTC) and ARK Invest/21Shares’ Bitcoin ETF (ARKB) likewise experienced considerable inflows. They brought in regarding $41.1 million and $12.7 million specifically.

These numbers represent that area Bitcoin ETFs went across the $100 million mark in inflows for the very first time in September. This increase complied with a Monday document of $28.6 million, which turned around an unpleasant eight-day touch of discharges, throughout which $1.2 billion left the marketplace.

Learn More: Just How To Profession a Bitcoin ETF: A Step-by-Step Technique

| August 23, 2024 | IBIT | FBTC | BITB | ARKB | BTCO | EZBC | BRRR | HODL | BTCW | GBTC | BTC | Overall |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Cost | 0.21% | 0.25% | 0.20% | 0.21% | 0.25% | 0.19% | 0.25% | 0.20% | 0.25% | 1.50% | 0.15% | |

| August 26, 2024 | 224.1 | ( 8.3 ) | ( 16.6 ) | 0.0 | 0.0 | 5.5 | 0.0 | ( 7.2 ) | 5.1 | 0.0 | 0.0 | 202.6 |

| August 27, 2024 | 0.0 | 0.0 | ( 6.8 ) | ( 102.0 ) | 0.0 | 0.0 | — | 0.0 | 0.0 | ( 18.3 ) | 0.0 | ( 127.1 ) |

| August 28, 2024 | 0.0 | ( 10.4 ) | ( 8.7 ) | ( 59.3 ) | 0.0 | 0.0 | 0.0 | ( 10.1 ) | 0.0 | ( 8.0 ) | ( 8.8 ) | ( 105.3 ) |

| August 29 | ( 13.5 ) | ( 31.1 ) | ( 8.1 ) | 5.3 | 0.0 | 0.0 | ( 1.7 ) | 0.0 | 0.0 | ( 22.7 ) | 0.0 | ( 71.8 ) |

| August 30, 2024 | 0.0 | ( 12.9 ) | ( 16.4 ) | ( 65.0 ) | ( 11.1 ) | 0.0 | 0.0 | 0.0 | 0.0 | ( 70.2 ) | 0.0 | ( 175.6 ) |

| September 2, 2024 | — | — | — | — | — | — | — | — | — | — | — | 0.0 |

| September 3, 2024 | 0.0 | ( 162.3 ) | ( 25.0 ) | ( 33.6 ) | ( 2.3 ) | ( 8.4 ) | ( 2.5 ) | ( 3.3 ) | 0.0 | ( 50.4 ) | 0.0 | ( 287.8 ) |

| September 4, 2024 | 0.0 | ( 7.6 ) | 9.5 | 0.0 | 0.0 | 0.0 | — | ( 4.9 ) | 0.0 | ( 34.2 ) | 0.0 | ( 37.2 ) |

| September 5, 2024 | 0.0 | ( 149.5 ) | ( 30.0 ) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ( 23.2 ) | ( 8.4 ) | ( 211.1 ) |

| September 6, 2024 | 0.0 | ( 85.5 ) | ( 14.3 ) | ( 7.2 ) | 0.0 | 0.0 | ( 4.6 ) | 0.0 | 0.0 | ( 52.9 ) | ( 5.5 ) | ( 170.0 ) |

| September 9, 2024 | ( 9.1 ) | 28.6 | 22.0 | 6.8 | 3.1 | 0.0 | 0.0 | 0.0 | 0.0 | ( 22.8 ) | 0.0 | 28.6 |

| September 10, 2024 | 0.0 | 63.2 | 0.0 | 12.7 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 41.1 | 117.0 |

| Overall | 20,908 | 9,516 | 1,950 | 2,292 | 345 | 385 | 521 | 574 | 211 | ( 20,035) | 375 | 17,043 |

On the other hand, BlackRock’s iShares Bitcoin Depend on has actually not mirrored this favorable fad. For the previous 10 trading days, beginning August 27, IBIT has actually taped no inflows, noting a duration of stagnancy and periodic discharges. Additionally, on August 29, IBIT noted its second-ever discharge because beginning, shedding regarding $13.5 million.

Nonetheless, these problems have actually not tested IBIT’s market management, as the fund remains to control with holdings surpassing $20 billion. Likewise, IBIT currently flaunts 661 institutional owners, with 20% of its shares held by these entities. Moreover, there more than 1,000 institutional financiers throughout all ETFs, as confirmed by 2 13F declaring durations.

These filings, compulsory quarterly disclosures for institutional financial investment supervisors, show an expanding and continual passion in Bitcoin ETFs.

As these funds obtain brand-new funding adhering to an extended discharge duration, Bitcoin is revealing indicators of healing. Given that the previous weekend break, Bitcoin’s cost has actually climbed by around 6.71%, currently floating around $56,600.

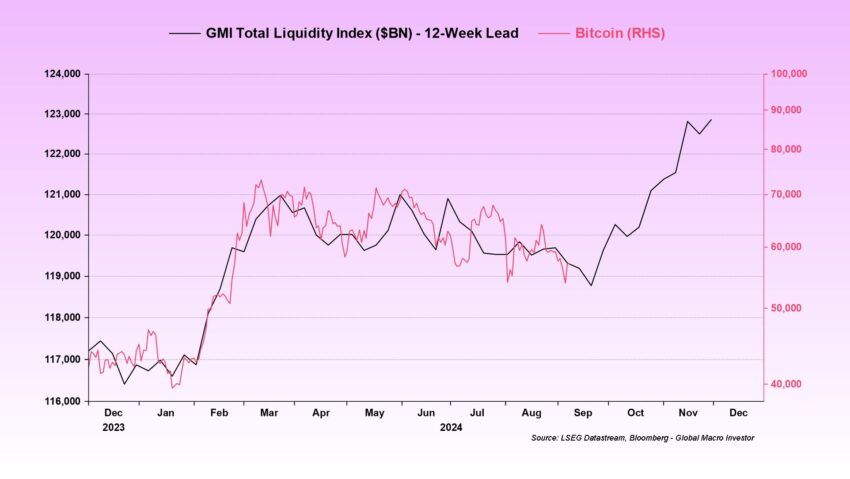

This uptick is carefully linked to wider financial signs that recommend an increase in liquidity, which commonly profits Bitcoin as a result of its level of sensitivity to liquidity adjustments.

Julien Bittel, a macro scientist, discussed the scenario.

” Liquidity gets on the increase once more, and Bitcoin– being incredibly conscious adjustments in liquidity problems– has the possible to relocate explosively as fresh liquidity moves right into the system. The macro setting is changing. A significant liquidity wave is currently coming up, and when it strikes, Bitcoin looks topped for a solid press greater in Q4,” Bittel said.

Learn More: Bitcoin (BTC) Cost Forecast 2024/2025/2030

The Worldwide Cash Index (GMI), which gauges the quantity of cash in blood circulation amongst customers and financial institutions, is increasing. A boost in the GMI normally signifies even more readily available funds, which might result in raised Bitcoin acquisitions.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to supply exact, prompt info. Nonetheless, viewers are recommended to confirm realities individually and speak with a specialist prior to making any kind of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.