Dogecoin (DOGE) has actually continued to be greatly untouched after United States Area Court Alvin Hellerstein rejected a suit versus Elon Musk and Tesla, which affirmed that they controlled the coin’s cost.

Since press time, DOGE is trading at $0.10, revealing a 0.18% cost decrease and a 24% decrease in trading quantity over the previous 24 hr.

Dogecoin Seeks to Expand Decrease

DOGE’s soft response to Court Hellerstein’s judgment can be credited to the bearish stress presently evaluating on the altcoin. Its technological configuration on a 12-hour graph suggests that bears are controling the marketplace, pressing to prolong its month-long decrease.

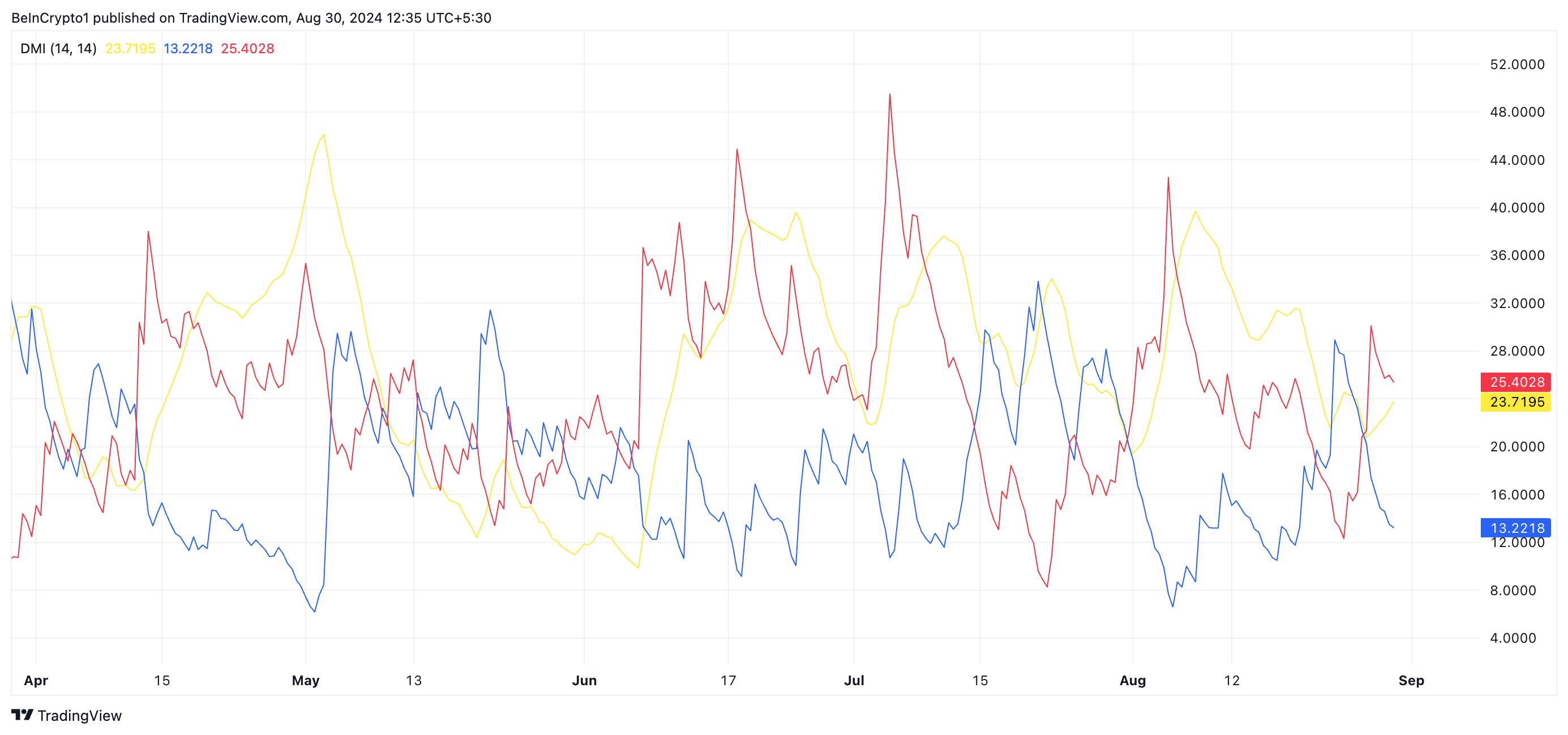

For example, DOGE’s Directional Motion Index (DMI) reveals the favorable directional sign (+ DI) in blue existing listed below the adverse directional sign (- DI) in red, signaling proceeded bearish control.

A property’s Directional Motion Index (DMI) determines the stamina and instructions of a fad. When the +DI drops listed below the -DI, it signifies a solid sag, suggesting bearish market problems where marketing stress controls and an ongoing cost decrease is most likely.

