On Thursday, BlackRock’s iShares Bitcoin Count on (IBIT) experienced its very first discharge after virtually 4 months. Formerly, IBIT signed up a discharge on May 1.

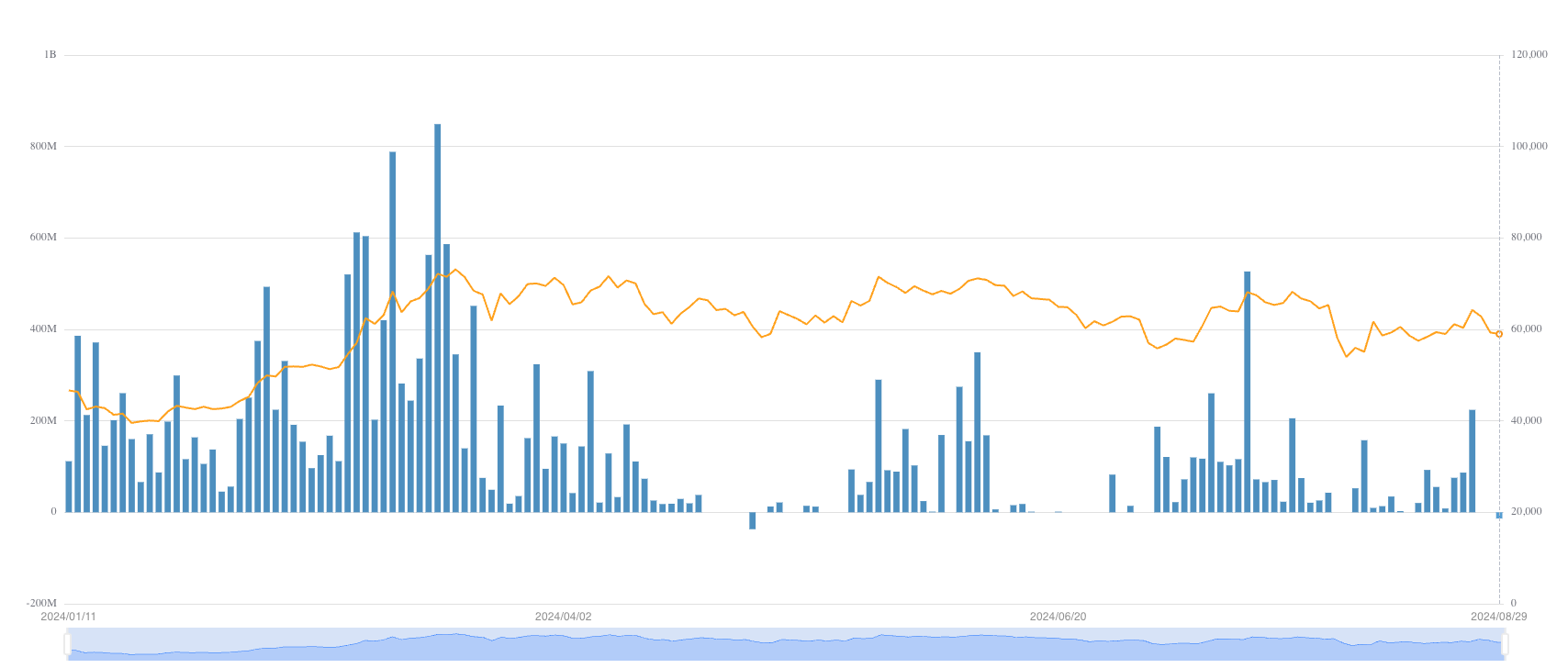

The week began solid for area Bitcoin exchange-traded funds (ETFs), with web inflows of about $202.6 million on Monday. Nonetheless, the trend promptly transformed, with considerable discharges complying with very closely behind.

BlackRock Records Its 2nd Discharge Day

On Tuesday, financier withdrawals got to around $127.1 million. In a similar way, on Wednesday, funds remained to drain, completing about $105.3 million.

In spite of a minor decrease, Thursday likewise saw discharges of $71.8 million from the area Bitcoin ETFs. Especially, BlackRock’s IBIT signed up a discharge of $13.5 million, noting an uncommon incident given that its creation in January.

The iShares Bitcoin Count on’s efficiency has actually been greatly durable in the middle of market variations. Undoubtedly, Thursday’s task was just the 2nd circumstances of discharges given that the fund’s launch.

Find Out More: Exactly How To Profession a Bitcoin ETF: A Step-by-Step Strategy

On the other hand, the ARK 21Shares Bitcoin ETF (ARKB) threw the pattern, gathering web inflows of $5.3 million on the very same day. On the other hand, various other funds, such as the Integrity Bitcoin Trust Fund (FBTC), taped the highest possible discharge at $31.1 million.

The background to these resources motions is a significant decrease in Bitcoin’s cost, which has actually dropped about 7.5% given that Monday and is presently trading at $59,400. Maartunn, a crypto expert, highlighted that Bitcoin is evaluating the typical price basis of the BlackRock Bitcoin ETF for the 4th time.

” Each time a rate degree is checked, it deteriorates,” he remarked, highlighting the vulnerable nature of this assistance degree.

With BlackRock Bitcoin ETF holding concerning 340,855 BTC, it rates as the third-largest worldwide owner after the strange Satoshi Nakamoto and the leading crypto exchange, Binance. This considerable holding highlights the importance of the ETF’s typical price basis as a possible market assistance throughout slumps.

Additionally, historic efficiency information paints a grim photo for the upcoming month. According to Coinglass, Bitcoin has actually continually underperformed in September, with an ordinary return of -4.78% given that 2013, making it the cryptocurrency’s worst month.

Find Out More: That Possesses one of the most Bitcoin in 2024?

In addition, the 3rd quarter has actually usually verified testing for Bitcoin and the wider crypto market. As September impends, capitalists appear to be placing themselves very carefully, preparing for the typical slump. This tactical change appears in the current discharges from numerous Bitcoin ETFs, consisting of BlackRock’s iShares Bitcoin Count on.

Please Note

In adherence to the Count on Job standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to offer precise, prompt info. Nonetheless, visitors are recommended to validate truths individually and speak with a specialist prior to making any kind of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.