The efficiency of the marketplace’s favored altcoin, Ethereum (ETH), has actually been hindered by issues with its network in the previous couple of months.

As these issues linger, ETH’s cost problems might remain longer than expected.

Ethereum Deals With Reduced Customer Task, ETF Sees Discharges

The Ethereum network has actually observed a decrease in customer need over the previous couple of months. Artemis information reveals that the previous 90 days have actually been noted by a 6% decrease in the matter of special energetic addresses that have actually finished a minimum of one purchase on the Layer 1 (L1) network.

A decrease in energetic customers on a blockchain network usually results in a decrease in day-to-day purchase matters, and Ethereum has actually experienced this fad over the previous 90 days. On-chain information discloses that Ethereum’s day-to-day purchase matter has actually reduced by 5%.

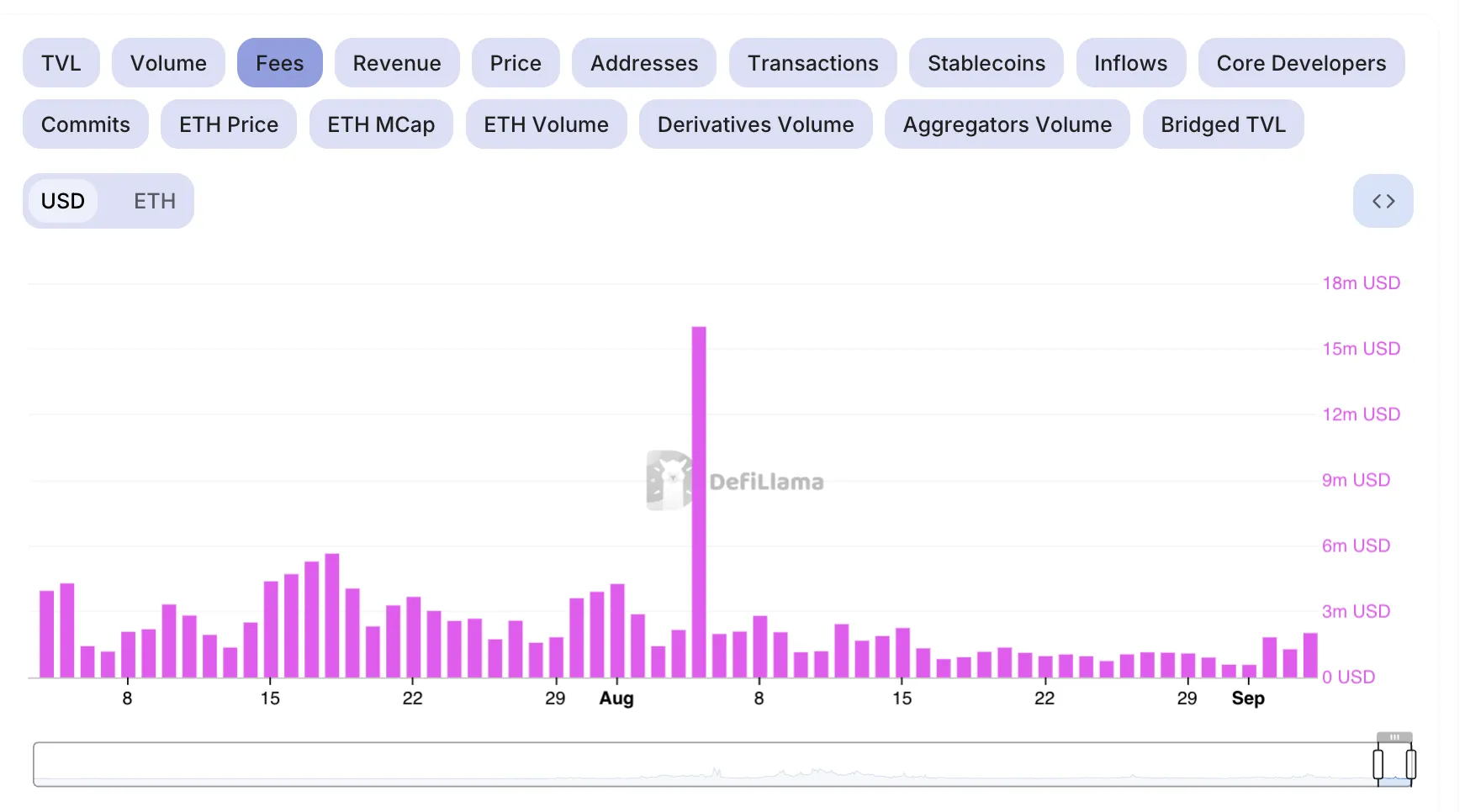

This decrease in customer task has actually additionally influenced the network’s costs. According to DefiLlama, by the week finishing August 31, Ethereum’s network costs had actually been up to $3.1 million, their most affordable degree in greater than 4 years.

