-

Nvidia gets on track to strike a $10 trillion appraisal, expert Beth Kindig states.

-

Kindig is anticipating solid development and “fireworks” for the supply after its Blackwell launch.

-

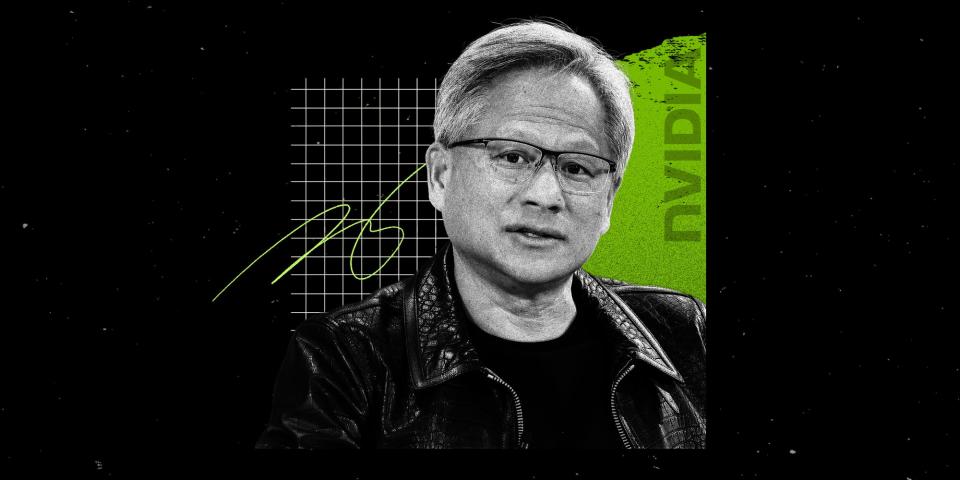

Jensen Huang ensured financiers on Nvidia’s next-gen AI chip, guaranteeing “billions” in profits.

Nvidia gets on track to greater than three-way in worth, according to Beth Kindig, the lead technology expert at I/O Fund.

Talking To Yahoo Money on Thursday, Kindig stated she visualizes Nvidia scratching a $10 trillion appraisal over the long-term. That suggests beast gains for the $2.9 trillion AI titan, mainly because of solid anticipated development and gains from its next-generation AI chip, referred to as Blackwell, Kindig stated.

Financiers on Wall surface Road have actually expanded worried that Nvidia is ending up being misestimated, provided its huge run-up over the previous year and financiers’ enormous expectations for revenues development. Nvidia shares dropped as far more than 6% Thursday after the business beat earnings for the 2nd quarter, albeit even more directly than previous quarters.

Financiers likewise have issues regarding Nvidia’s Blackwell chip after market experts reported that the chip’s launch would be postponed by 2 to 3 months because of “significant concerns within high manufacturing quantity.”

Kindig suggests that Nvidia’s outcomes were still “excellent,” and sufficient to reject financiers’ issues heading right into the outcomes.

Nvidia Chief Executive Officer Jensen Huang defended the progress on Blackwell in a recent interview with Bloomberg, exposing that the business made a “mass modification to enhance return” and was seeking to draw in “billions of bucks” in profits from the next-gen chip.

” That’s why points are being changed up and they were never ever changed down,” Kindig stated of Nvidia quotes, including that she stayed favorable on Blackwell’s upcoming launch. “They’re stating Blackwell is primarily in a timely manner. Blackwell is not a worry. If anything, it’s incredibly favorable.”

Kindig forecasted that Nvidia’s development trajectory need to end up being much more noticeable once Wall surface Road experts upwardly modify financial quotes for the list below year. That need to be a “huge minute” for Nvidia, complied with by the launch of delivery quantity numbers for Blackwell in 2025.

” That’s mosting likely to be fireworks, is exactly how I would certainly place it. Outright, utmost fireworks for Blackwell will certainly be available in Q1, with that said Q2 overview,” Kindig stated. “Early following year will certainly be fireworks once again for Nvidia, and we will certainly get on track for that $10 trillion.”

Kindig’s projection for the chip business is amongst one of the most favorable, though Wall surface Road is still really feeling positive regarding the chipmaker. Experts have actually provided an ordinary cost target of $151 per share, per Nasdaq information, suggesting an additional 27% advantage for the supply over the following year.

Review the initial write-up on Business Insider

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.