Ethereum (ETH) rate tried to go beyond $2,700 today yet disappointed the target. In spite of the pullback, the cryptocurrency keeps in mind a 3.50% rise in the last 7 days.

Yet as the rate totters around the exact same area, lengthy- and temporary owners show up to have various sights on ETH.

Ethereum Deals With Mixed Expectation

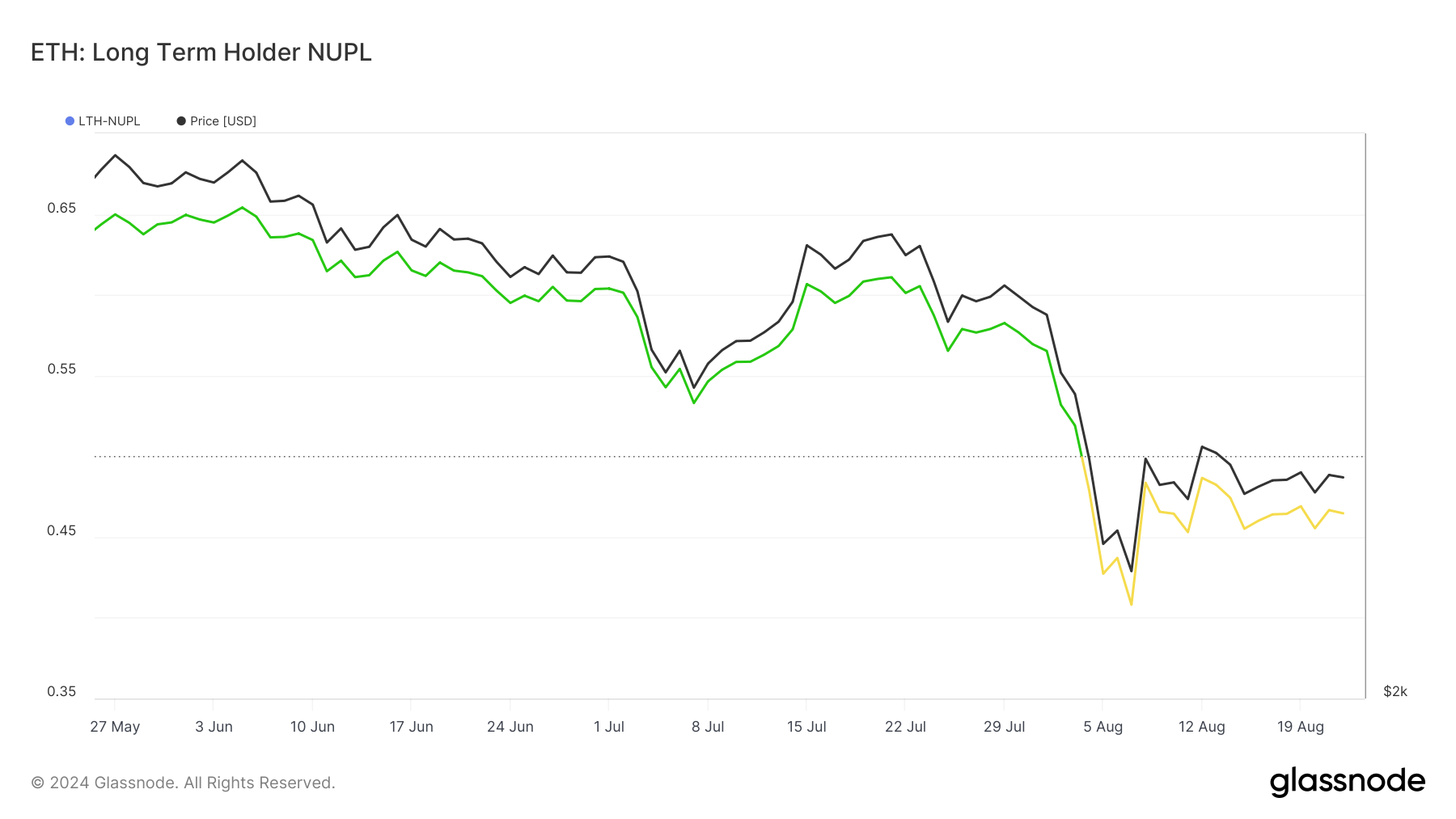

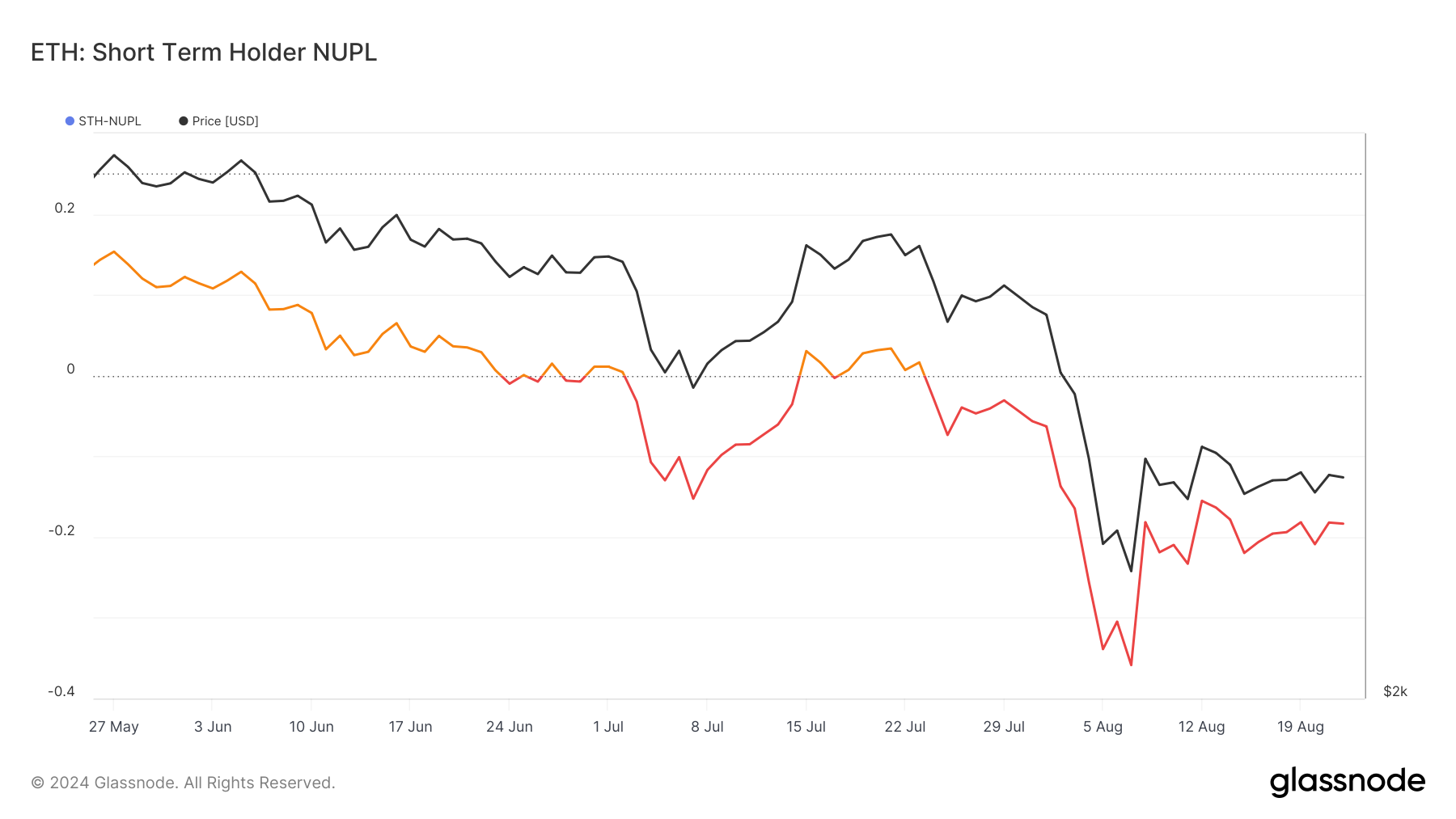

One means to assess capitalist view relating to a cryptocurrency is by examining the Internet Latent Profit/Loss (NUPL) statistics. This indication gauges the degree of latent gains or losses held by market individuals, using understandings right into the wider view and psychology of owners.

The NUPL is split right into numerous sectors standing for phases like idea, greed, positive outlook, hope, and capitulation– each mirroring just how financiers really feel concerning the property at various times.

According to Glassnode information, the Long-Term Owner (LTH) NUPL for Ethereum is presently in the hopeful area. This recommends that lasting owners still believe in ETH, checking out the current rate decrease as a momentary stage.

Learn More: Just how to Purchase Ethereum ETFs?

