Among rough market problems, investor (VC) continue to be favorable on the crypto industry’s possibility. In spite of varying markets, VC companies like ParaFi Funding and Lemniscap have actually safeguarded considerable financial investments.

In total amount, both VC companies intend to infuse $190 million right into the crypto market.

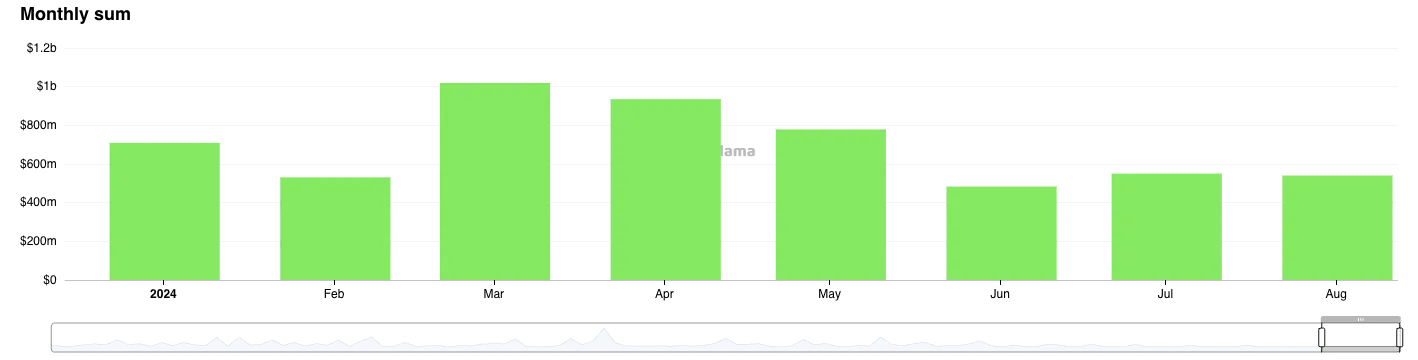

VC Investments Are Down 50% From March’s Optimal

ParaFi Funding, a popular electronic possession supervisor in New york city, revealed a $120 million financing round. This initiative consists of payments from popular capitalists such as Theta Funding Monitoring and Distinction Allies.

ParaFi’s technique entails getting risks in numerous crypto funds. As a result, the company wishes to generate a profile of 30 to 50 such financial investments over the following 3 to 5 years.

” We have actually enjoyed the crypto-fund landscape develop very closely for many years. Our company believe there will certainly be a lot more crypto funds as institutional funding enters this area. It is essential to have expertise and emphasis, whether it’s throughout location, style or kind of financial investment,” Ben Forman, the creator of ParaFi, said.

Learn More: Just How To Fund Advancement: An Overview to Web3 Grants

On The Other Hand, Lemniscap, an investment company recognized for its worldwide, thesis-driven technique, has actually introduced a $70 million fund. This fund will certainly concentrate on varied possibilities within the blockchain ecological community, varying from no expertise Facilities to arising Bitcoin ecological communities.

Led by Creator and Taking care of Companion Roderik van der Graaf, Lemniscap intends to give tactical assistance to aid Web3 start-ups range properly. The company has actually made greater than 130 crypto financial investments until now.

” This brand-new fund will certainly offer us substantial monetary firepower to sustain the future generation of enthusiastic sector leaders,” van der Graaf said.

Furthermore, numerous various other crypto equity capital are likewise broadening their funds. Heavyweights like Standard and Pantera Funding have actually just recently revealed considerable brand-new funds targeted at cultivating the following wave of crypto advancement. Standard elevated $850 million for its 3rd fund, while Pantera Funding remains in the procedure of increasing $1 billion for its Fund V.

According to DefiLlama, crypto companies have actually elevated over $5.5 billion in financing this year, with $540 million safeguarded in August alone. Nevertheless, the August financings are around 50% below the height in March.

Learn More: Discovering DefiLlama: A Substantial Overview to DeFi Monitoring

Experts think that financing has actually decreased because of market unpredictabilities and regulative obstacles from the United States Stocks and Exchange Payment (SEC). Current activities by the SEC, consisting of a Wells notification to the NFT industry OpenSea, mean a feasible suppression.

” This area is simply not appealing because of Gary Gensler & & the SEC pursuing anything and every little thing crypto relevant. Its to high-risk for VC cash to be revealed to a financial investment that can obtain struck with an SEC claim at anytime, in addition to the SEC has actually pursued VC’s themselves,” crypto expert Matthew Hyland said.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to give precise, prompt info. Nevertheless, viewers are encouraged to confirm truths individually and seek advice from a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.