Binance Coin (BNB) has actually experienced a steady decline in market volatility over the previous couple of days, as its rate starts to combine within a specified variety.

This combination appears on the one-day graph, where BNB’s 20-day rapid relocating standard (EMA) and 50-day straightforward relocating standard (SMA) have actually begun to squash out, showing a duration of decreased rate activity.

B inance Coin Is Not In Jeopardy Of Rate Swings

The 20-day EMA is a temporary relocating standard that promptly replies to value adjustments, standing for the typical closing rate of a property over the previous 20 days. On the other hand, the 50-day SMA is a longer-term relocating standard that shows a property’s typical closing rate over the last 50 days.

Because August 26, BNB’s 20-day EMA and 50-day SMA have actually both squashed. When a property’s relocating standards squash, it indicates market indecisiveness, where neither purchasers neither vendors have adequate toughness. This normally shows that the marketplace is trending laterally.

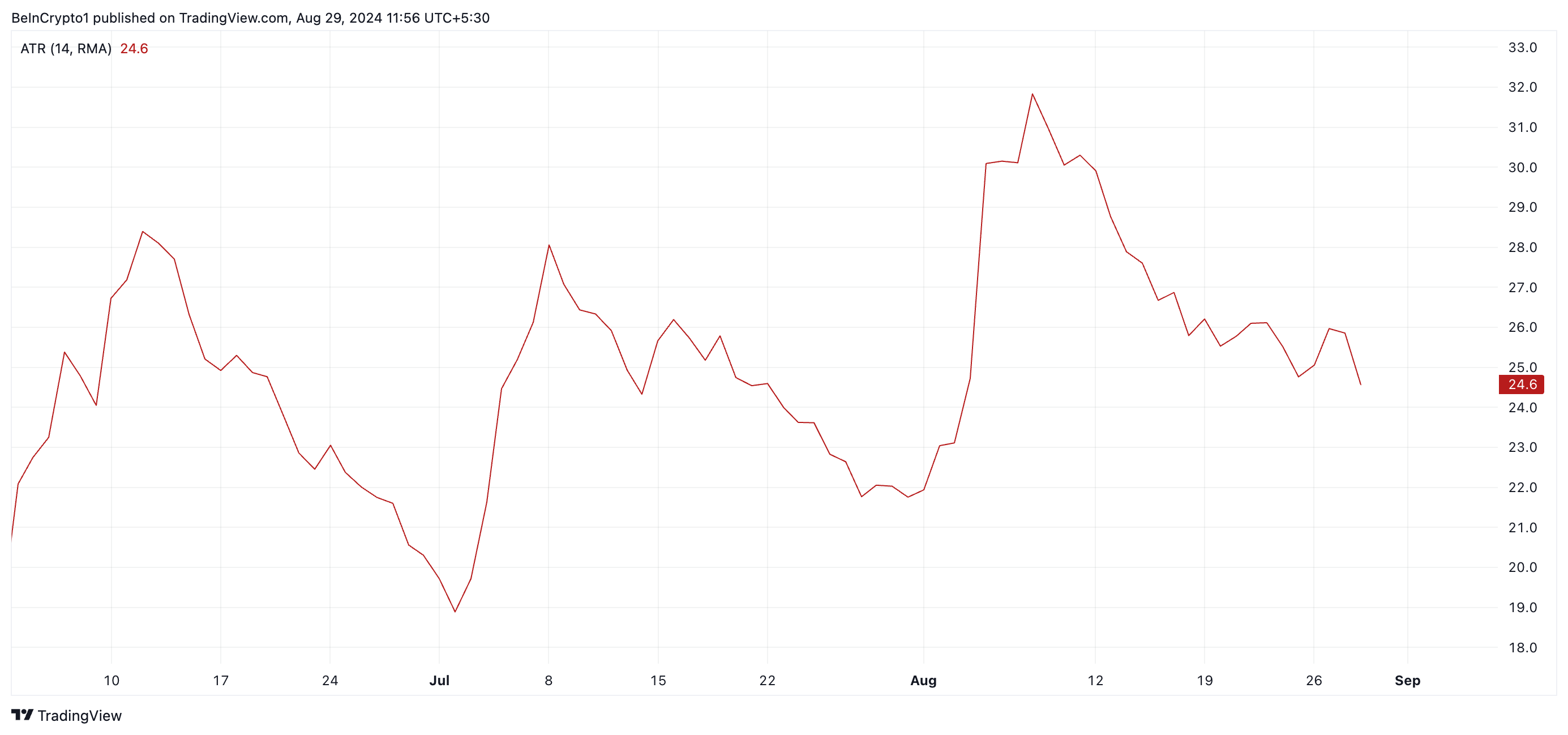

This duration is defined by a reduced chance of substantial rate swings, as validated by BNB’s volatility signs. As an example, the coin’s Typical Real Array (ATR), which determines the level of a property’s rate volatility, has actually been trending downward over the previous couple of days. Since the most recent information, BNB’s ATR stands at 24.6.

Learn More: Exactly How To Profession Crypto on Binance Futures: Whatever You Required To Know

A decreasing ATR recommends that a property’s rate is experiencing much less change, showing that the marketplace is going into a loan consolidation stage where rates have a tendency to relocate within a narrower variety.

