In some cases your ideal simply isn’t sufficient. That’s the lesson Nvidia (NVDA) discovered Wednesday after the business’s supply cost dropped 3% regardless of uploading better-than-expected 2nd quarter revenues and assistance for the 3rd quarter.

It’s not as though the business’s development was unimpressive, either. Revenue jumped 122% year over year to $30 billion, up from $13.5 billion. Nvidia’s critical information facility earnings peaked at $26.3 billion, a 154% year-over-year boost.

Yet that had not been the type of blowout that capitalists have actually promptly expanded familiar with over the last couple of quarters.

Past capitalist view, Wall surface Road experts have actually likewise apparently figured Nvidia’s development after numerous quarters of large shocks to the benefit.

Nvidia’s earnings reported Wednesday defeat Wall surface Road assumptions by 4.1%, the slimmest margin considering that the 4th quarter of its 2023 .

As Nvidia’s organization has actually flourished over the last 2 years, the business’s earnings covered Wall surface Road projections by double-digit percent factors for 3 straight quarters, consisting of a 22% distinction in its monetary 2nd quarter of 2024.

And as Wall surface Road shows up to have actually obtained a far better feeling for Nvidia’s development now in the AI financial investment cycle, inquiries have actually likewise emerged regarding the standing of Nvidia’s next-generation Blackwell chip.

Ahead of the business’s revenues news, the Info reported that the chip, the follow-up to Nvidia’s Receptacle line, dealt with hold-ups that can influence a few of the business’s most significant consumers consisting of Microsoft and Google.

