In current months, an associate of Bitcoin (BTC) owners has been significantly impacted by the coin’s battle to support over $70,000. This team consists of temporary owners (STHs)– capitalists that have actually held the property for much less than 155 days.

While the remainder of the market stays rewarding in spite of BTC’s cost difficulties, its STHs remain to videotape losses in their financial investments.

Bitcoin Short-Term Owners Face Document Losses

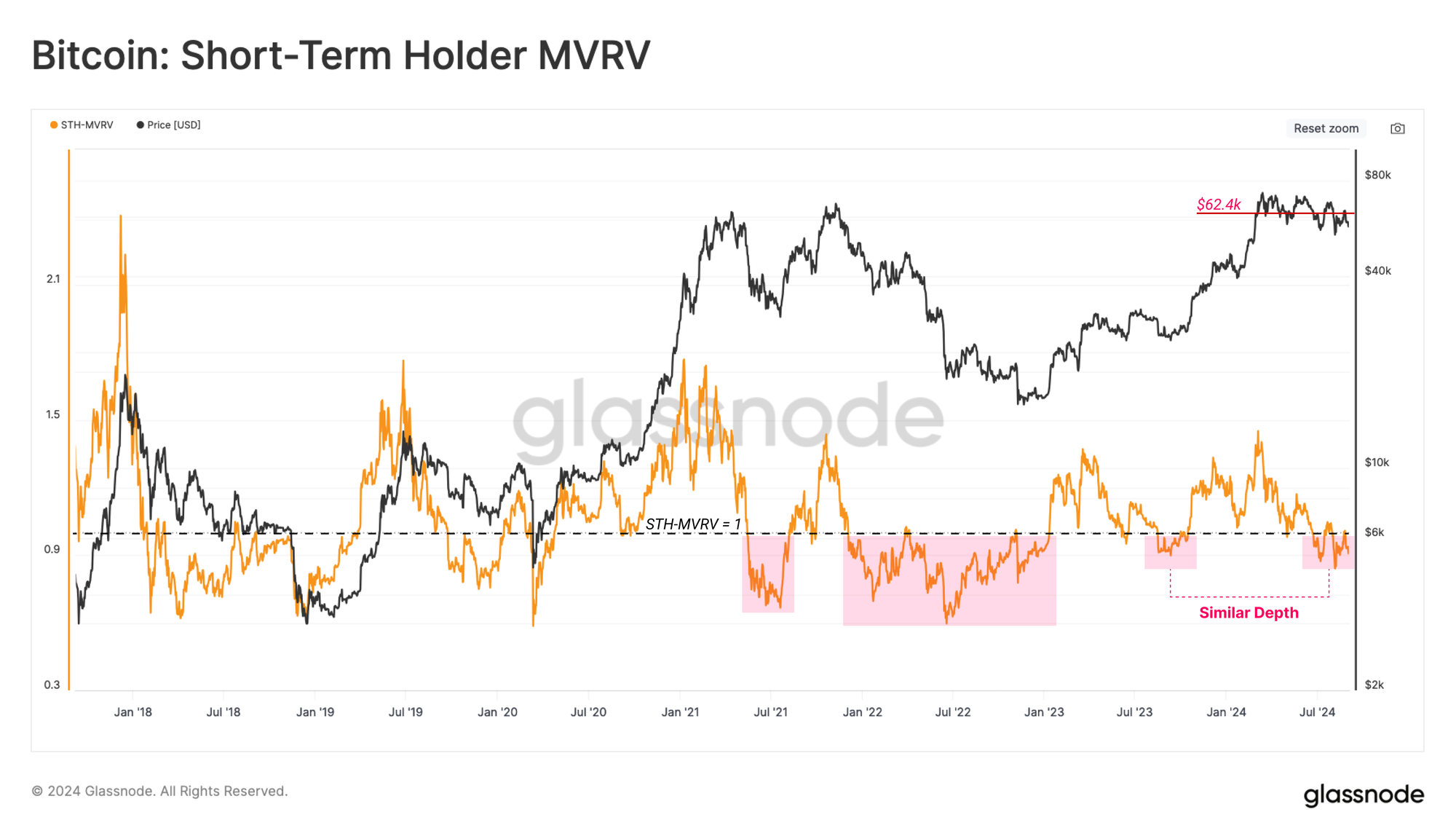

In its brand-new report, on-chain information supplier Glassnode located that BTC’s STHs remain to remain on even more latent losses than the remainder of the market. Defining them as the “key friend in jeopardy,” Glassnode kept in mind that the size of the losses sustained by this group of coin owners has actually raised over the previous couple of months.

The on-chain analytics strong evaluated BTC’s STH market price to understood worth (MVRV) proportion. It located that its worth has actually stayed listed below one and is currently at” degrees comparable to Aug 2023 throughout the healing rally after the FTX failing.”

When a possession’s MVRV proportion is listed below one, its market price is much less than the ordinary cost paid to obtain it by owners. Consequently, if they market, they would certainly sustain losses.

