Speciality automobile carrier REV (NYSE: REVG) disappointed experts’ assumptions in Q2 CY2024, with profits down 14.8% year on year to $579.4 million. The firm’s full-year profits support of $2.4 billion at the navel additionally can be found in 1.8% listed below experts’ quotes. It made a non-GAAP revenue of $0.48 per share, boosting from its revenue of $0.25 per share in the very same quarter in 2015.

Is currently the moment to acquire REV Team? Find out in our full research report.

REV Team (REVG) Q2 CY2024 Emphasizes:

-

Profits: $579.4 million vs expert quotes of $618.7 million (6.4% miss out on)

-

EPS (non-GAAP): $0.48 vs expert quotes of $0.42 (13.6% beat)

-

The firm dropped its profits support for the complete year to $2.4 billion at the navel from $2.45 billion, a 2% decline

-

EBITDA support for the complete year is $160 million at the navel, over expert quotes of $157.7 million

-

Gross Margin (GAAP): 13.5%, up from 11.8% in the very same quarter in 2015

-

EBITDA Margin: 7.8%, up from 5.8% in the very same quarter in 2015

-

Cost-free Capital Margin: 1.5%, below 8.3% in the very same quarter in 2015

-

Market Capitalization: $1.57 billion

Using the very first full-electric North American fire engine, REV (NYSE: REVG) produces and offers specialized automobiles.

Hefty Transport Devices

Hefty transport devices firms are purchasing computerized automobiles that enhance effectiveness and linked equipment that gathers workable information. Some are additionally creating electrical automobiles and wheelchair services to attend to consumers’ problems regarding carbon discharges, developing brand-new sales chances. Furthermore, they are significantly using computerized devices that raises effectiveness and linked equipment that gathers workable information. On the various other hand, hefty transport devices firms go to the impulse of financial cycles. Rates of interest, for instance, can significantly affect the building and construction and transportation quantities that drive need for these firms’ offerings.

