Notcoin (NOT), the cryptocurrency connected with the Telegram-based remote control video game, has actually seen a 5% cost boost in the last 24-hour. This increase complied with conjecture on social media sites that Telegram owner Pavel Durov had actually been launched by French authorities.

Nonetheless, the report ended up being unreliable. Offered this, an on-chain evaluation recommends that Notcoin’s current cost boost may be temporary.

Notcoin Bulls Remain To Play 2nd Fiddle

On August 28, French authorities laid a number of fees versus the owner, particularly pertaining to illegal task on the application. While Durov was launched on a EUR5 million bond, the Telegram owner is restricted from leaving the nation.

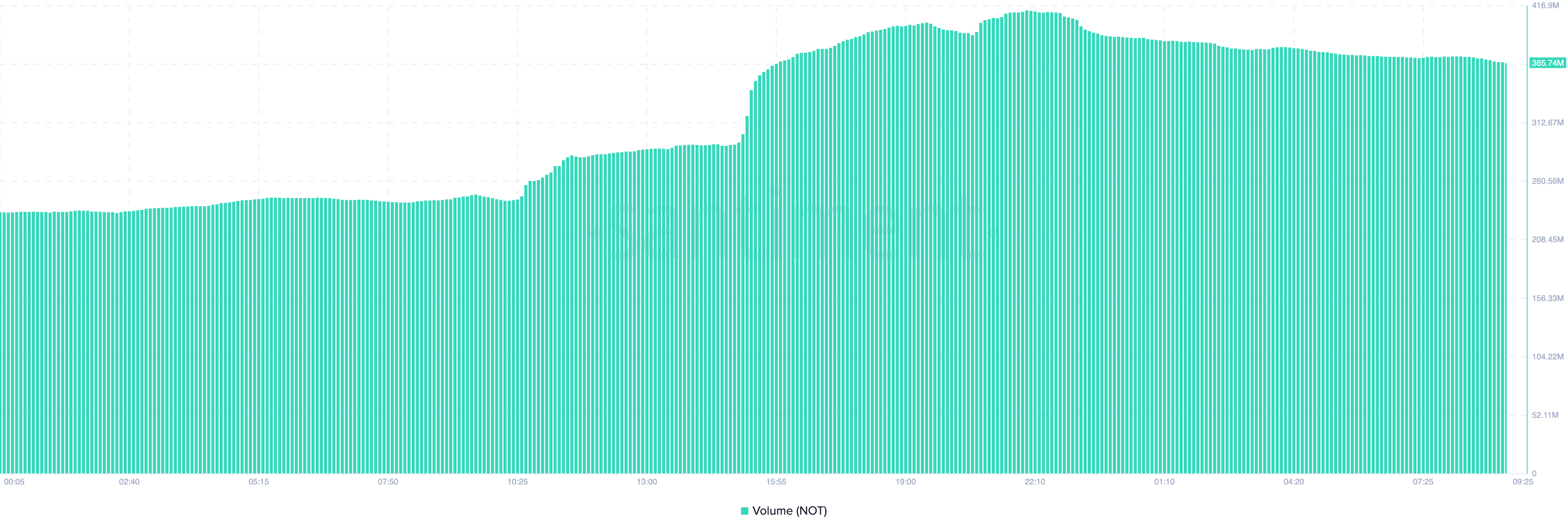

Following this judgment, Notcoin’s cost rose to $0.0092. Like the cryptocurrency’s market price, the quantity leapt by 50% within the last 24-hour, getting to an optimal of $412.84 million.

Find Out More: Leading 7 Telegram Tap-to-Earn Gamings to Play in 2024

Quantity is an essential indication of market passion, and the first rise in Notcoin (NOT) recommended that conjecture bordering Durov’s circumstance caused enhanced trading task. Nonetheless, the mix of decreasing quantity and a dropping cost currently recommends that passion in the cryptocurrency might be winding down. If this pattern proceeds, it can stop the current rally.

