Specialists are wondering about whether decentralized financing (DeFi) can really drive the following wave of crypto fostering. As this dispute proceeds, focus has actually moved towards Decentralized Physical Facilities Networks (DePIN) and real-world possessions (RWA) as possible development chauffeurs.

Arising patterns play a progressively essential duty beforehand the cryptocurrency sector, and their impact fit fostering techniques can not be ignored.

Ethereum and Helius Labs Execs Probe DeFi

Ethereum founder Vitalik Buterin thinks the blockchain’s future depend on sustainably helpful applications. He worries the requirement to keep core concepts like permissionless gain access to and decentralization.

The Russo-Canadian pioneer supporters for incorporating decentralized financing (DeFi) with various other innovations to attain this vision. Buterin recognizes that while DeFi has its toughness, it deals with basic restrictions that cover its capability to drive a noteworthy 10-100x rise in crypto fostering.

” The type of applications that I intend to see are applications that work in a lasting method, and do not give up on the concepts. I believe DEXes are terrific, and I utilize them weekly. I believe decentralized stablecoins are terrific. I believe USDC is much less terrific than RAI, yet as a sensible issue we just need to appreciate that it’s exceptionally hassle-free and great deals of individuals utilize it,” Buterin shared.

Learn More: Leading 11 DeFi Protocols To Watch on in 2024

Helius Labs chief executive officer Mert Mumtaz mirrors this sight, keeping in mind that financing is simply a downstream part of a flourishing economic situation. Mumtaz says that DeFi can not exist alone without running the risk of collapse, highlighting the requirement for a more comprehensive community to sustain lasting development.

” It does not make much feeling for it to exist separated without this, or else it will certainly break down as it’s naturally round and calls for a growing number of input to proceed working– which is the precise reverse of what the principle of innovation implies,” Mumtaz explained.

Mumtaz straightens with Buterin’s position on stablecoins, while additionally calling DePIN and tokenized RWA as vital chauffeurs for the following wave of crypto fostering. Nonetheless, he stresses that sustainability is vital in opening this capacity.

DePin, Stablecoins, and Tokenized RWA Drive Crypto Fostering

In method, DePIN, stablecoins, and RWAs are currently pressing crypto fostering ahead. are currently driving crypto fostering. Stablecoins, particularly, remain to see solid need, with Tether’s USDT leading in profits generation, adhered to by Circle’s USDC.

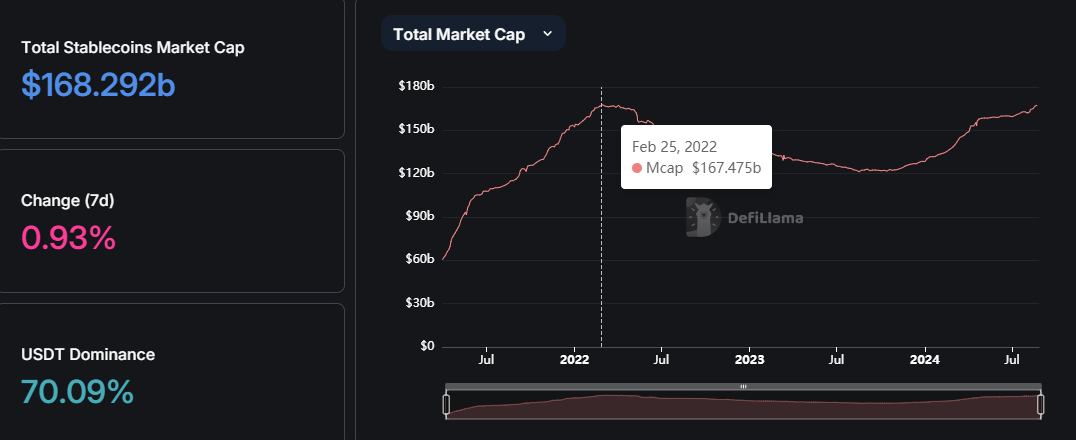

Current information discloses that the complete market capitalization of stablecoins has actually risen to an all-time high of $168 billion after 11 successive months of development. This notes a brand-new landmark for the industry, going beyond the previous height of $167 billion videotaped in February 2022.

The rise shows increasing funding inflows right into the marketplace, driven greatly by continual retail involvement over the previous 8 months.

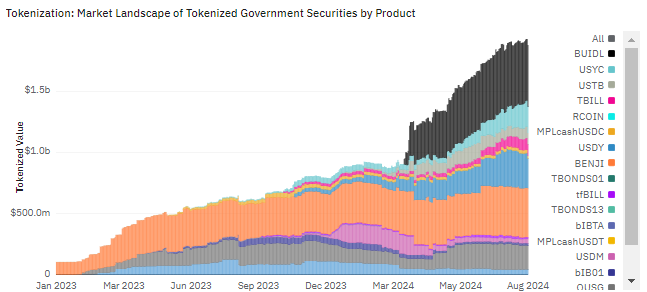

Along with stablecoins, tokenized real-world possessions are experiencing remarkable development, drawing in institutional passion. Significant gamers like BlackRock, Grayscale, and Franklin Templeton are making large relocate this room. The tokenized safeties market has actually exceeded $1.92 billion, highlighting the duty of RWA in connecting the space in between TradFi and DeFi.

Learn More: Exactly How To Purchase Real-World Crypto Properties (RWA)?

The DePIN story is additionally getting grip, with Bittensor (TAO) leading in social task metrics. A rise in social interaction highlights expanding area passion, which can drive more comprehensive fostering and energy.

Various other significant gamers in the DePIN room consist of Render (RNDR), Filecoin (FIL), and Net Computer System (ICP). According to current records, the industry’s allegorical development has actually pressed its market capitalization past $20 billion.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to supply precise, prompt info. Nonetheless, viewers are encouraged to validate realities separately and seek advice from an expert prior to making any type of choices based upon this material. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.