The securities market has actually soared higher this year, led by huge technology supplies like Nvidia, Meta Systems, and Broadcom Yet if you damage the surface area, you locate an unusual team of supplies that are also hotter than technology: energies. That’s right.

Allow’s go into what’s taking place to boost those supplies’ efficiency, and why the energy industry can complete the year as the marketplace’s top-performing industry.

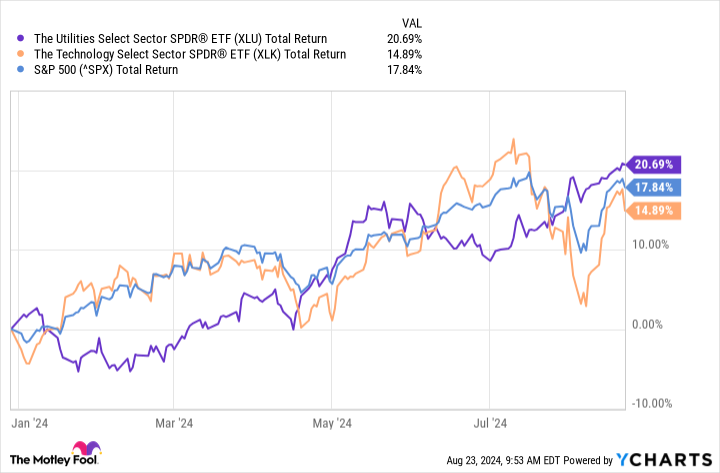

Exactly how energies have actually carried out until now this year

Since this writing, the S&P 500 has actually produced an overall return of 17.8% year to day. The utility sector, as determined by the Energies Select Field SPDR ETF ( NYSEMKT: XLU), has actually produced an overall return of 20.7%. That’s much better than any type of various other industry, consisting of the technology industry, as determined by the Innovation Select Field SPDR ETF

Yet why is it outmatching? The response hinges on a number of favorable patterns.

Initially, the energy industry is obtaining a tailwind from the expanding use expert system (AI). Essentially, AI applications are power starving– incredibly power starving. Some records approximate that AI applications presently take in approximately 8 terawatt hours (TWh) of power. That’s approximately equivalent to the quantity of power generated by the state of Rhode Island in 2022.

What’s even more, AI’s power usage is anticipated to escalate over the following couple of years. Some anticipate it can get to 52 TWh by 2026– comparable to the whole annual power manufacturing of Massachusetts. By 2030, it can absolutely blow up– needing even more power than the whole 2022 outcome produced by Florida, The Golden State, and New York City.

Simply put, there’s a huge need coming for added power manufacturing many thanks to the increasing need for AI applications. Undoubtedly, this can be an advantage for energy companies.

Nonetheless, there are some cautions. For something, several energies are very managed because of their monopolistic personality, implying it’s tough for them to elevate rates. 2nd, it’s lengthy and pricey to include brand-new nuclear power plant. So despite having included need, energy companies will certainly need to invest huge dollars on capital investment to build or increase their nuclear power plant.

Why energies can complete the year as the leading industry entertainer

Yet, there’s greater than simply AI driving the cost of energy supplies greater. The 2nd aspect at play is the expense of loaning: rate of interest.

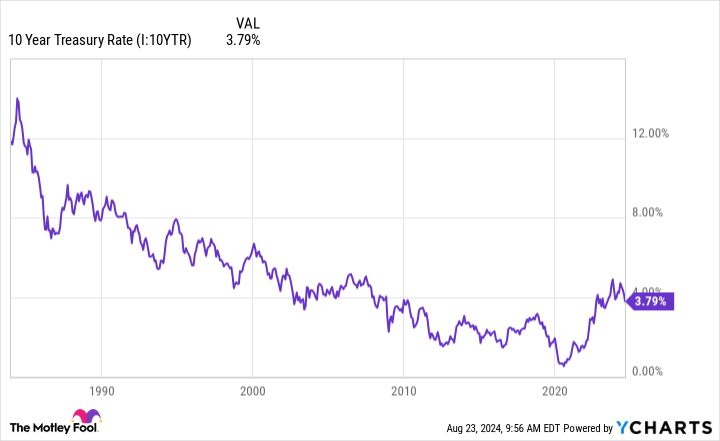

After bumping along at multi-decade lows, long-lasting rate of interest turned back upwards in 2022 as rising cost of living rose and the Federal Get improved its standard prices in a proposal to obtain it in check. Yet rising cost of living has actually cooled down, and currently long-lasting rate of interest are relieving back downward as the marketplace anticipates cuts in the government funds price.

That’s excellent information for energy supplies for 2 factors:

-

Reduced rate of interest imply reduced loaning prices. Energy business like reduced loaning prices because– as kept in mind– it’s pricey to construct brand-new nuclear power plant or increase existing ones.

-

Reduced rate of interest drive down the allure of fixed-income safeties like bonds. That can motivate income-seeking capitalists to change even more of their financial investments to energy supplies, which typically have strong reward returns.

Obviously, dropping long-lasting rate of interest can likewise indicate slower financial development– or perhaps the opportunity of a future economic crisis. Nonetheless, energy supplies, as a protective industry, usually outshine in recessionary settings.

Altogether, there are a variety of reasons that energy supplies are having such an excellent 2024, consisting of dropping rate of interest, climbing power need, and the possibility for slower financial development. Financiers that might have been forgeting the industry prior to might intend to provide it a review currently.

Should you spend $1,000 in Select Field SPDR Count On – The Utilities Select Field SPDR Fund today?

Prior to you acquire supply in Select Field SPDR Count On – The Utilities Select Field SPDR Fund, consider this:

The Supply Consultant expert group simply determined what they think are the 10 best stocks for capitalists to acquire currently … and Select Field SPDR Count On – The Utilities Select Field SPDR Fund had not been among them. The 10 supplies that made it can create beast returns in the coming years.

Think About when Nvidia made this listing on April 15, 2005 … if you spent $1,000 at the time of our referral, you would certainly have $774,894! *

Supply Consultant gives capitalists with an easy-to-follow plan for success, consisting of assistance on constructing a profile, routine updates from experts, and 2 brand-new supply choices every month. The Supply Consultant solution has greater than quadrupled the return of S&P 500 considering that 2002 *.

* Supply Consultant returns since August 26, 2024

Randi Zuckerberg, a previous supervisor of market growth and spokesperson for Facebook and sibling to Meta Operating systems Chief Executive Officer Mark Zuckerberg, belongs to The ‘s board of supervisors. Jake Lerch has settings in Nvidia and Select Field SPDR Trust-The Utilities Select Field SPDR Fund. The has settings in and suggests Meta Operatings systems and Nvidia. The suggests Broadcom. The has a disclosure policy.

Prediction: This Unexpected Category Will Finish 2024 as the Stock Market’s Top Sector was initially released by The

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.