As Bitcoin (BTC) has a hard time to recover the $60,000 mental degree, the on-chain information company CryptoQuant has actually highlighted 5 vital graphes that highlight the current cost decline.

The crypto markets remain in chaos, leaving investors on side as Bitcoin’s cost sends out combined signals. Experts are split on whether the marketplace is going to an improvement or readied to proceed its uptrend.

5 Graphes to Discuss the most recent Bitcoin Cost Decline

Bitcoin has actually slid listed below the vital $60,000 mental degree, expanding its decrease after a current rise over $65,000. A closer take a look at the underlying basics exposes fascinating characteristics as investors and financiers browse the marketplace problems.

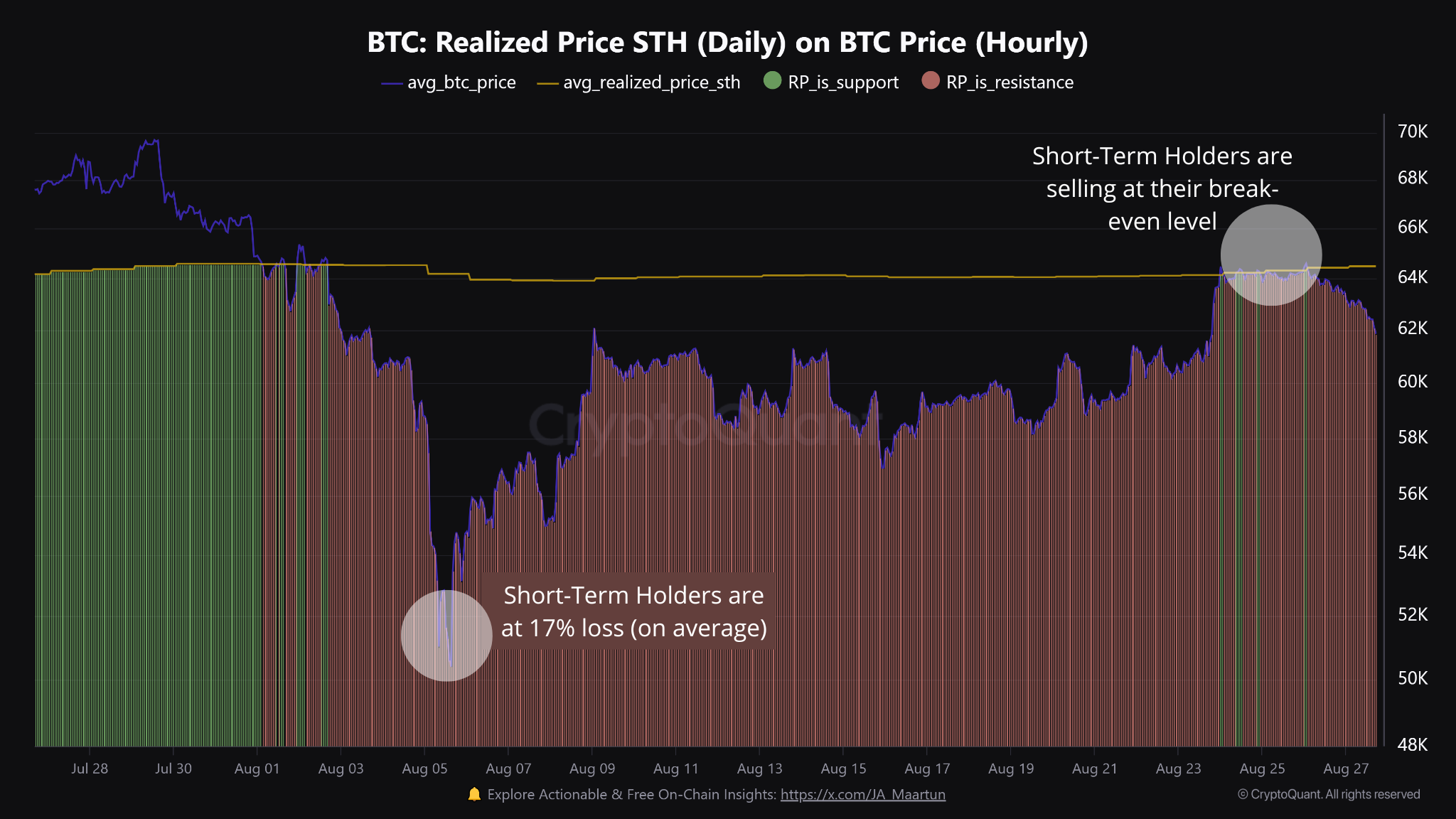

Temporary Owners Money In at Break-Even

According to CryptoQuant, Bitcoin temporary owners developed a resistance wall surface at their break-even cost, showing they took revenues. The break-even cost is where investors neither gain neither shed, with the property trading near their acquisition cost.

This tactical profit-taking adhered to Bitcoin’s earlier cost decline, which had actually created temporary owners to sustain a 17% loss. When the cost recoiled to their typical expense basis, these owners marketed around their break-even rates. The resulting marketing stress added to the most recent cost decline.

