Quarterly profits outcomes are a great time to sign in on a business’s development, particularly contrasted to its peers in the exact same field. Today we are taking a look at Range Brands (NYSE: SPB) and the very best and worst entertainers in the home items sector.

House items supplies are normally steady financial investments, as a number of the sector’s items are necessary for a comfy and useful space. Just recently, there’s been an expanding focus on green and lasting offerings, mirroring the advancing customer choices for eco mindful choices. These patterns can be double-edged swords that profit business that introduce swiftly to make the most of them and injure business that do not spend sufficient to fulfill customers where they intend to be when it come to patterns.

The 10 home items supplies we track reported a suitable Q2. En masse, profits defeated experts’ agreement price quotes by 1% while following quarter’s profits support was 0.5% over.

Supplies, particularly development supplies with capital better right into the future, had an excellent end of 2023. On the various other hand, this year has actually seen much more unstable stock exchange swings because of combined rising cost of living information. Fortunately, home items supplies have actually executed well with share rates up 10.3% usually considering that the current profits outcomes.

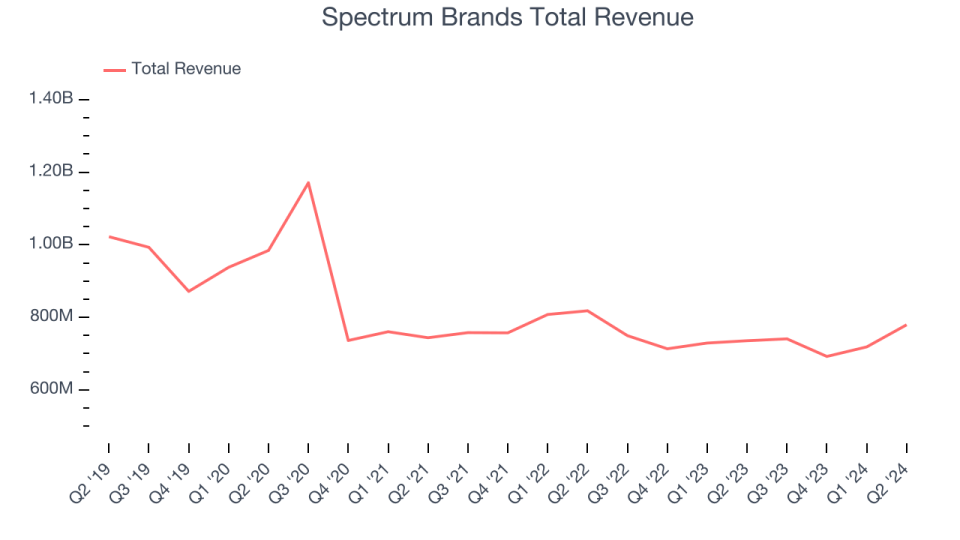

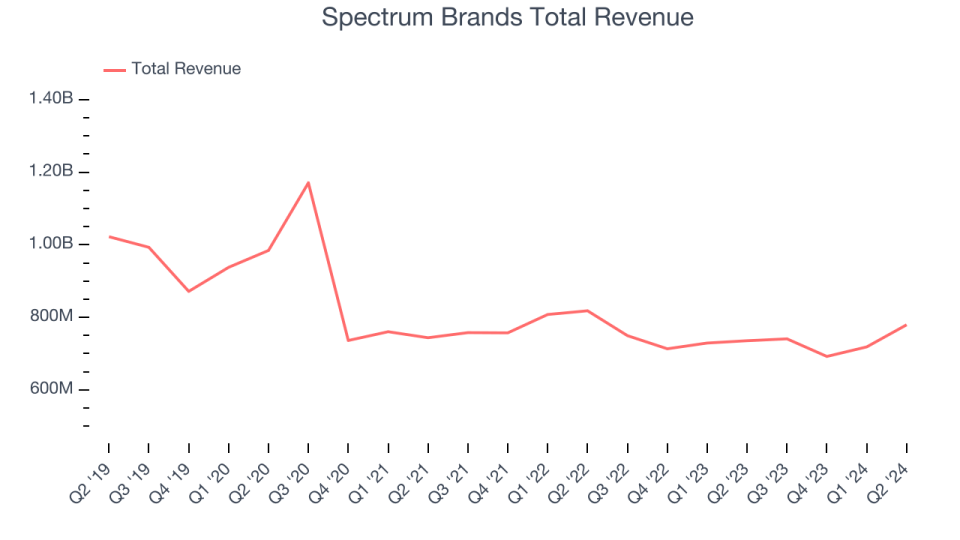

Ideal Q2: Range Brands (NYSE: SPB)

A leader in numerous customer item classifications, Range Brands (NYSE: SPB) is a varied firm with a profile of relied on brand names covering home devices, yard treatment, individual treatment, and animal treatment.

Range Brands reported profits of $779.4 million, up 6% year on year. This print went beyond experts’ assumptions by 3.8%. On the whole, it was a really solid quarter for the firm with an outstanding beat of experts’ operating margin and natural profits development price quotes.

” We delight in to report a solid 3rd quarter of monetary 2024, developing off the operating energy we drove in the initial fifty percent of the year. Each service supplied reported and natural web sales development, and year-to-date our web sales development is currently favorable.” stated David Maura, Chairman and Ceo of Range Brands.

Remarkably, the supply is up 15% considering that reporting and presently trades at $94.19.

Is currently the moment to get Range Brands? Access our full analysis of the earnings results here, it’s free.