Sales Development

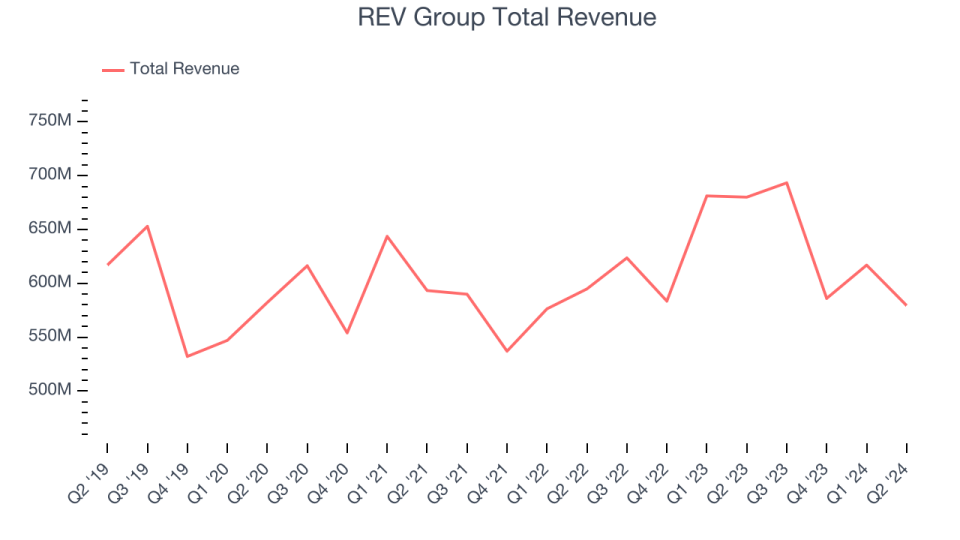

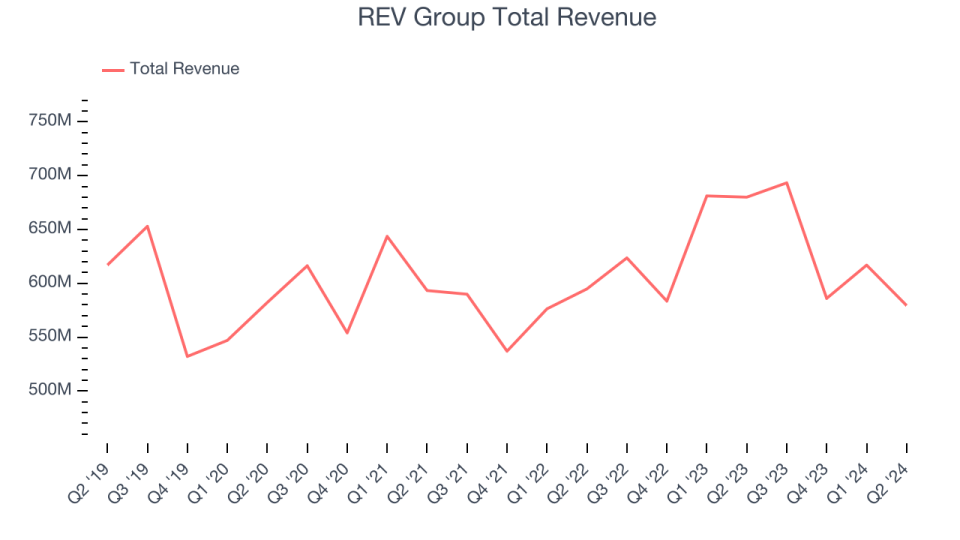

A firm’s long-lasting efficiency can offer signals regarding its company top quality. Also a poor company can beam for a couple of quarters, however a top-tier one often tends to expand for several years. REV Team battled to create need over the last 5 years as its sales were level. This is a hard beginning factor for our evaluation.

We at StockStory put one of the most focus on long-lasting development, however within industrials, a half-decade historic sight might miss out on cycles, sector patterns, or a business profiting from stimulants such as a brand-new agreement win or an effective line of product. REV Team’s annualized profits development of 3.8% over the last 2 years is over its five-year fad, however we were still let down by the outcomes.

This quarter, REV Team missed out on Wall surface Road’s quotes and reported an instead unexciting 14.8% year-on-year profits decrease, producing $579.4 numerous profits. Looking in advance, Wall surface Road anticipates profits to continue to be level over the following one year.

When a business has even more money than it understands what to do with, redeeming its very own shares can make a great deal of feeling– as long as the cost is right. Fortunately, we have actually discovered one, a low-cost supply that is spurting complimentary capital AND redeeming shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Operating Margin

