Alongside lots of various other altcoins, ETH’s rate remains to battle, and its future currently rests on some important assistance degrees. If these vital degrees stop working to hold, ETH can deal with a long term bearish duration.

Current rate activity has actually revealed that Ethereum (ETH) can be on the edge of bidding process goodbye to this cycle, which lots of have actually marked as the long-lasting stage of the booming market.

Ethereum Will Shed the Fight

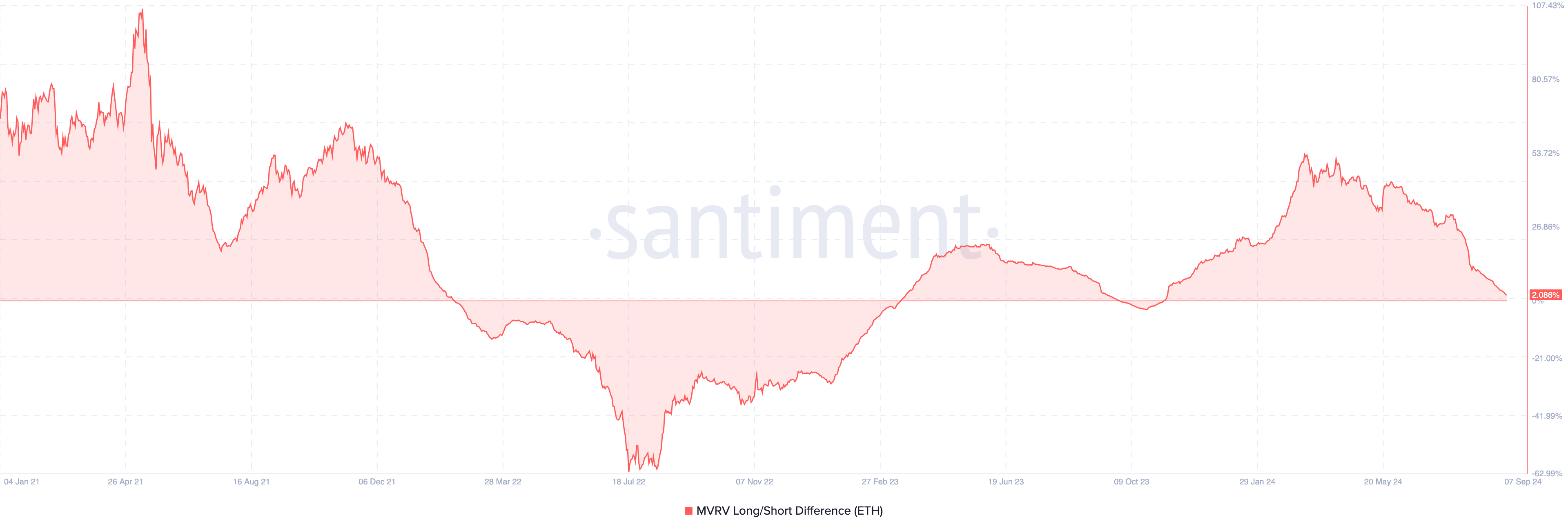

6 months earlier, Ethereum’s Market price to Understood Worth (MVRV) Long/Short Distinction struck an annual high of 55%. This on-chain indication is vital throughout advancing market, as it discloses whether temporary owners have extra latent revenues than long-lasting owners.

When the MVRV Long/Short Distinction climbs, long-lasting owners acquire the benefit. A decline, specifically right into the adverse array, signifies the contrary. Already, the analysis stands at 2.08%, suggesting that lots of long-lasting ETH owners have actually left successful settings.

If this pattern proceeds, the analysis can transform adverse. The last time this took place remained in February 2022, adhered to by a year-long bearish market throughout cryptocurrencies, consisting of Ethereum.

Find Out More: 9 Finest Places To Bet Ethereum in 2024

If the present pattern mirrors previous patterns, assumptions of Ethereum getting to 5 numbers in this cycle might be impractical.