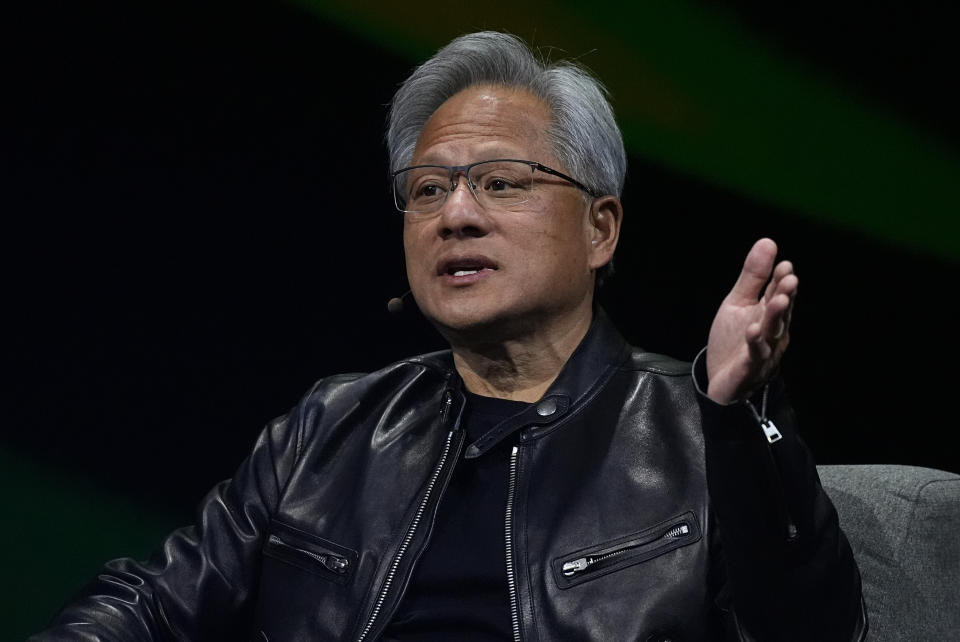

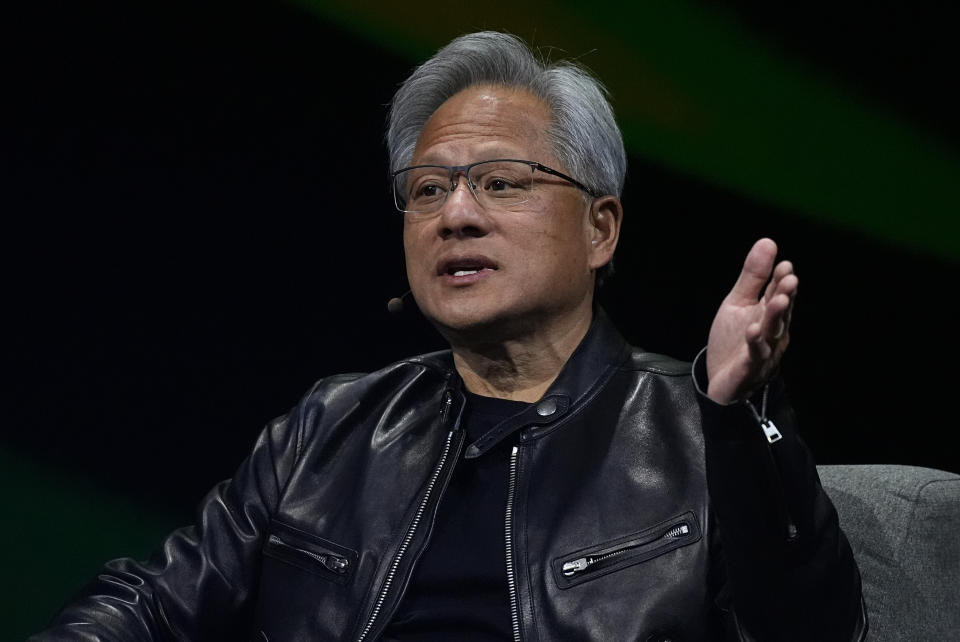

In her quarterly remarks, Nvidia CFO Colette Kress explained that the business made modifications to Blackwell to enhance its manufacturing return. Chief Executive Officer Jensen Huang, on the other hand, claimed that the chip is presently being experienced to consumers, a significant action towards delivering the cpu at quantity.

Huang claimed the business anticipates to deliver numerous billion bucks of Blackwell earnings in the 4th quarter. Yet the chief executive officer could not determine specifically just how much earnings Blackwell would certainly produce, regardless of experts’ inquiries.

Huang, nevertheless, did supply a variety of various other strengths for Nvidia, consisting of mentioning that need for Blackwell systems is well over supply. The chief executive officer likewise claimed that Nvidia’s Receptacle system will certainly remain to expand in the 2nd fifty percent of the year, and discussed that the business anticipates its information facility organization to expand “rather dramatically following year.”

Huang likewise claimed that AI inferencing is driving the business’s information facility earnings. Inferencing describes computer systems running AI programs and supplying customers with solution to their questions.

That must lay to rest anxieties of risks to Nvidia’s long-lasting development as business pivot from training AI designs to utilizing reasoning. Huang shows up to think that Nvidia will certainly remain to rake ahead as consumers utilize its chips to both train and run their AI designs.

Nvidia is still the globe leader in AI chips, and it’ll be a long time prior to opponents AMD (AMD) and Intel (INTC) reach its software and hardware lead. And while Nvidia might be dealing with a near-term decrease in its supply cost, Wall surface Road is still aboard.

In a capitalist note launched adhering to Nvidia’s revenues, BofA’s Vivek Arya increased his cost target on the chip developer to $165 from $150 per share, composing, “Regardless of the quarterly sound, we remain to count on [Nvidia’s] distinct development possibility, implementation and leading 80%+ share as generative AI implementations are still in their initial 1-1.5 [years] of what goes to the very least a 3 to 4-year ahead of time financial investment cycle.”

Raymond James’s Srini Pajjuri likewise increased the company’s cost target on Nvidia’s supply from $120 to $140, composing in a capitalist note that “Blackwell hold-ups show up much better than been afraid and monitoring is anticipating a solid ramp in FQ4.”

Pajjuri likewise claimed need for Nvidia’s current-generation Receptacle chip remains to be healthy and balanced and sharp to awaited sales development in Q4, regardless of Blackwell manufacturing increase at the exact same time.

Morgan Stanley’s Joseph Moore, that increased his cost target for Nvidia from $144 to $150, called out Nvidia’s overpriced assumptions when it come to the business’s supply relocations after the revenues record.

” Assumptions come to be a lot more tough as the outstanding ends up being ordinary, yet this was still a really solid quarter offered the transitional nature of the existing atmosphere.”

Whether that suffices to please capitalists following quarter stays to be seen.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on Twitter at @DanielHowley.

For the most up to date revenues records and evaluation, revenues murmurs and assumptions, and business revenues information, click on this link

Review the most up to date monetary and organization information from Yahoo Fin ance.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.