While the decrease in Ethereum’s task might recommend effective fostering of Layer-2 (L2) scaling services, it positions a lasting threat to the network. If customers significantly move to L2 networks for purchases, Ethereum’s base layer might see a decrease in financial task and income in time.

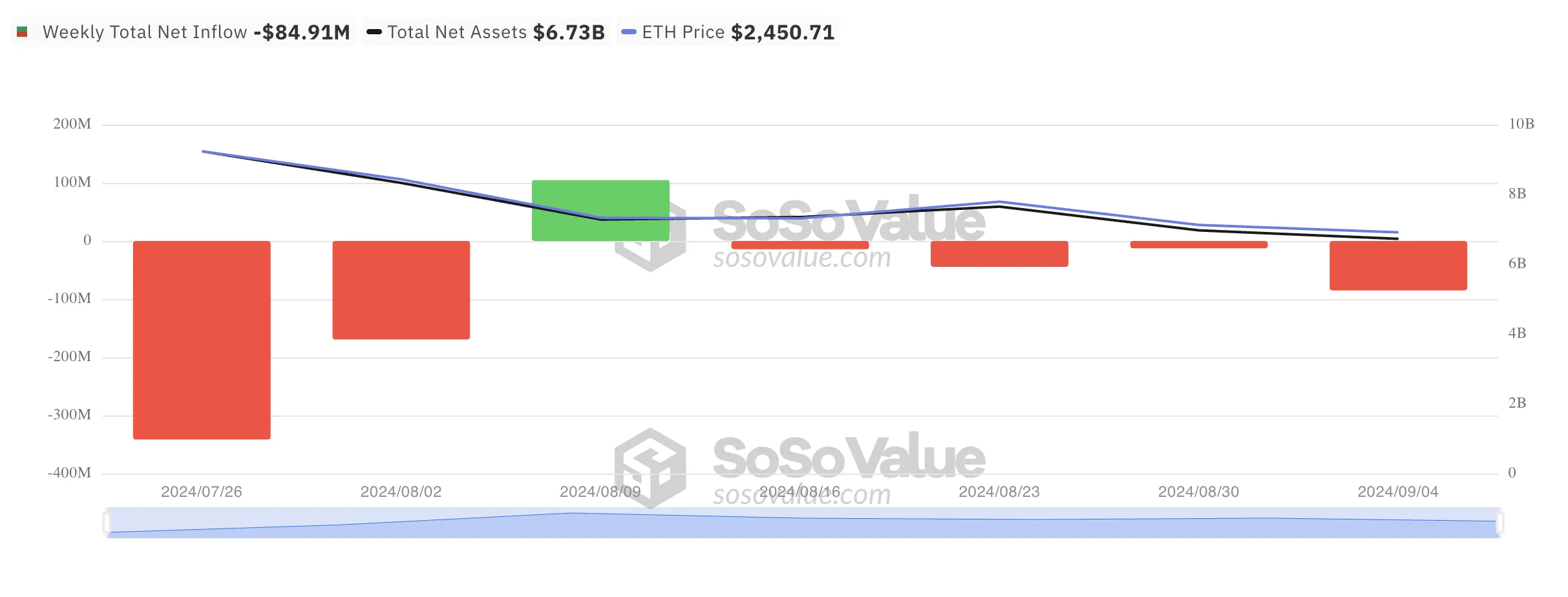

Along with network difficulties, Ethereum encounters one more concern: discharges from place ETH exchange-traded funds (ETFs). Regardless of high assumptions that these ETFs would certainly enhance market view, they have actually continually videotaped regular discharges. Because their launch on July 26, the funds have actually seen inflows in just one week. Currently in their 7th week, discharges have actually surpassed $750 million.

Find Out More: Solana vs. Ethereum: An Ultimate Contrast

ETH Rate Forecast: Purchasers and Vendors Enjoy From the Sidelines

Ethereum (ETH) is presently trading at $2,411. Over the previous month, the altcoin has actually stayed within a straight network because of an equilibrium in between trading stress.

Because relocating sidewards on August 8, Ethereum cost has actually dealt with resistance at $2755 and located assistance at $2317. The altcoin’s level RSI shows the uncertainty amongst market individuals as they wait for a stimulant to either trigger a break over resistance or an autumn listed below assistance.

If the altcoin witnesses a rebirth in purchasing task, it might press its cost over resistance, triggering it to trade at $2868. If build-up obtains energy, it might rally past the $3000 cost degree to trade hands at $3102.

Find Out More: Ethereum (ETH) Rate Forecast 2024/2025/2030

Nonetheless, if marketing stress places, ETH will certainly damage listed below assistance, and its cost will certainly be up to $2111, a reduced last observed throughout the basic market accident of August 5.

Please Note

In accordance with the Trust fund Task standards, this cost evaluation write-up is for informative objectives just and need to not be thought about monetary or financial investment suggestions. BeInCrypto is dedicated to precise, objective coverage, however market problems go through alter without notification. Constantly perform your very own study and speak with an expert prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.