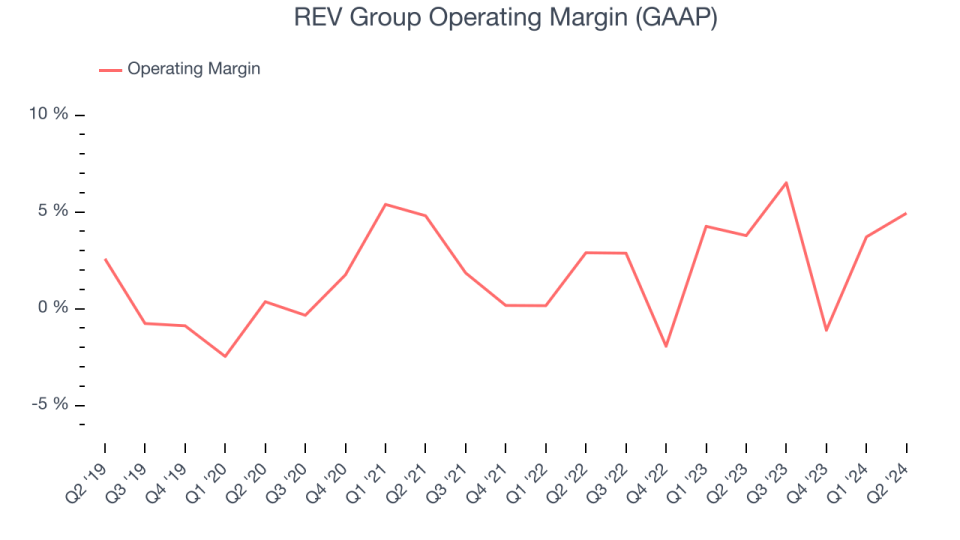

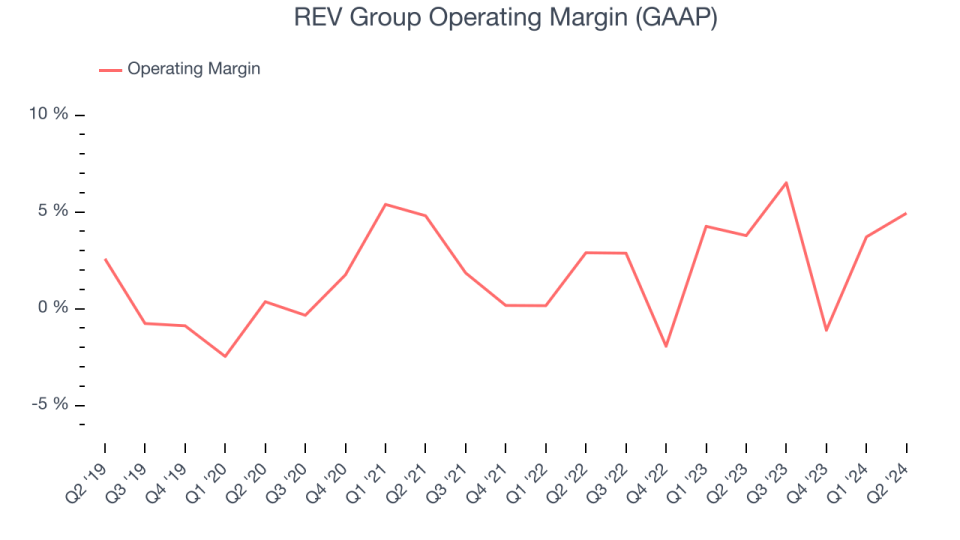

REV Team paid over the last 5 years however kept back by its huge cost base. It showed poor earnings for an industrials company, generating a typical operating margin of 1.9%. This outcome isn’t as well unusual provided its reduced gross margin as a beginning factor.

On the silver lining, REV Team’s yearly operating margin climbed by 4.6 percent factors over the last 5 years

In Q2, REV Team created an operating revenue margin of 4.9%, up 1.2 percent factors year on year. Given that its gross margin broadened greater than its operating margin, we can presume that take advantage of on its price of sales was the main motorist behind the lately greater performance.

