Current information recommends Ethereum can gain from reducing rate of interest in Bitcoin (BTC). At press time, ETH’s cost had actually dropped by virtually 2%, comparable to BTC’s motion.

Nevertheless, throughout this duration, market rate of interest in ETH has actually expanded, while Bitcoin has actually seen a decrease in investor task. This increases the concern: is a resources turning from BTC to altcoins beginning?

Ethereum Make Headway Versus the Primary Coin

On August 26, Bitcoin’s open rate of interest (OI) stood at over $12 billion. Currently, it has actually gone down to $11.55 billion, showing that settings worth $500 million have actually been enclosed the previous 24 hr. On the other hand, Ethereum’s OI has actually increased from $5.25 billion the other day to $5.38 billion today.

Open up rate of interest tracks the circulation of cash in and out of the crypto market. A boost in OI implies investors are acquiring extra direct exposure to a cryptocurrency by including liquidity to their agreements, while a reduction signals lowered internet positioning and resources draining of the marketplace.

The current surge in Ethereum’s OI, combined with Bitcoin’s decrease, recommends investors are moving their emphasis from BTC to ETH, looking for far better returns from Ethereum’s cost activities.

Find Out More: Ideal Ethereum Pocketbooks To Select in 2024

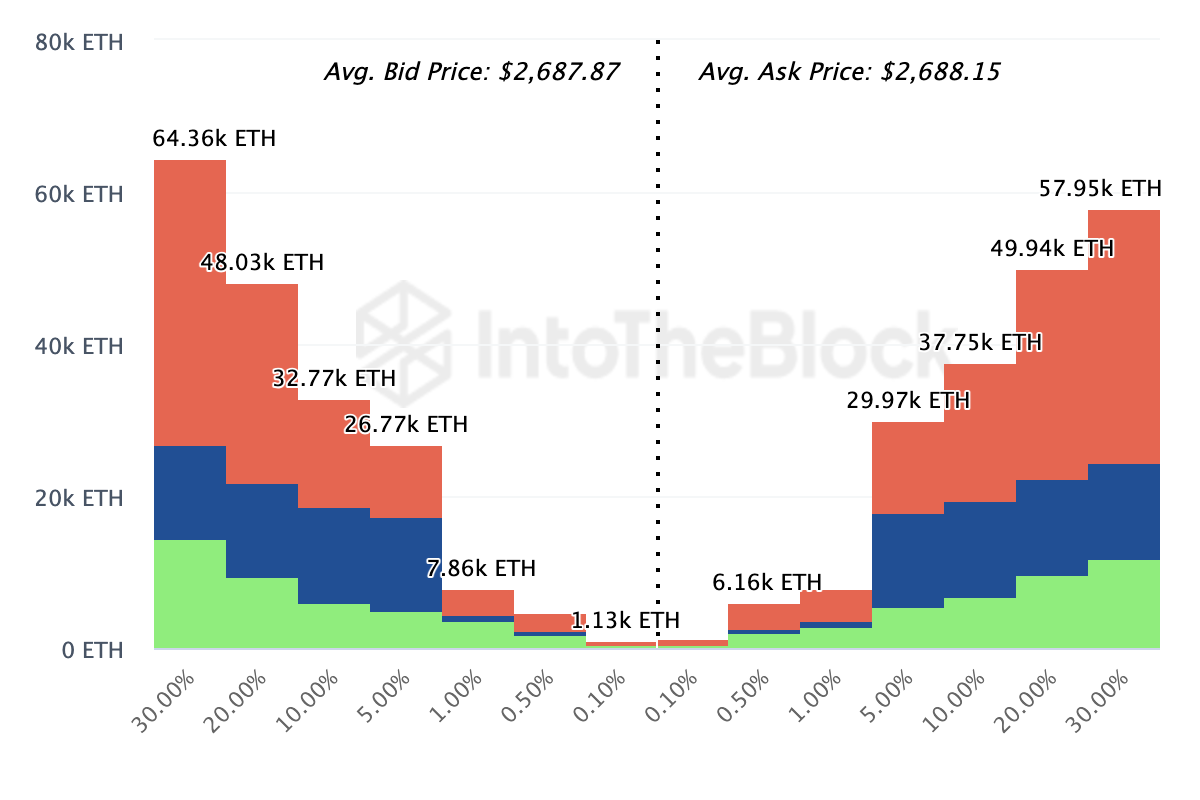

Surprisingly, this view prolongs past by-products market task. According to IntoTheBlock, market individuals are extra likely to get direct exposure to ETH instantly market instead of revolving resources out of the altcoin.

This fad is mirrored in the purchasing and marketing quantities noticeable on the order publications of the leading 20 exchanges. As revealed listed below, individuals are bidding process (purchasing) 185,700 ETH, valued at around $2,687 each.

These coins, worth about $500 million, a little surpass the quantity of those aiming to market. If the quote side remains to surpass the ask, ETH’s cost can be positioned for a bounce.

ETH Rate Forecast: The $2,800 Resistance Offers Difficulties

Ethereum’s day-to-day graph discloses a sharp drop in very early August, with ETH’s cost dropping from $3,392 to $2,109. Nevertheless, in current weeks, the cryptocurrency has actually gotten in a combination stage, showing a facility situation where the marketplace doubts concerning the following relocation.

Trick assistance at $2,556 recommends that ETH might not go down listed below this degree in the short-term. Furthermore, the Product Network Index (CCI) reveals that ETH’s present cost of $2,647 is dramatically listed below its reasonable worth.

The CCI gauges a property’s cost about its ordinary cost over a provided duration. A high CCI analysis suggests a property is misestimated, indicating a possible cost decline. On the other hand, a reduced CCI recommends the property is underestimated, offering a possible purchasing chance.

In Ethereum’s situation, the CCI’s decrease indicate the present cost being listed below its historic standard, a fairly favorable indicator that can sustain a much more confident overview.

Find Out More: Ethereum (ETH) Rate Forecast 2024/2025/2030

In the meantime, ETH may proceed trading laterally. Nevertheless, if the altcoin can get over the present market doubt in getting big quantities, it can test resistance at $2,810, possibly damage the $3,000 obstacle, and go for $3,360.

On the other side, failing to appear the above resistance can revoke the favorable overview for ETH. Because situation, ETH’s cost may retest reduced assistance degrees around $2,556.

Please Note

In accordance with the Trust fund Job standards, this cost evaluation post is for informative functions just and ought to not be taken into consideration economic or financial investment guidance. BeInCrypto is dedicated to precise, objective coverage, yet market problems undergo alter without notification. Constantly perform your very own study and talk to a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.