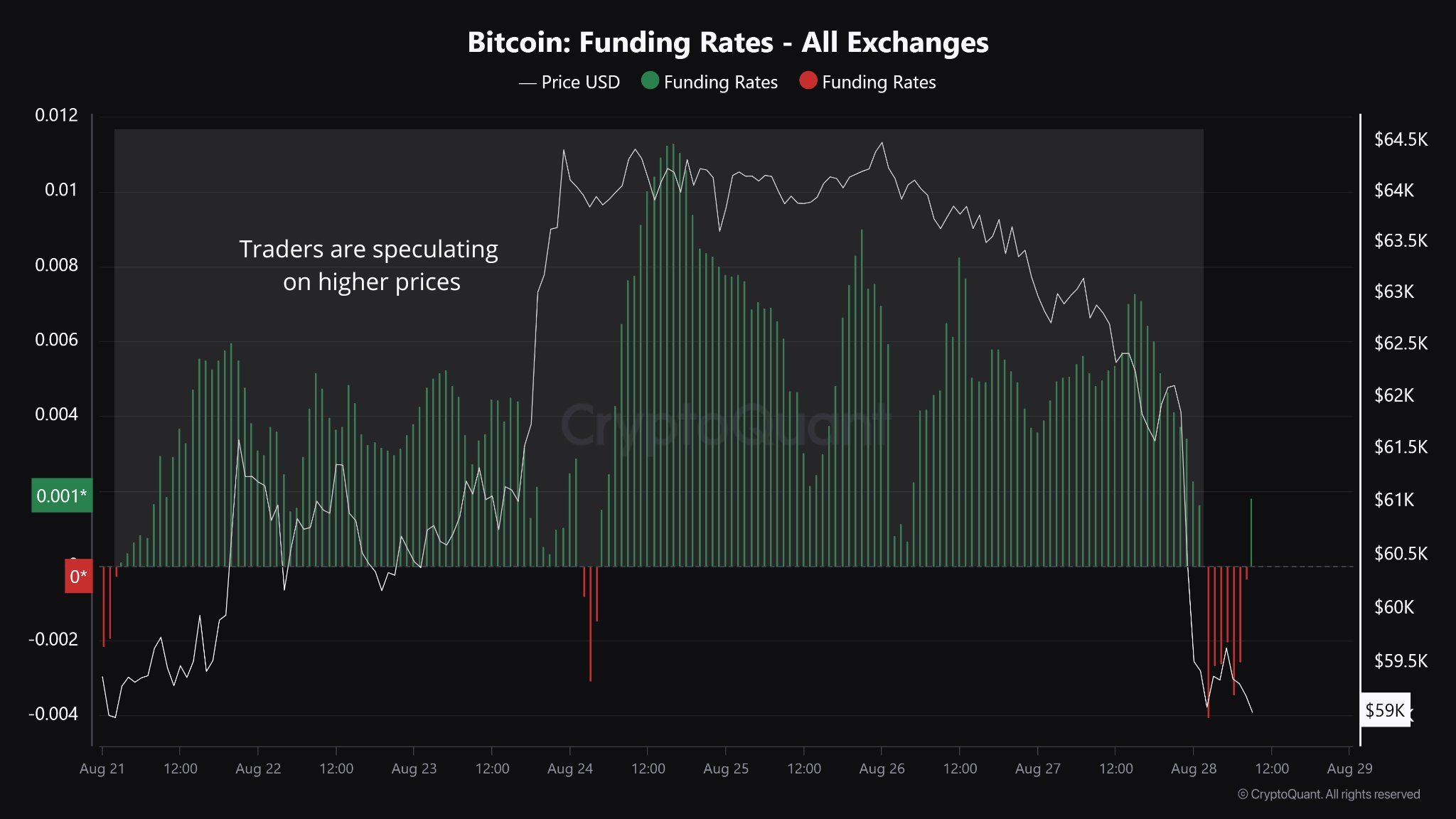

Enhanced Open Passion and Favorable Financing Fees

CryptoQuant additionally reports a costs on Bitcoin continuous agreements, with open rate of interest climbing by 31% because August 5, relocating from $13.5 billion to $17.9 billion. Open up rate of interest stands for the overall variety of employment opportunities, mirroring futures investors’ forecasts concerning the following market relocation.

In a fluid market, high open rate of interest generally leads to far better implementation rates, tighter bid-ask spreads, and lowered slippage, offering investors with improved market effectiveness and simpler access and departure possibilities. The 31% boost in open rate of interest recommends expanding market involvement and increased rate of interest in Bitcoin.

Find Out More: Where To Profession Bitcoin Futures: A Comprehensive Overview

At the exact same time, financing prices stayed favorable, showing that lengthy placements (purchasers) were paying brief placements (vendors) to keep their placements. This situation shows market problems where need goes beyond supply.

The mix of climbing open rate of interest and favorable financing prices can undercut investors’ placements, largely as a result of boosted speculative task. As even more individuals get in and leave placements in an effort to maximize possible cost activities, volatility rises, triggering abrupt changes in market view.

This dynamic can produce a responses loophole, where expanding market involvement gas more cost activities. Because of this, herd habits and energy trading enhance market patterns, making it progressively tough to forecast and take care of dangers properly.