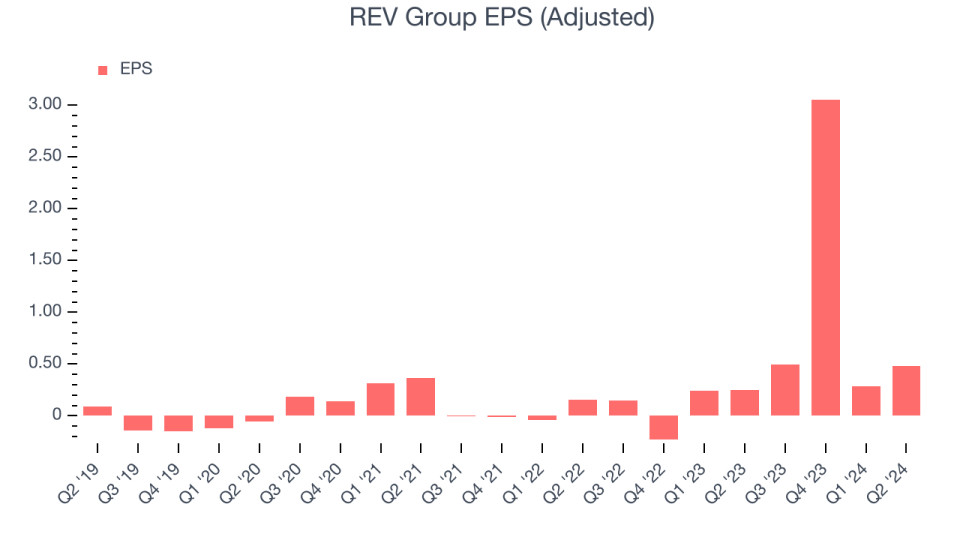

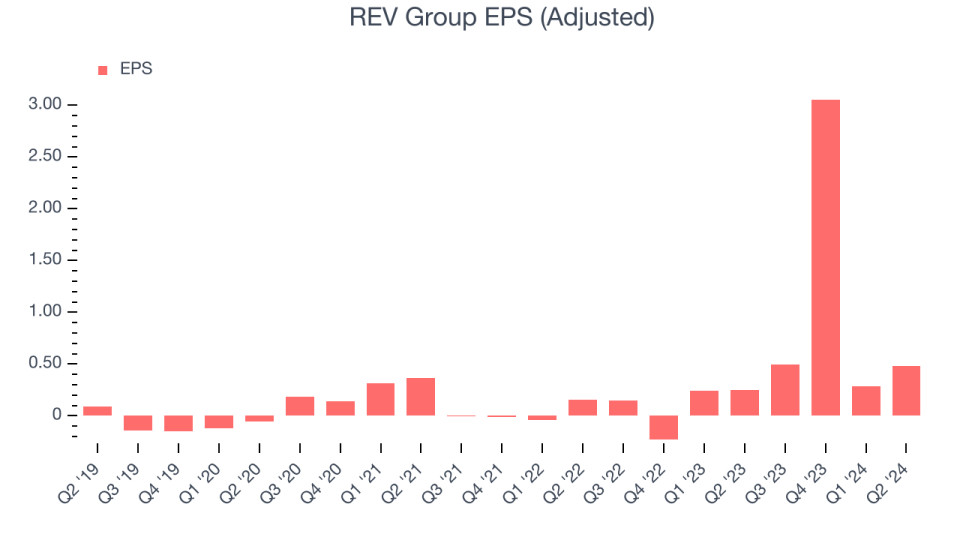

EPS

We track the long-lasting development in revenues per share (EPS) for the very same factor as long-lasting profits development. Contrasted to profits, nevertheless, EPS highlights whether a business’s development paid.

REV Team’s full-year EPS turned from unfavorable to favorable over the last 5 years. This is motivating and reveals it goes to a defining moment in its life.

Like with profits, we additionally evaluate EPS over an extra current duration due to the fact that it can offer understanding right into an arising motif or growth for business. REV Team’s EPS expanded at an amazing 533% intensified yearly development price over the last 2 years, more than its 3.8% annualized profits development. This informs us the firm ended up being much more lucrative as it broadened.