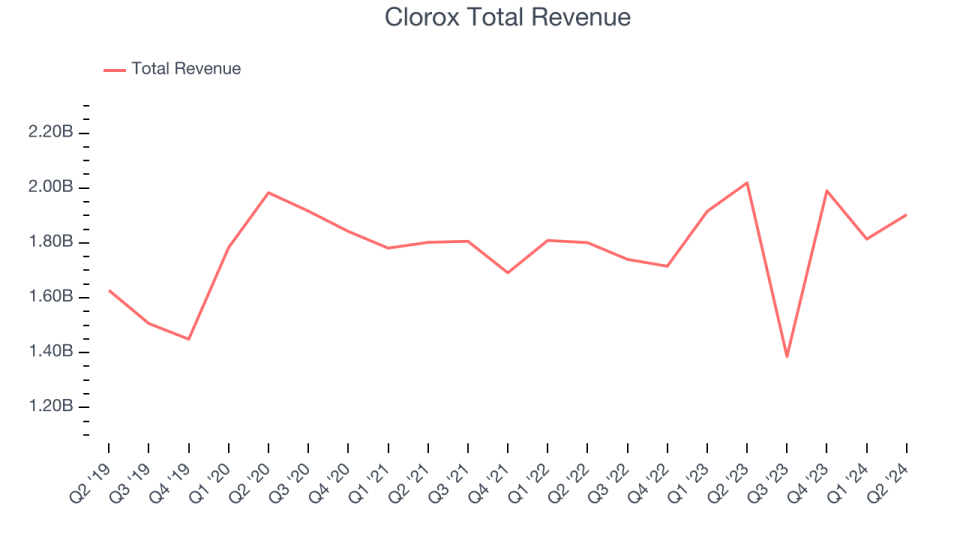

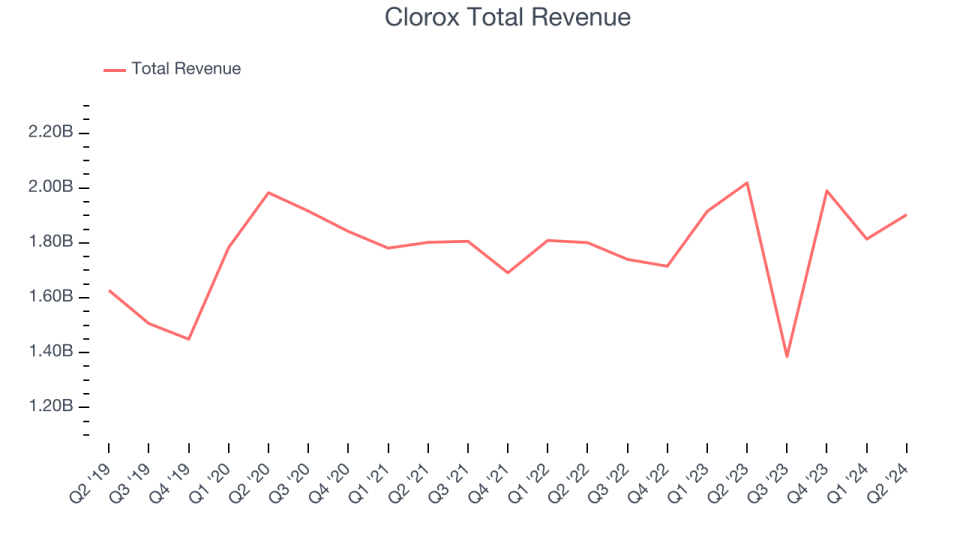

Clorox (NYSE: CLX)

Established In 1913 with bleach as the single item offering, Clorox (NYSE: CLX) today is a customer items gigantic whose item profile covers every little thing from bleach to skin care to salad clothing to feline trash.

Clorox reported profits of $1.90 billion, down 5.7% year on year, disappointing experts’ assumptions by 2.4%. Nevertheless, it was still a solid quarter for the firm with an outstanding beat of experts’ natural profits development price quotes.

The marketplace appears delighted with the outcomes as the supply is up 22.9% considering that coverage. It presently trades at $164.82.

Is currently the moment to get Clorox? Access our full analysis of the earnings results here, it’s free.

Weakest Q2: Kimberly-Clark (NYSE: KMB)

Initially established as a Wisconsin paper mill in 1872, Kimberly-Clark (NYSE: KMB) is currently a family items giant recognized for individual treatment and cells items.

Kimberly-Clark reported profits of $5.03 billion, down 2% year on year, disappointing experts’ assumptions by 1.3%. It was a slower quarter for the firm with a miss out on of experts’ natural profits development price quotes.

Remarkably, the supply is up 2% considering that the outcomes and presently trades at $147.03.

Read our full analysis of Kimberly-Clark’s results here.

Reynolds (NASDAQ: REYN)

Ideal recognized for its light weight aluminum foil, Reynolds (NASDAQ: REYN) is a family items firm whose items concentrate on food storage space, food preparation, and waste.

