Binance Coin (BNB) futures investors are secured an intense fight, with lengthy and brief placements trying supremacy.

With the marketplace seeing a greater need for lengthy placements, a possible decrease in BNB’s worth places these lengthy investors in danger of liquidation.

Binance Coin Lengthy Investors Fire Their Shot

BNB’s current rate changes have actually developed an inequality in the need for lengthy and brief placements in its futures market. This appears from the rotating favorable and unfavorable financing prices tape-recorded considering that August 28.

Financing prices in continuous futures agreements assist line up a possession’s agreement rate with its place rate. Favorable financing prices suggest greater need for lengthy placements, while unfavorable prices recommend an enhanced cravings for brief placements.

In BNB’s instance, the control of favorable financing prices over the previous couple of days reveals that investors are preferring long placements, also as the coin proceeds its effort to expand its present drop.

Since press time, BNB is trading at $504.63, having actually gone down 7% over the previous week. The altcoin has actually continued to be listed below a coming down pattern line, showing unfavorable market view and the possibility for more decreases.

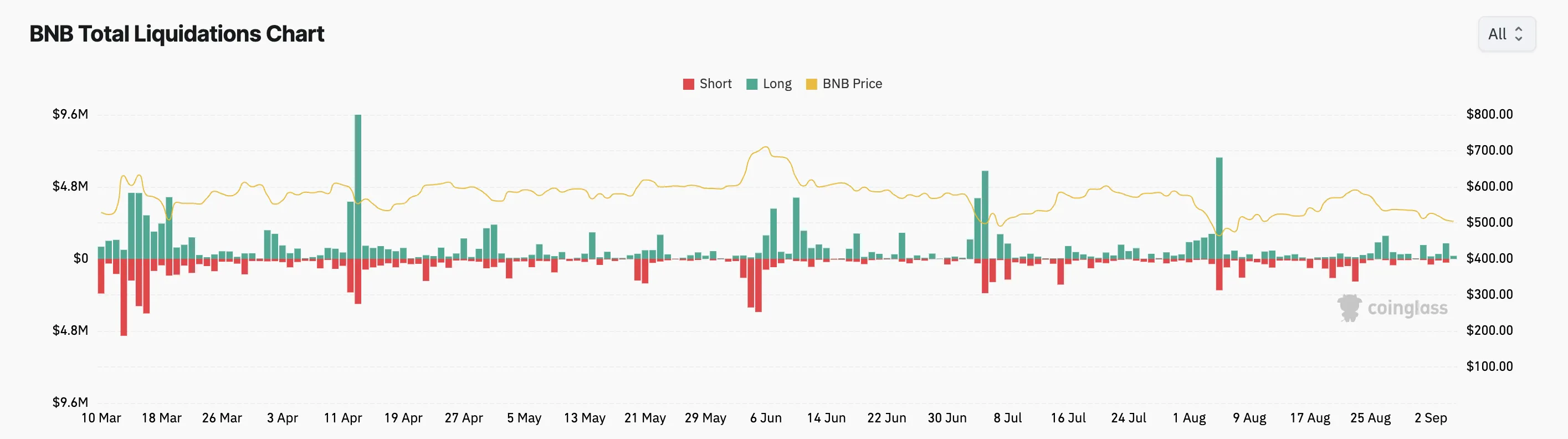

If BNB’s drop proceeds, lengthy placements can encounter a higher danger of liquidation. This pattern has actually currently started, with lengthy liquidations outmatching brief ones in current days. On Wednesday alone, lengthy liquidations got to $1.04 million, while brief liquidations were a lot reduced, completing much less than $250,000.

Find Out More: Finest BNB Pocketbooks to Think About in 2024

BNB Rate Forecast: The Bears Have It

There is no gain stating in refuting that BNB is positioned for even more decline. Its dropping Loved one Stamina Index (RSI) shows reinforcing offering stress in the marketplace. Since this writing, this vital energy sign remains in a sag at 38.33, recommending that market individuals have actually chosen to offer their coins as opposed to acquire brand-new ones.

In addition, a procedure of BNB’s bull-bear power discloses that the vendors regulate the marketplace. The coin’s Elder-Ray Index, which determines the connection in between the toughness of customers and vendors in the marketplace, has actually been unfavorable considering that the coin started trading under the coming down pattern line on August 27. When its worth is unfavorable, bear power is leading.

Find Out More: Binance Coin (BNB) Rate Forecast 2024/2025/2030

If bearish stress places, BNB’s rate will certainly drop under $500 to trade at $475.90. Nonetheless, if the marketplace pattern changes to favorable, its worth might reach $522.90.

Please Note

According to the Depend on Job standards, this rate evaluation write-up is for informative objectives just and ought to not be thought about monetary or financial investment suggestions. BeInCrypto is devoted to exact, objective coverage, however market problems go through alter without notification. Constantly perform your very own research study and talk to an expert prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.