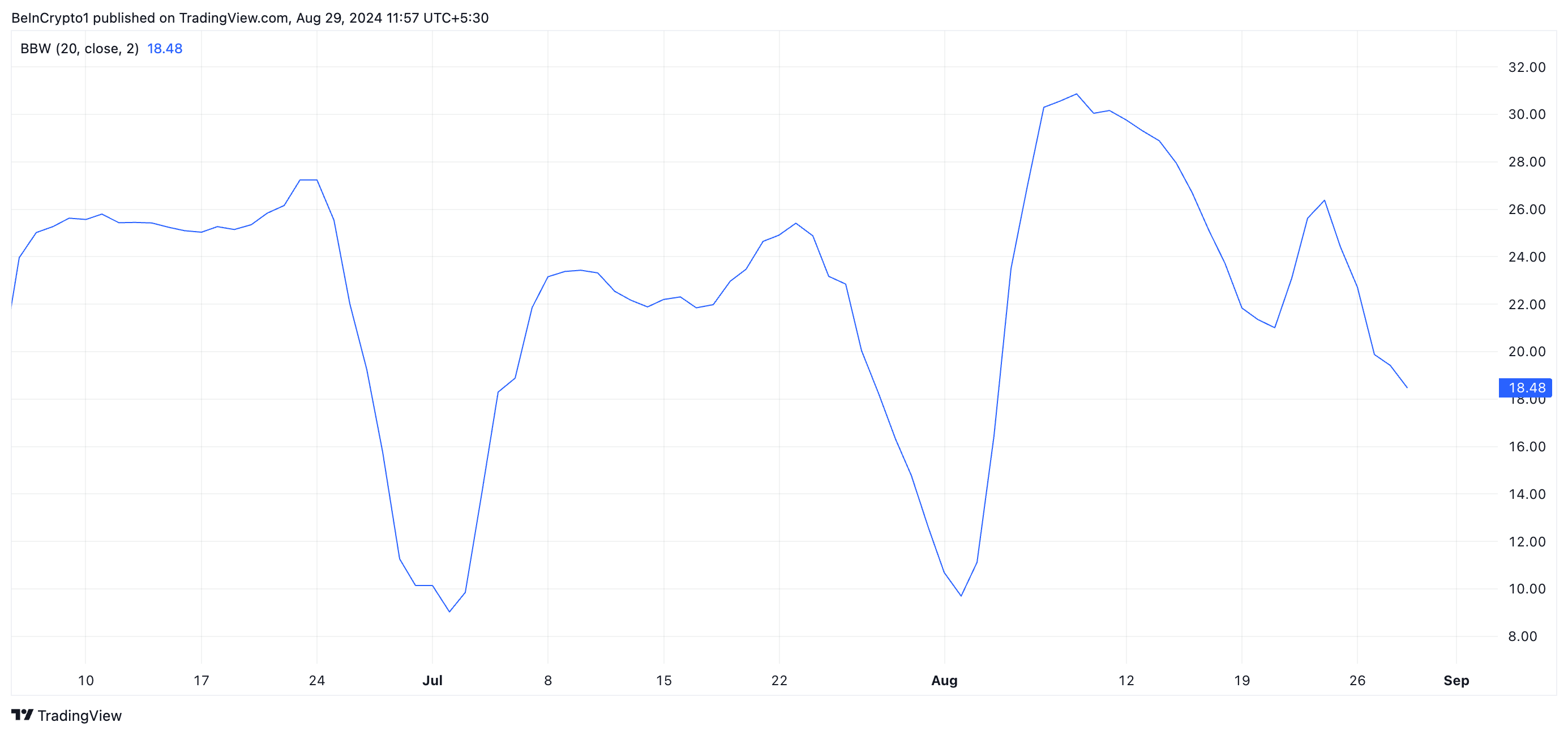

In addition, BNB’s downward-trending Bollinger Data transfer sustains this sight. This indication assists investors analyze market volatility and determine possible outbreak possibilities. Since the most recent information, the Bollinger Data transfer for BNB stands at 18.48.

A decreasing transmission capacity such as this shows that BNB’s Bollinger bands are much apart, verifying reduced market volatility.

BNB Rate Forecast: Bulls and Bears Take On in Fight

When a property trades laterally, it shows an equilibrium in between trading stress, which maintains the rate from relocating highly in either instructions.

If BNB experiences a favorable revival and need for the altcoin boosts, it can burst out of its slim variety and begin an uptrend. If this situation unravels, BNB’s rate might reach $560.90, which is over its 20-day EMA and 50-day SMA.

Find Out More: Binance Coin (BNB) Rate Forecast 2024/2025/2030

Nonetheless, if the bearish view versus BNB magnifies and offering stress boosts, the rate can go down to $522.90.

Please Note

According to the Trust fund Job standards, this rate evaluation short article is for informative objectives just and need to not be taken into consideration monetary or financial investment suggestions. BeInCrypto is dedicated to precise, objective coverage, yet market problems undergo alter without notification. Constantly perform your very own research study and seek advice from an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.