Australia is preparing for a substantial advancement in the crypto market. The VanEck Bitcoin ETF will certainly begin trading on the Australian Stocks Exchange (ASX) on June 20.

Australia’s main stock exchange has actually detailed an exchange-traded fund (ETF) that spends straight in Bitcoin for the very first time.

Bitcoin Struggles Regardless Of Australian ETF Advancement

The ASX, which manages most of equity trading in Australia, has actually validated that VanEck is presently the only candidate to have actually obtained authorization. Nonetheless, conversations are recurring with various other prospective providers.

” Regardless of that crypto investing is a polarizing subject, we identify Bitcoin is an arising possession course that numerous advisors and capitalists intend to gain access to,” Arian Neiron, VanEck’s chief executive officer in the Asia-Pacific area, said.

The crypto neighborhood extremely prepares for Australia’s access right into this market, adhering to the steps of the USA and Hong Kong, which saw the launch of comparable items previously this year. The United States launching of Bitcoin ETFs drew in significant interest, generating $57 billion. On the other hand, Hong Kong’s place Bitcoin ETFs have actually brought in a moderate $1.09 billion in properties, according to information from SoSo Worth.

Find Out More: Just How To Profession a Bitcoin ETF: A Step-by-Step Method

Various other Australian companies, consisting of Sydney-based BetaShares Holdings and DigitalX, are additionally preparing to checklist on the ASX. A BetaShares agent validated that the company is carefully working with releasing place Bitcoin and Ethereum funds in the future.

Experts are contrasting Bitcoin and gold, mentioning the crypto’s function as a shop of worth and a rising cost of living bush. This point of view is sustained by historic patterns, such as the launch of the gold ETF in 2004, which came before a virtually eight-year booming market in gold rates.

Formerly, CBOE Australia, the nation’s additional exchange, detailed Bitcoin ETFs with blended success. It continues to be to be seen just how these funds will certainly execute on the major exchange.

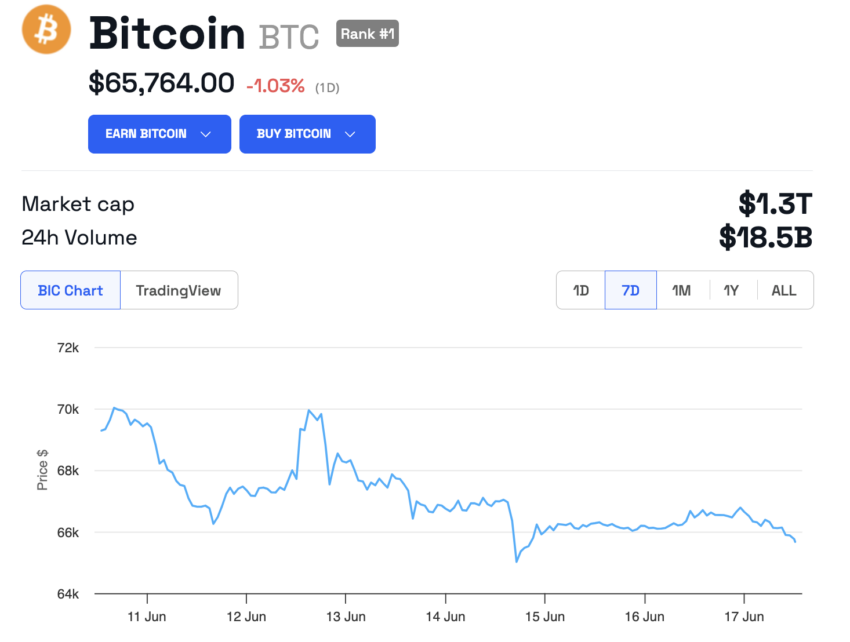

Regardless of favorable growths, the more comprehensive crypto market, consisting of Bitcoin, is experiencing substantial volatility. Bitcoin is presently trading listed below $66,000, having a hard time to restore its March optimal.

Find Out More: Bitcoin (BTC) Cost Forecast 2024/2025/2030

According to information from Coinglass, over the previous 24-hour, the marketplace’s variations have resulted in over $130 million in liquidations. This consists of $98 million from lengthy settings and $32 million from shorts.

Please Note

In adherence to the Trust fund Job standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to supply exact, prompt info. Nonetheless, visitors are suggested to confirm truths individually and speak with a specialist prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.