The network’s choice to change its indigenous token with a brand-new one ought to commonly trigger a favorable feedback. Nonetheless, given that Polygon verified the September 4 day for moving its indigenous token MATIC to POL, it has actually dealt with a collection of issues.

Customer task has actually decreased, and big owners have actually progressively unloaded their symbols, placing descending stress on MATIC’s cost. Since the movement is total, these concerns stay and might continue for an extensive duration.

Polygon’s New Symbol Call Will Certainly Not Conserve Its Falling Worth

The other day, Polygon finished the 1:1 movement of its indigenous token from MATIC to POL, making it the network’s gas and betting token. Ever since, the cost issues that dealt with MATIC have actually started to route POL.

POL trades at $0.37 at press time, observing a low-key response to the token upgrade. Over the previous 1 day, the token’s cost has actually dropped by 3%. Nonetheless, its trading quantity has actually increased by 925% throughout that duration.

Each time a possession’s cost declines while its trading quantity spikes, there is increased market task driven by solid marketing stress. The marketplace might be experiencing a panic-selling stage, where anxiety and unpredictability control because of numerous aspects, such as a network upgrade, as seen in POL’s instance, or considerable changes in more comprehensive market fads. These aspects can heighten marketing stress as capitalists respond to viewed dangers.

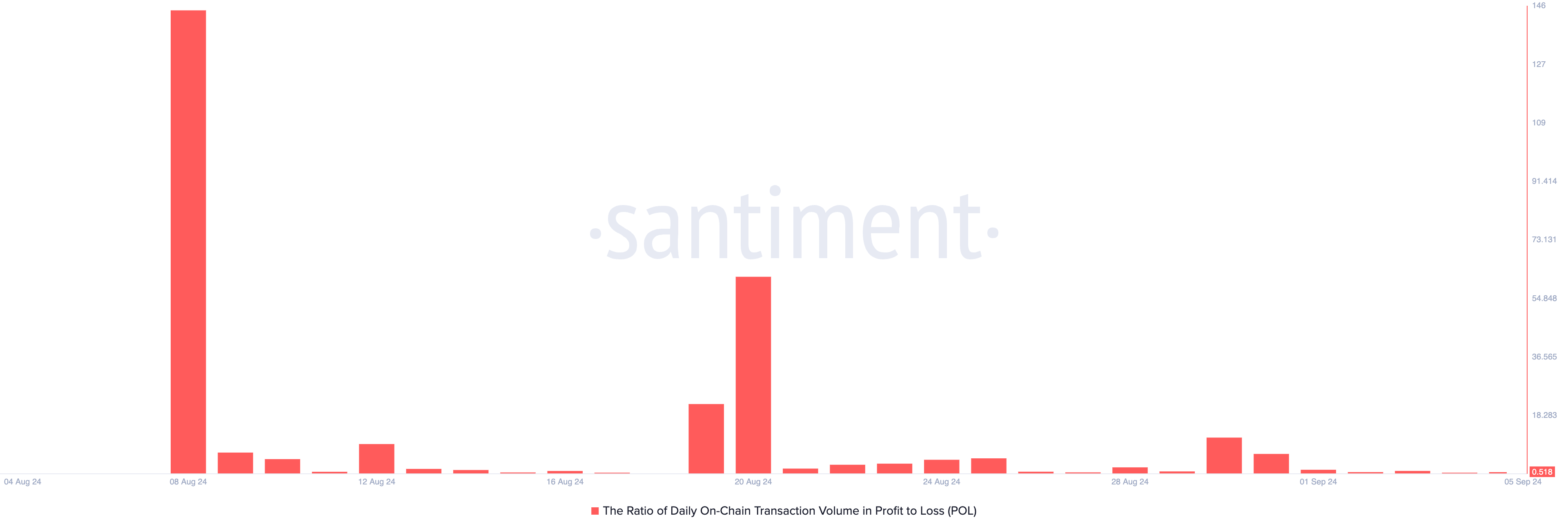

Regrettably, numerous POL owners have actually been compelled to offer their symbols muddle-headed. BeinCrypto’s evaluation of the token’s proportion of everyday purchase quantity in earnings to loss discloses that Thursday has actually seen even more deals finishing in a loss than those generating an earnings.

Since this writing, this proportion stands at 0.51, suggesting that for each POL purchase that has actually finished in a loss, just 0.51 deals have actually returned an earnings.

Learn More: 15 Ideal Polygon (MATIC) Purses in 2024

POL Rate Forecast: Even More Decrease Ahead

POL’s technological arrangement on a 12-hour graph recommends that its cost might witness an additional slump. For instance, analyses from its Relocating Ordinary Convergence/Divergence (MACD) indication reveal its MACD line (blue) relaxing listed below its signal (orange) and absolutely no lines.

This indication recognizes a possession’s pattern instructions, adjustments, and prospective cost turnaround factors. When it’s established in this manner, the sag is solid. Investors see this as an indicator to leave lengthy settings and take brief settings.

Nonetheless, all hope is not shed, as POL’s Loved one Toughness Index (RSI) recommends that a possible cost rebound might loom. Since this writing, the indication’s worth is 28.67. An RSI worth listed below 30 shows a possession is oversold and might schedule for a rebound.

Learn More: Polygon (MATIC) Rate Forecast 2024/2025/2030

For this to take place, POL has to witness a renewal in brand-new need, which will certainly transform the program of the existing pattern. If the need for the token spikes, it might drive a cost uptick, triggering it to trade hands at $0.55.

Nonetheless, if POL selloffs heighten, its cost will certainly drop even more to $0.35, revoking the favorable thesis over.

Please Note

According to the Trust fund Task standards, this cost evaluation short article is for informative functions just and ought to not be thought about economic or financial investment suggestions. BeInCrypto is devoted to precise, impartial coverage, however market problems undergo transform without notification. Constantly perform your very own study and talk to a specialist prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.