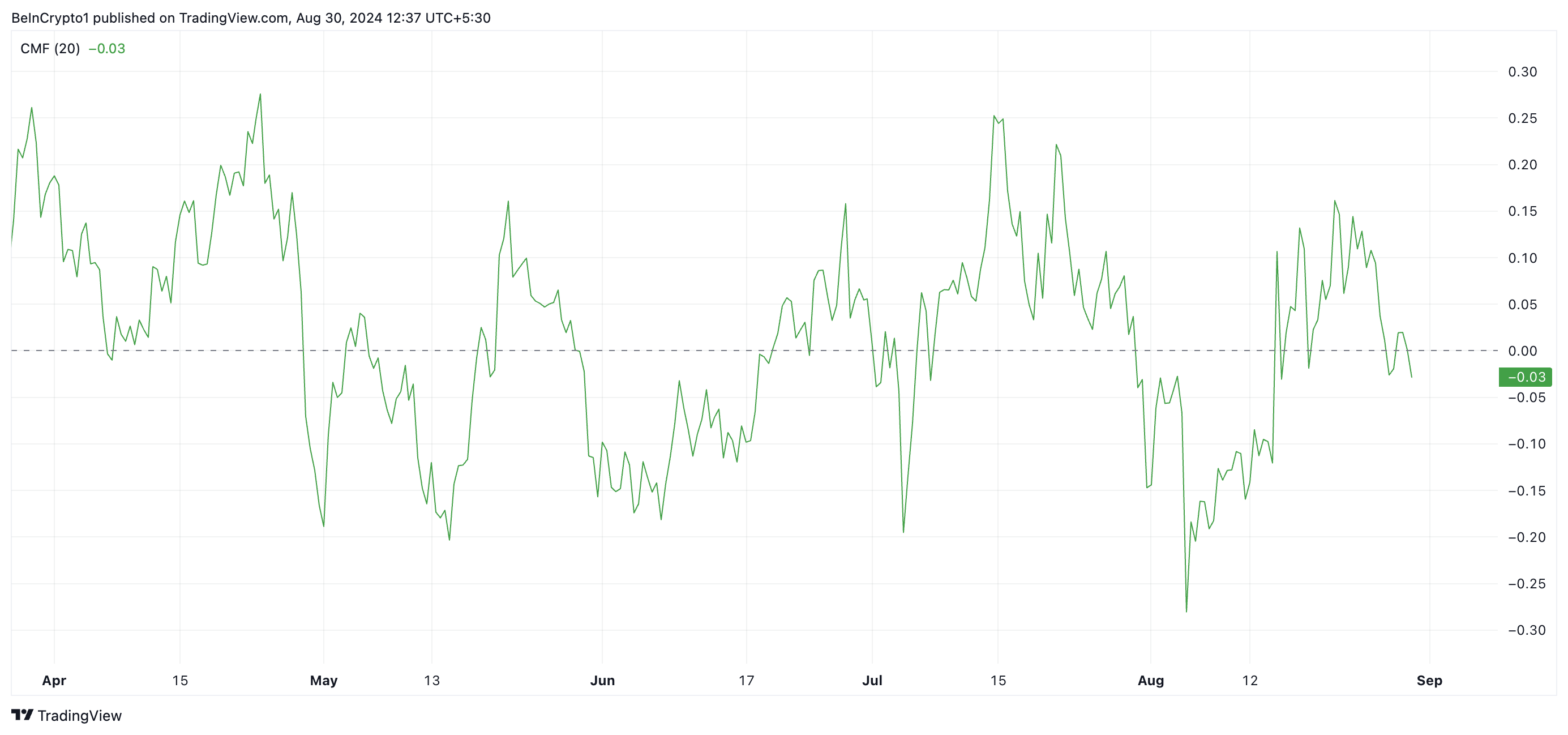

Furthermore, DOGE’s Chaikin Cash Circulation (CMF) lately went across listed below its no line, signaling weakening purchasing stress. Presently, the sign stands at -0.05.

Learn More: Dogecoin (DOGE) Cost Forecast 2024/2025/2030

The CMF determines the circulation of cash right into and out of a property’s market. A CMF worth listed below no recommends market weak point and liquidity discharge, which investors usually take a forerunner to a continual cost decrease throughout a drop.

DOGE Cost Forecast: Coin Threats Being Up To August 5 Reduced

DOGE’s by-products market has actually additionally seen a decrease in trading quantity over the previous 24 hr, coming by 24% to $650 million.

In spite of DOGE’s technological indications recommending a prolonged sag, futures investors remain to open up lengthy placements, as revealed by its favorable financing price throughout cryptocurrency exchanges. Presently, DOGE’s financing price stands at 0.008%.

A favorable financing price suggests that there is even more need for lengthy placements, implying even more investors are banking on a cost rally than on a decrease.

Nonetheless, if offering stress rises and DOGE proceeds its down trajectory, its worth might go down towards its August 5 reduced of $0.08, taking the chance of the liquidation of numerous lengthy placements.

Find Out More: Dogecoin (DOGE) vs Shiba Inu (SHIB): What’s the Distinction?

On the other hand, a favorable change in market belief might bring about a 10% cost rise, pressing DOGE to $0.11.

Please Note

According to the Trust fund Job standards, this cost evaluation post is for educational functions just and need to not be taken into consideration monetary or financial investment recommendations. BeInCrypto is dedicated to exact, impartial coverage, yet market problems undergo transform without notification. Constantly perform your very own research study and speak with an expert prior to making any kind of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.