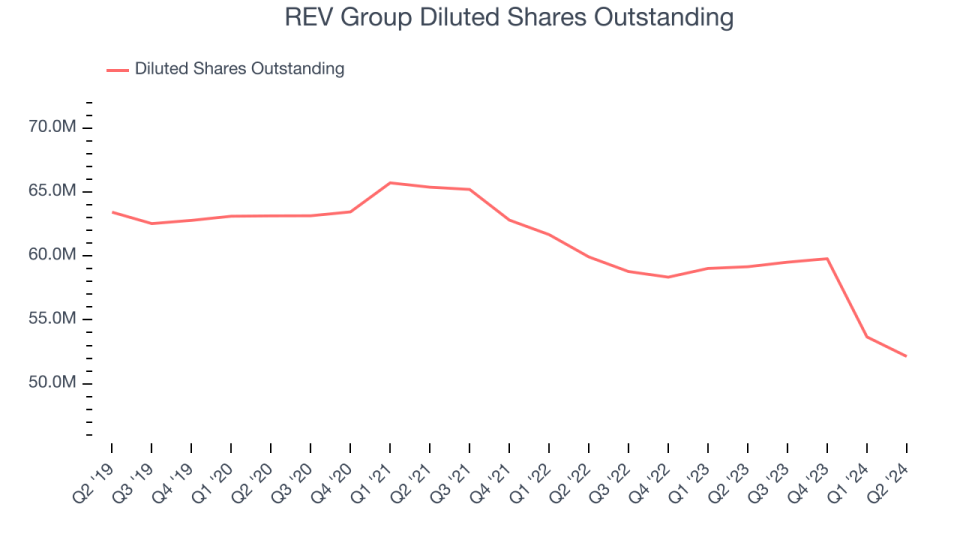

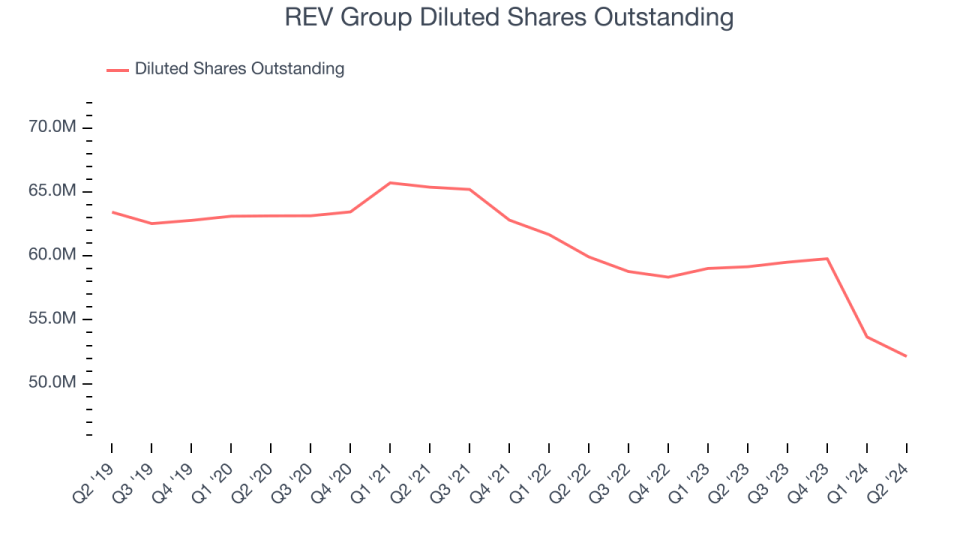

We can take a much deeper consider REV Team’s revenues top quality to much better recognize the chauffeurs of its efficiency. REV Team’s operating margin has actually broadened 2 percent factors over the last 2 years while its share matter has actually diminished 13%. These declare indications for investors due to the fact that boosting earnings and share buybacks turbocharge EPS development about profits development.

In Q2, REV Team reported EPS at $0.48, up from $0.25 in the very same quarter in 2015. This print conveniently got rid of experts’ quotes, and investors must be material with the outcomes. Over the following one year, Wall surface Road anticipates REV Team to choke up. Experts are forecasting its EPS of $4.32 in the in 2015 to reduce by 54.2% to $1.98.

Secret Takeaways from REV Team’s Q2 Outcomes

We took pleasure in seeing REV Team go beyond experts’ EPS assumptions this quarter. We were additionally thankful its full-year EBITDA support surpassed Wall surface Road’s quotes. On the various other hand, its profits sadly missed out on and its full-year profits support disappointed Wall surface Road’s quotes. In general, this was a weak quarter. The supply traded down 12.9% to $26.32 right away adhering to the outcomes.

REV Team may have had a hard quarter, however does that in fact develop a chance to spend today? When making that choice, it is essential to consider its appraisal, company top qualities, in addition to what has actually occurred in the most recent quarter. We cover that in our actionable full research report which you can read here, it’s free.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.