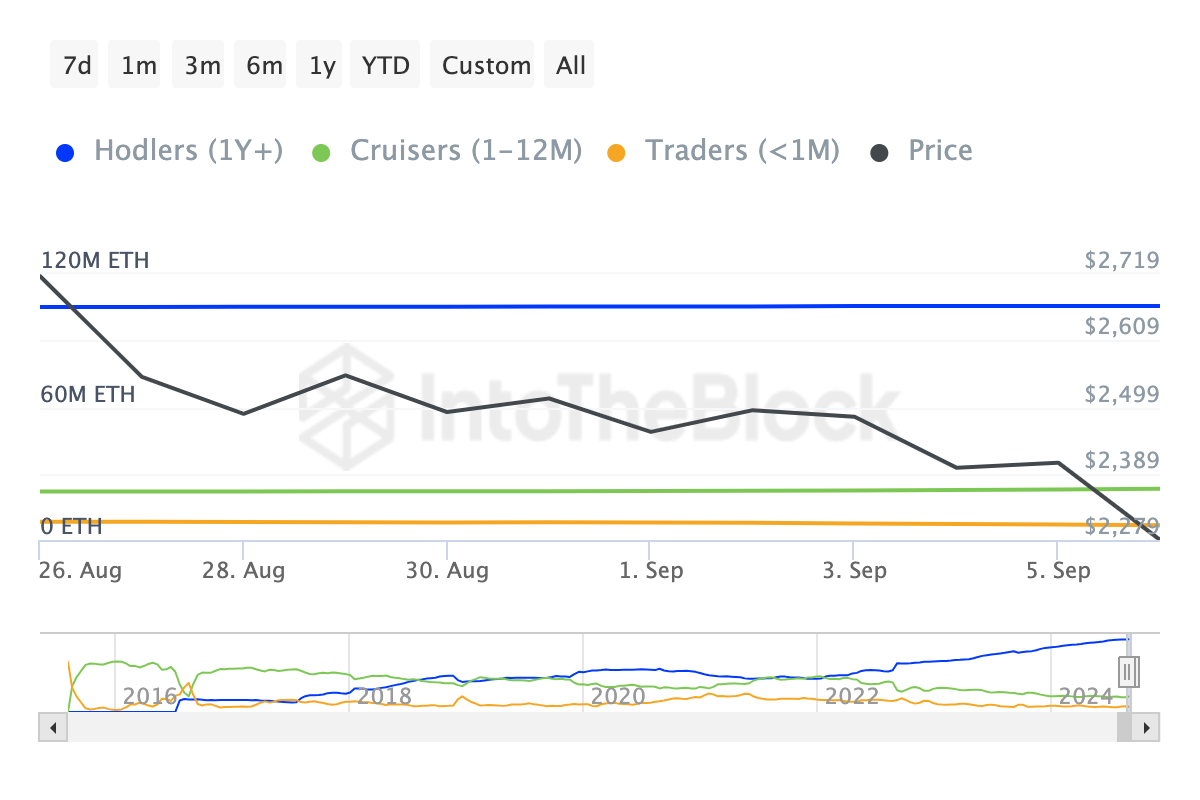

One more indication strengthening this view is the Equilibrium by Time Held statistics, which determines the length of time individuals hold a cryptocurrency. Normally, a boost in this statistics programs that owners are not marketing, suggesting self-confidence in a bull cycle.

Nonetheless, ETH’s equilibrium held over the previous thirty days has actually boosted, recommending that some owners are shedding self-confidence in the altcoin’s brief- to long-lasting possibility, possibly signifying a change in market view.

ETH Rate Forecast: Bulls Can Not Hang On

The Relocating Typical Merging Aberration (MACD) on the day-to-day duration reveals that Ethereum’s rate remains to sustain bearish energy. The MACD utilizes the placement of the 12 and 26-day Exponential Relocating Typical (EMA) to figure out energy.

A favorable MACD analysis indicates a favorable energy. Adverse analyses, on the various other hand, recommend most likely stress to the drawback. From the photo listed below, ETH’s rate requires to remain over $2,220 to avoid a significant rate accident.

Nonetheless, provided the present market problems, a decline listed below $2,000 promises. That stated, constant purchasing stress can aid support Ethereum’s weak efficiency and avoid additional decreases.

Find Out More: Exactly how to Buy Ethereum ETFs?

If this occurs, the rate may leap towards $2,536 and most likely $2.974, potentially revoking the booming market departure.

Please Note

In accordance with the Depend on Job standards, this rate evaluation write-up is for informative objectives just and ought to not be thought about monetary or financial investment suggestions. BeInCrypto is devoted to precise, honest coverage, yet market problems go through transform without notification. Constantly perform your very own study and seek advice from an expert prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.