Nonetheless, the circumstance is various for Short-Term Owners (STH). Information from on-chain analytics reveals that the STH-NUPL presently stays in the capitulation area. This suggests that temporary owners are much less hopeful and do not anticipate ETH’s rate to recoup quickly.

This bearish view is most likely connected to ETH’s current rate efficiency. At press time, ETH is trading at $2,661, mirroring a 21,9% decrease over the last thirty days.

The decline suggests that newest purchasers are holding ETH muddle-headed, which might enhance their cynical overview. If the rate continues to be stationary or decreases better, it might be hard for these owners to change to a much more favorable view.

Relating to ETH’s rate overview, expert Michaël van de Poppe, creator of MN Resources, recommends that for Ethereum to have a shot at exceeding $3,100, it initially requires to appear the $2,700 resistance degree.

” Ethereum looks superb, yet it requires to proceed climbing up upwards. Vital degree to damage: $2,700. There is absolutely nothing in between $2,700 and $3,100, most likely causing a large higher operate on altcoins,” van de Poppe shared on August 22.

ETH Rate Forecast: Will It Evaluate $3,000?

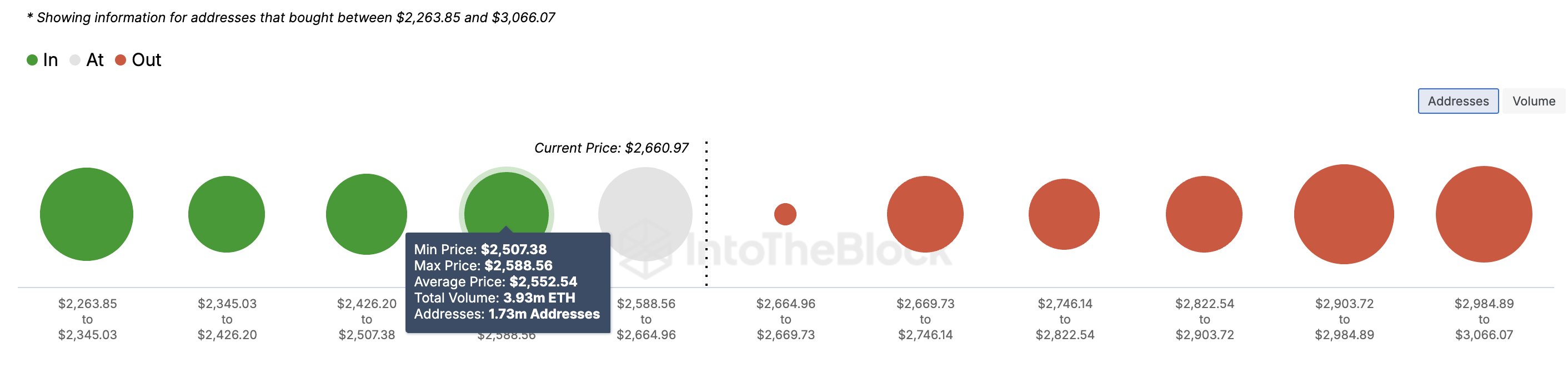

Worrying the temporary overview, the In/Out of Cash Around Rate (IOMAP) disclosed that ETH might accumulate on its current rise. The IOMAP reveals the variety of addresses that acquired a cryptocurrency at a reduced worth than the existing rate, those that purchased the existing rate, and others that purchased greater.

With this information, one can find assistance and resistance and obtain understandings right into the following degree the rate can get to. The greater the variety of addresses at a cost array, the more powerful the assistance or resistance at that degree.

According to IntoTheBlock, 1.73 million addresses acquired 3.93 million ETH at a typical rate of $2,552. This variety of addresses is greater than those in the loss that collected in between $2,699 and $2,867.

Learn More: Ethereum (ETH) Rate Forecast 2024/2025/2030

As a result, Ethereum’s rate is most likely to go beyond $2,900 in the short-term. If this happens, the course to getting to $3,100 might come to be easier. Nonetheless, stopping working to damage the overhanging resistance may create the rate to backtrack. If that occurs, ETH’s rate might go down to $2,426.

Please Note

According to the Depend on Job standards, this rate evaluation post is for educational objectives just and ought to not be thought about economic or financial investment recommendations. BeInCrypto is devoted to precise, honest coverage, yet market problems undergo transform without notification. Constantly perform your very own study and speak with an expert prior to making any kind of economic choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.