” This informs us that the ordinary brand-new capitalist is holding a latent loss. Typically talking, up until the area cost redeems the STH expense basis of $62.4 k, there is an assumption for more market weak point,” Glassnode stated.

As a result of current spike in losses, Bitcoin temporary owners (STHs) have actually readjusted their actions. According to Glassnode, “the wide range held by new-demand capitalists has actually decreased over current months” as these STHs dispersed their coins.

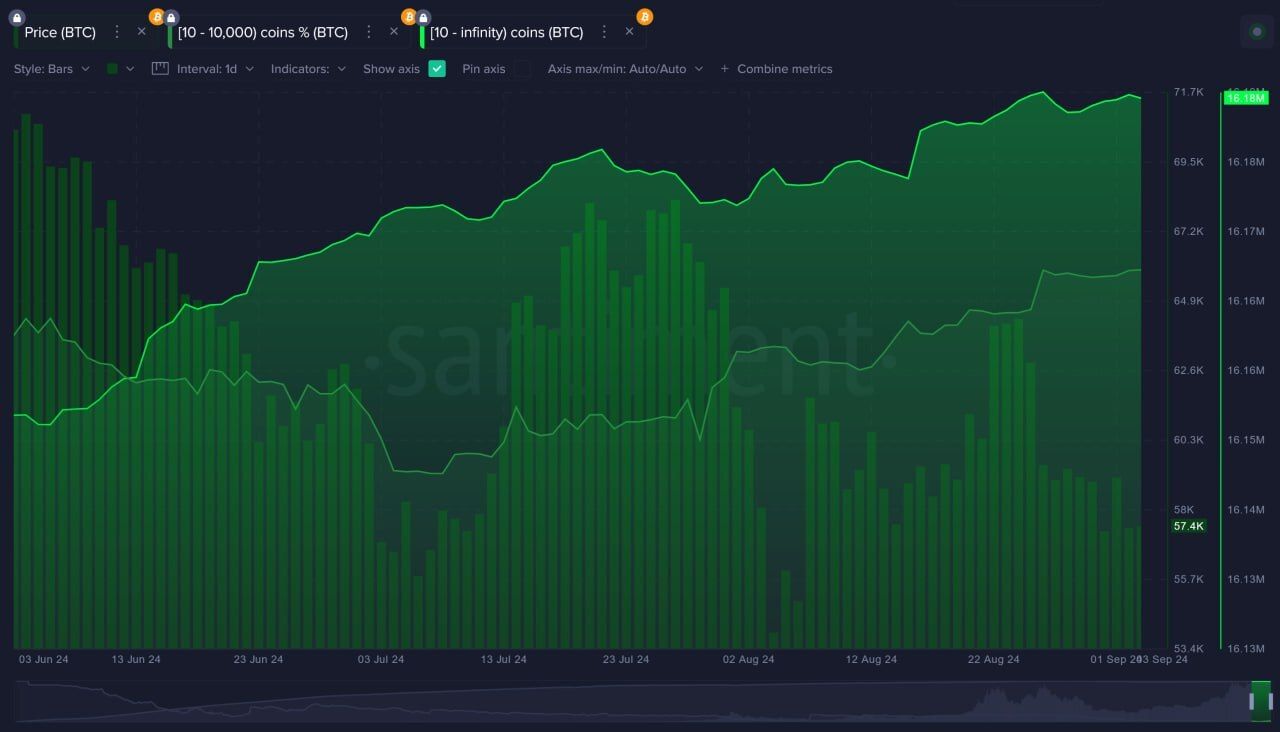

Alternatively, lasting owners (LTHs) have actually lowered profit-taking and increase buildup, revealing different approaches in between both teams. This pattern appears among BTC whales also.

” For Bitcoin, the primary graph that remains to look motivating is this revealing that whales remain to collect. Over the previous 3 months, 10+ BTC purses have actually included a consolidated 34.2 K a lot more coins,” Brian Quinlivan, lead expert at Santiment, kept in mind in an unique meeting with BeinCrypto.

Learn More: What Took place at the Last Bitcoin Halving? Forecasts for 2024

BTC Rate Forecast: Even More Discomfort Ahead

BTC’s technological arrangement recommends that the leading coin is positioned for an additional decrease. At press time, its Awesome Oscillator, which gauges market energy, is adverse.

At -1,545, BTC’s Awesome Oscillator signals that its temporary cost motions are weak than its longer-term motions, recommending descending energy. In addition, its Chaikin Cash Circulation (CMF), in a sag, signals liquidity departure from the BTC market.

Learn More: Bitcoin Halving Background: Whatever You Required To Know

If this fad proceeds, the king coin’s cost might be up to $53,968. Nevertheless, if acquiring task outweighs offering stress, the coin’s worth might rally to $57,291.

Please Note

According to the Depend on Job standards, this cost evaluation write-up is for informative functions just and need to not be taken into consideration economic or financial investment suggestions. BeInCrypto is devoted to precise, objective coverage, however market problems go through transform without notification. Constantly perform your very own research study and talk to a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.