Today has actually confirmed tough for Bitcoin and the wider crypto market. After almost getting to the $60,000 mark, Bitcoin’s rate has actually gone down concerning 5%, presently trading at roughly $56,400.

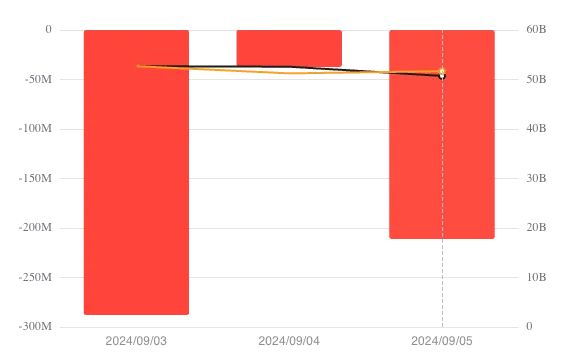

Substantial discharges from area Bitcoin Exchange Traded Finances (ETFs) significantly affected the decline.

Crypto Market Goes Into Extreme Worry as Bitcoin Struggles

Although United States markets were shut on Monday, significant withdrawals returned to after that. On Tuesday, area Bitcoin ETFs saw a web discharge of $287.78 million.

Ultimately, on Wednesday, ETFs taped a more withdrawal of $37.29 million, adhered to by $211.15 million on Thursday. Consequently, area Bitcoin ETFs taped a complete discharge of $536.22 million today.

Find Out More: Exactly How To Profession a Bitcoin ETF: A Step-by-Step Method

Taking into account these discharges, numerous market leaders have actually articulated a bearish point of view on Bitcoin. Arthur Hayes, founder of the BitMEX crypto exchange, honestly introduced his brief placement on Bitcoin, targeting a loss listed below $50,000.

” BTC is hefty, I’m gunning for sub $50,000 this weekend break. I took an audacious brief. Wish my heart, for I am a degen,” Hayes shared on X (previously Twitter).

In a similar way, proficient investor Peter Brandt recommended that Bitcoin could decrease to the $46,000 degree.

” This is called an upside down broadening triangular or a loudspeaker. An examination of the reduced limit would certainly be to $46,000 or two. A large drive right into brand-new perpetuity highs is called for to obtain this booming market back on the right track for Bitcoin. Marketing is more powerful than acquiring in this pattern,” Brandt outlined.

Find Out More: Bitcoin (BTC) Cost Forecast 2024/2025/2030

Additionally, the United States work non-farm pay-roll record schedules today. This information is essential as it could affect the Federal Book’s price choice. A specifically weak work report last month currently set off worldwide market instability, influencing cryptocurrencies too.

” The upcoming launch of the United States pay-roll information is excitedly prepared for by capitalists, as it can affect the Federal Book’s choice on the prospective dimension of the rates of interest reduced this month. The marketplace’s volatility shows the unpredictability bordering this essential financial sign,” Avinash Shekhar, chief executive officer of crypto by-products exchange Pi42, informed BeInCrypto.

Subsequently, the cryptocurrency market has actually plunged right into an “severe concern” area, according to the Crypto Worry & & Greed Index, which gauges market belief. On September 6, the index was up to 22, suggesting “severe concern”– a raw comparison from the previous day’s rating of 29, classified “concern.” This notes the most affordable rating given that August 8, when the index struck 20.

Find Out More: What Is the Crypto Worry and Greed Index?

Regardless of the prevalent unfavorable belief, some investors area prospective possibilities. Quinten Francois, a popular crypto financier, highlighted that market views mirror those when Bitcoin last struck a reduced of $16,000 in November 2022. Therefore, he advised the capitalists to act as necessary.

However, it is essential to recognize that severe concern can linger, possibly bring about prolonged durations of market unpredictability.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to supply precise, prompt info. Nonetheless, visitors are recommended to confirm truths individually and speak with a specialist prior to making any kind of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.