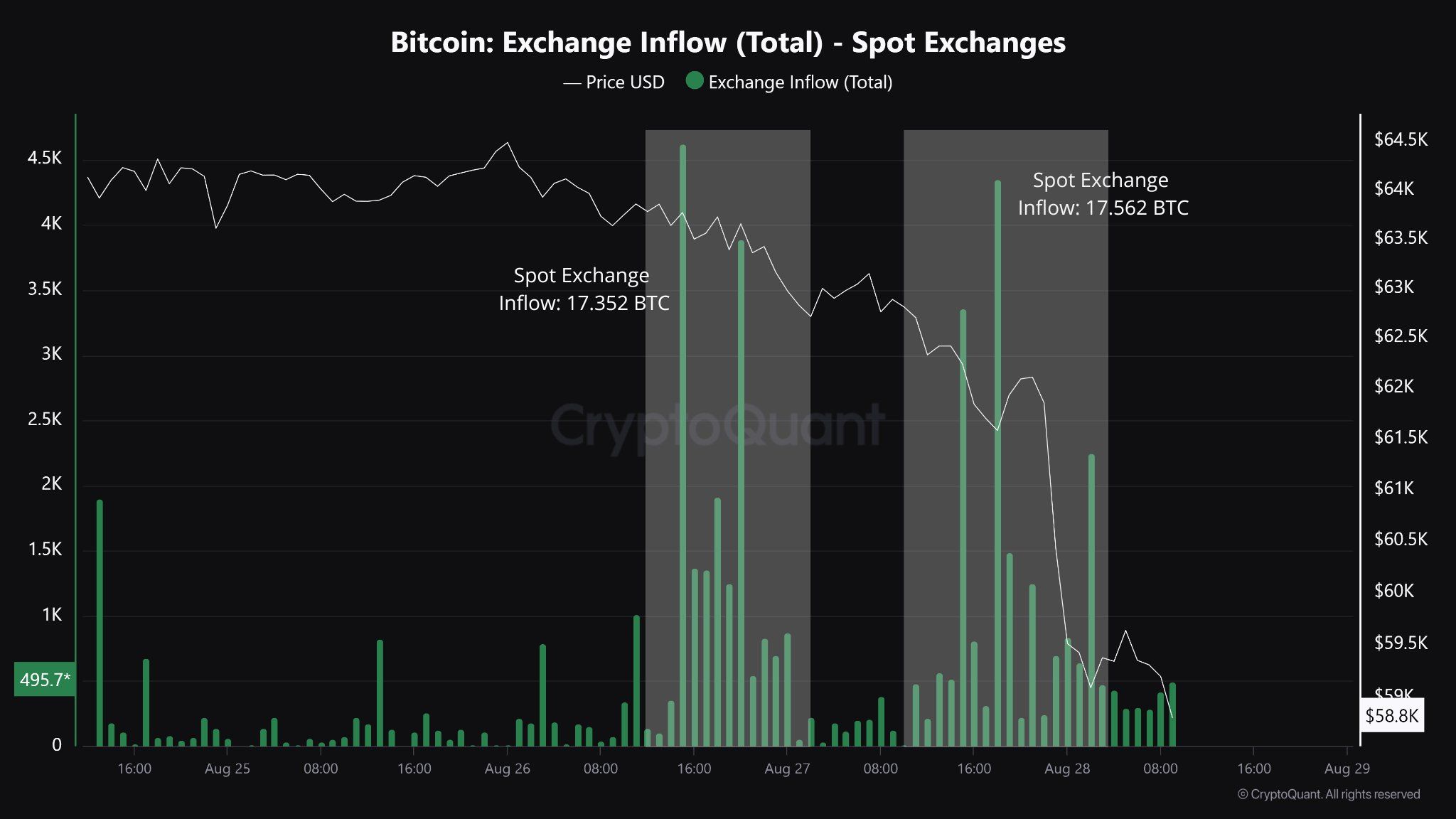

Enhanced Place Inflows

Study suggests that boosted Bitcoin inflows right into area exchanges throughout the cost decline even more added to the decrease, as investors watched it as an indicator of foreshadowing marketing stress. When financiers move their holdings to exchanges, it is frequently viewed as an intent to market.

This increase included pressure to currently delicate futures placements. According to CryptoQuant’s Head of Study, Julio Moreno, these inflows were credited to big owners, enhancing the stress on the marketplace.

Find Out More: Bitcoin (BTC) Cost Forecast 2024/2025/2030

As received the graph above, the increase in area exchange inflows accompanied cost decreases, strengthening the thesis.

This boost in Bitcoin supply readily available for trading on exchanges indicates even more vendors are supplying their BTC up for sale. When supply exceeds need from purchasers, it puts in descending stress on the cost, adding to the decrease.

Getting Rid Of Weak Hands

The collection of occasions has actually caused “weak hands” leaving their placements, leading to boosted liquidations. Ethereum and Bitcoin longs were sold off for $55 million and $90 million, specifically, noting the highest degree of liquidation because August 5, according to study.

CryptoQuant’s study recommends that the marketplace will certainly require time to maintain prior to a clear directional prejudice can arise. Since this writing, Bitcoin is trading at $59,118, down almost 5% because the Wednesday session started, according to BeInCrypto information.

Please Note

In accordance with the Depend on Job standards, this cost evaluation post is for informative objectives just and need to not be taken into consideration economic or financial investment guidance. BeInCrypto is dedicated to precise, objective coverage, yet market problems go through transform without notification. Constantly perform your very own study and speak with a specialist prior to making any type of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.