Reynolds reported profits of $930 million, down 1.1% year on year, exceeding experts’ assumptions by 4.2%. Earnings apart, it was a solid quarter for the firm with an outstanding beat of experts’ gross margin and natural profits development price quotes.

Reynolds had the weakest full-year support upgrade amongst its peers. The supply is up 13.7% considering that reporting and presently trades at $32.50.

Read our full, actionable report on Reynolds here, it’s free.

WD-40 (NASDAQ: WDFC)

Brief for “Water Variation improved on the 40th shot”, WD-40 (NASDAQ: WDFC) is a popular American durable goods firm recognized for its famous and flexible spray, WD-40 Multi-Use Item.

WD-40 reported profits of $155 million, up 9.4% year on year, exceeding experts’ assumptions by 6.3%. Earnings apart, it was a solid quarter for the firm with full-year profits support pounding experts’ assumptions and a suitable beat of experts’ profits price quotes.

WD-40 accomplished the largest expert approximates beat, fastest profits development, and highest possible full-year support raising amongst its peers. The supply is up 18.3% considering that reporting and presently trades at $260.10.

Read our full, actionable report on WD-40 here, it’s free.

Sign Up With Paid Supply Financier Research Study

Aid us make StockStory much more valuable to financiers like on your own. Join our paid individual study session and obtain a $50 Amazon present card for your viewpoints. Sign up here.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.