The Ethereum Structure is under attack for moving 35,000 ETH, worth regarding $100 million, to the Sea serpent exchange without notifying the area. On August 23, on-chain analytics solid Lookonchain reported the purchase, triggering prevalent worry.

In feedback, Aya Miyaguchi, the Exec Supervisor of the Ethereum Structure, cleared up that the transfer lines up with the Structure’s $100 million yearly spending plan. This spending plan sustains gives and wages, several of which call for fiat repayments. She described that the Structure could not reveal the purchase ahead of time as a result of regulative restrictions.

Regardless of Miyaguchi’s description, the crypto area continues to be split. Numerous slammed the Structure for not being clear regarding its monetary choices.

Crypto legal representative Gabriel Shapiro kept in mind that openness and responsibility should not shed importance since tasks aren’t on-chain. According to him, the Structure’s description does not hold water since it recommends that “individuals with power over Ethereum do not regard ETH as a financial investment any longer.”

” Sufficient suffices– this attitude is the most significant restriction on development of the crypto market as nobody wishes to buy something with un-dependable value-drivers where those in charge of creating worth to the property are currently also well-off and have huge disputes of rate of interest,” Shapiro added.

Learn More: Ethereum (ETH) Cost Forecast 2024/2025/2030

Marc Zeller, creator of AaveChan, was likewise not impressed by Miyaguchi’s description. He doubted the allowance of the $100 million spending plan, mentioning that some Ethereum groups, like Geth (Go Ethereum, a preferred Ethereum customer), obtain marginal payment.

” When the Cleanup & & Brink upgrades are supplied, it’s time to seriously think about defunding and liquifying the Ethereum Structure,” Zeller stated.

On the other hand, some area participants protected the Structure’s costs, mentioning the considerable sources required to preserve Ethereum. Mudit Gupta, Polygon’s Principal Info Gatekeeper, suggested that the Structure’s $100 million yearly expense is warranted.

Nevertheless, he slammed the hefty concentrate on device growth over on-chain applications. He doubted why the Structure does not discover even more earnings streams, such as betting its billion-dollar ETH holdings.

” The Ethereum Structure ought to be much more clear, open up to various other groups, discover brand-new earnings streams, and spend much more in advertising on-chain applications,” Gupta urged.

Previous Ethereum Structure worker Hudson James likewise protected the company’s expense. According to him, the Structure likewise sustains prices like worldwide hallmark security, web server upkeep, and study cooperations.

” The ~$ 100m spending plan each year is not insane when you consider every little thing the EF does. The factor individuals are having problem comprehending that number is since the EF’s framework and ideology does not offer itself to having each and every single effort they add to and service in a solitary area,” Jameson chimed.

Learn More: Just how to Buy Ethereum ETFs?

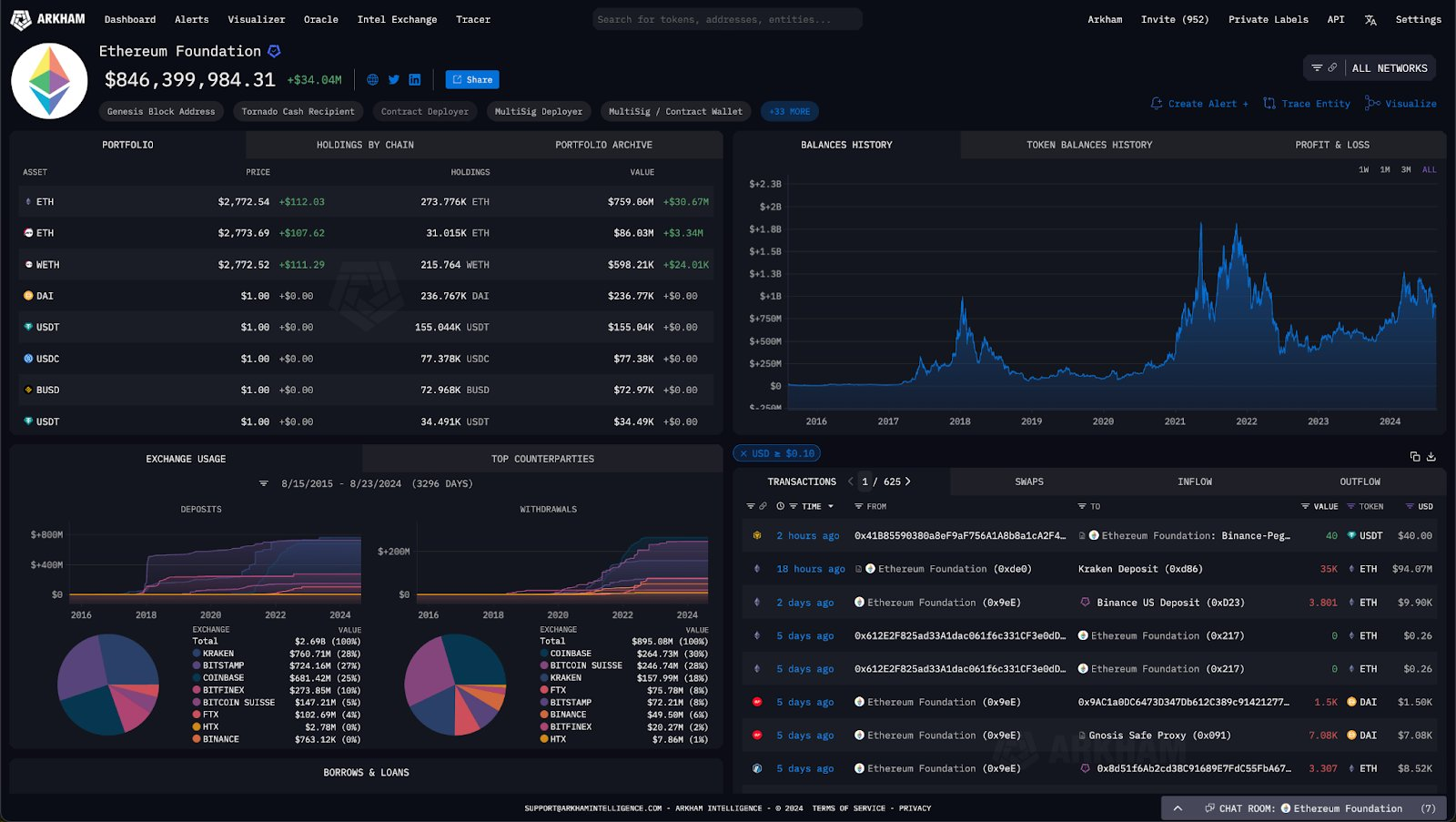

On its component, Arkham Knowledge mentioned exactly how the Structure marketing task affects the marketplace. The company stated the Structure has actually traditionally marketed ETH at different cost factors, consisting of near-market low and high. This pattern has actually sustained conjecture that the current transfer could signify either a market top or a possible cost rise.

Please Note

In adherence to the Count on Task standards, BeInCrypto is devoted to honest, clear coverage. This newspaper article intends to offer exact, prompt details. Nevertheless, viewers are encouraged to confirm truths separately and talk to an expert prior to making any type of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.