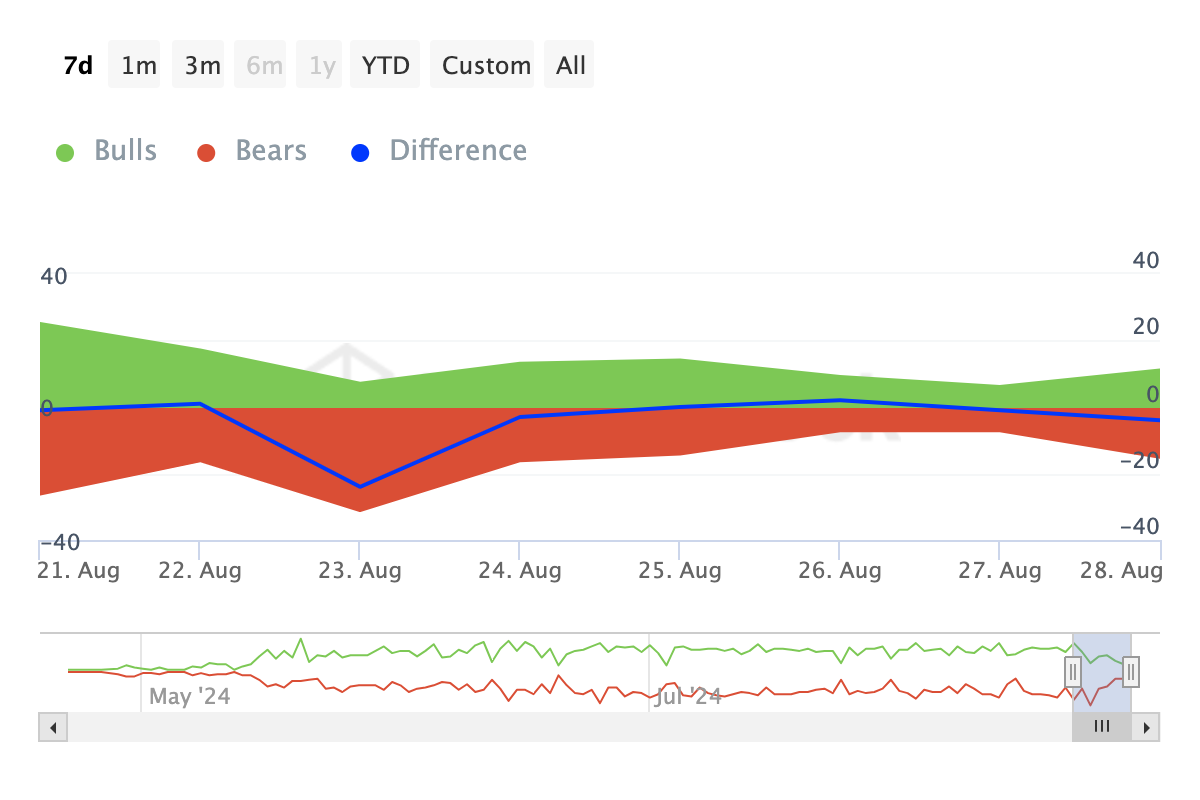

Sustaining this expectation, on-chain information from IntoTheBlock’s Bulls and Bears indication exposes that even more individuals are offering NOT than purchasing it. This indication tracks whether individuals that purchased the very least 1% of the overall trading quantity (bulls) are pressing the cost up, or if those that offered the very same quantity (bears) are dragging it down.

Currently, there are 4 even more bears than bulls, showing greater marketing stress. If this marketing stress lingers with completion of August, NOT’s cost might have a hard time to recuperate and can possibly glide towards a lowest level.

NOT Rate Forecast: The Rise Is a Dud

Notcoin’s short cost boost has actually aided with the development of a bearish flag on the everyday 4-hour graph. This pattern commonly arises after a sag with boosting quantity, complied with by a duration of debt consolidation with reducing quantity, which ultimately causes a more cost decline.

Otherwise stops working to damage over the top trendline of this bearish flag, the cost can go down to $0.0085. In addition, the Loved One Stamina Index (RSI) continues to be listed below the neutral line, showing that bears presently manage NOT’s cost pattern.

Find Out More: Notcoin (NOT) Rate Forecast 2024/2025/2030

The reduced RSI analysis recommends an absence of favorable energy, which can press the cost lower. Nonetheless, if purchasing stress boosts, NOT could climb up towards $0.0095, possibly revoking the bearish expectation.

Please Note

According to the Trust fund Task standards, this cost evaluation post is for educational functions just and ought to not be thought about economic or financial investment guidance. BeInCrypto is devoted to precise, impartial coverage, yet market problems go through transform without notification. Constantly perform your very own research study and seek advice from a specialist prior to making any type of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.