Study appointed by OKX exchange found institutional financiers watch entrance right into the electronic possession area as inescapable. The record mentions a “expanding agreement” amongst institutional financiers that electronic properties like cryptocurrencies, NFTs, and tokenized exclusive funds are vital to profile possession allotments.

Institutional rate of interest in the crypto area remains to raise, partially motivated by the introduction of Bitcoin ETFs (exchange-traded funds) in the United States, which supplied BTC to Wall surface Road.

Institutional Capitalists Discover Digital Possessions Unpreventable

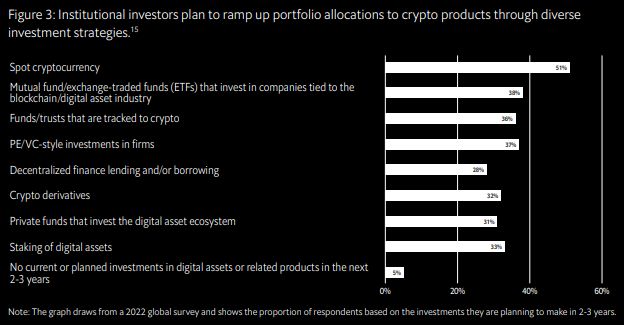

OKX’s report mentioned feedbacks from TradFi titans like Citi, Al Mal Resources, Skybridge Resources, and VanEck, to name a few. Based upon the research study, institutional financiers mean to increase their allotments to crypto, leveraging a variety of financial investment approaches.

The reduced relationship in between electronic properties and conventional properties gas institutional rate of interest, making them useful for diversity. With the expanding schedule of financial investment automobiles such as ETFs and by-products, establishments are significantly hopeful regarding incorporating electronic properties right into their profiles.

” About 51% of financiers taking into consideration place crypto allotments, 33% taking into consideration laying of electronic properties, and 32% taking into consideration crypto by-products. 69% of institutional financiers prepared for boosting their allotments to electronic properties and/or associated items in the following a couple of years,” reviewed the report.

Organizations presently assign approximately 1% to 5% of their profiles to electronic properties, depending upon their danger resistance. They expect boosting this appropriation to 7.2% by 2027.

This expanding rate of interest is driven by the introduction of institutional-grade custodians and the schedule of crypto ETFs. As the electronic possession community develops, conventional financiers are anticipated to function extra very closely with digital-native custodians.

” As the institutional electronic possession custodianship market expands, such standards safety and security, governing conformity, and performance, as are anticipated to end up being extra polished, more helping with institutional fostering of electronic properties. According to our study quick, the institutional electronic possession custodianship market is predicted to experience a substance yearly development price of over 23% with 2028, and 80% of conventional and crypto bush funds that purchase electronic properties make use of a third-party electronic possession custodian,” OKX Principal Commercial Policeman Lennix Lai informed BeInCrypto.

Find Out More: 12 Ideal Altcoin Exchanges for Crypto Trading in August 2024

Institutional financiers are additionally concentrating on understanding and adjusting to transforming laws to straighten with ideal techniques. They are remaining upgraded on modifications in crucial economic facilities to make sure a much more safe market. The placement of neighborhood and local laws, like the MiCA structure in Europe, is aiding to make international fostering of electronic properties extra attainable.

Crypto Narratives Drawin g Institutional Passion

Without a doubt, institutional rate of interest in crypto markets remains to expand, driven by advancements such as crypto ETFs, Decentralized Physical Facilities Networks (DePIN), and Real-World Possessions (RWAs). The marketplace capitalization of DePIN is coming close to $19 billion, with crucial jobs like Render and Bittensor leading the market.

Professionals think that DePIN and RWA fads will certainly sustain the following wave of crypto fostering. Institutional financiers, consisting of Andreessen Horowitz, are additionally making significant relocate this area.

” We’re seeing an appealing trajectory in the direction of the tokenization of properties like supplies, bonds and also property. This arising pattern has the prospective to significantly raise the liquidity and access of these possession courses. Think of having the ability to trade a portion of an industrial structure as quickly as you get shares of a public firm today– that’s the sort of democratization of financing we’re checking out,” Lennix Lai showed BeInCrypto.

Learn More: Exactly How To Fund Advancement: An Overview to Web3 Grants

Tokenized RWAs have actually turned into one of one of the most famous fads in 2024, connecting the space in between conventional and decentralized financing. The tokenized RWA market, valued at over $10 billion, deals with institutional customers trying to find safe financial companions and custodianship options for their crypto properties.

Blockchain innovation, with possession tokenization, supplies a much safer option to much less safe exchanges or purse companies. This procedure additionally improves procedures and produces brand-new chances for the economic market.

” While it’s prematurely to claim if tokenized properties will certainly end up being as fluid and easily accessible as conventional equities and bonds in the close to term, the lasting possibility is tremendous. As blockchain innovation remains to grow, governing structures advance and electronic safety and security techniques boost, we anticipate to see institutional financiers coming to be significantly comfy with incorporating tokenized properties right into their profiles,” Lai included.

Please Note

In adherence to the Count on Task standards, BeInCrypto is dedicated to objective, clear coverage. This newspaper article intends to offer precise, prompt details. Nevertheless, viewers are recommended to validate truths separately and speak with a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.