Orbiter Money safeguarded over $50 million in yearly profits, driven by expanding Layer-2 (L2) fostering. This landmark places it amongst one of the most rewarding decentralized cross-chain L2 procedures.

L2 options improve blockchain scalability by unloading deal handling from the primary chain. This lowers blockage, reduces charges, and increases deal throughput, driving need for such options.

Orbiter Money Records $50 Million Yearly Income

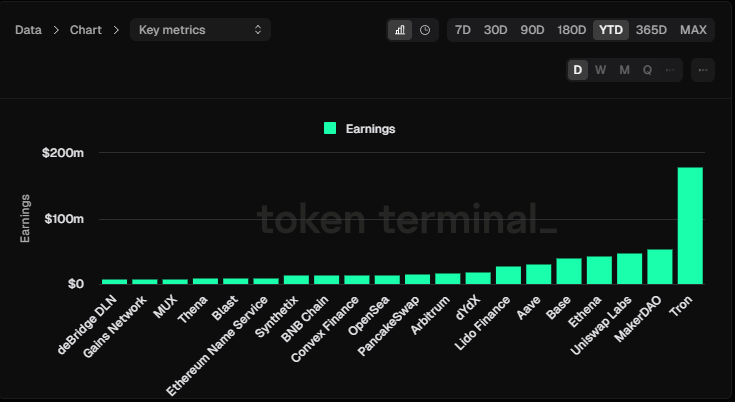

Orbiter Money created over 20,000 Ethereum (ETH) (around $52.7 million) in year-to-date profits, exceeding the mixed profits of all various other third-party cross-chain bridges. This success placements Orbiter over Base, the second-largest Layer-2 scaling option by complete worth secured (TVL), which reported $39.075 million over the very same duration.

Orbiter Financer runs within the Ethereum ecological community, supplying links within the mainnet. It helps with property transfers throughout numerous L2 networks, such as zkSync and Arbitrum, to name a few. The group claims the method has actually refined over 24 million deals until now, with greater than 4 million customers internationally.

” Cross-chain deals are progressively anticipated to happen without customers straight engaging with a connecting method’s user interface. The Orbiter group is presently concentrated on allowing smooth cross-chain deals and making sure that customers can connect with the blockchain without regarding any kind of fragmentation amongst Layer-2 options,” Iris Cheung, Orbiter Founder, informed BeInCrypto.

Find Out More: A Beginner’s Guide to Layer-2 Scaling Solutions

Supposedly, Orbiter Money has actually refined over $16 billion in deal quantity. This success is partially credited to the Manufacturer system, an essential profits generation engine within the method.

” We saw firsthand the capacity of their ingenious cross-chain liquidity technique. Their vibrant assimilation of zk modern technology repaid, with Orbiter currently holding over 50% of the cross-chain market share. Orbiter’s bank on zk and Ethereum L2s in 2023 has actually driven their remarkable development. With an enthusiastic roadmap for a completely interoperable cross-rollup ecological community in 2024, Orbiter is readied to continue to be a leader in DeFi, and we’re delighted to see their proceeded success,” claimed Suji Yan, the creator of Mask Network.

L2s continue to be a prominent story in the crypto market as a result of the promote much better scalability. These options take on blockchain difficulties, specifically on networks like Ethereum, by allowing faster and less costly deals while making sure solid protection and decentralization.

The Appeal of Ethereum L2 Scaling Solutions

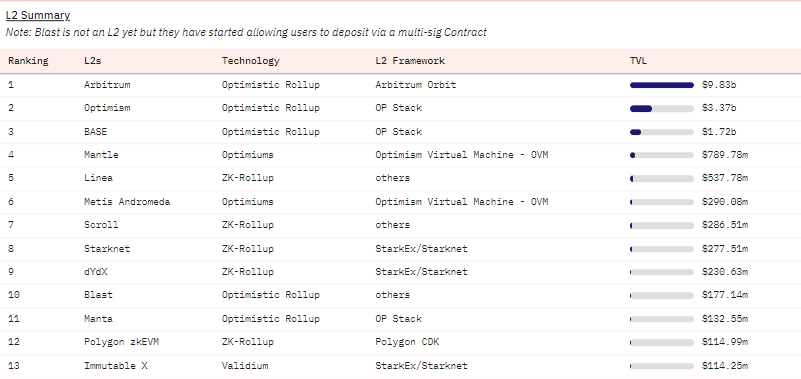

Based Upon the L2 control panel on Dune Analytics, the complete connected TVL in L2 networks is $18.19 billion. This number highlights the expanding fostering and application of L2 options by customers and decentralized applications (dApps), revealing their significance in reinforcing blockchain scalability and performance.

Significant gamers in the L2 room consist of Arbitrum (ARB), Positive Outlook (OP), and Base, which all utilize positive rollups. These rollups are typically related to lengthy withdrawal durations; for example, Base withdrawals can take around 7 days, which is a significant await customers desiring fast accessibility to their funds.

Find Out More: What Is Arbitrum? Whatever You Required To Know

The hold-up might be triggered by Positive outlook’s anti-fraud system, which is apparently ‘positive’ concerning individuals’ sincerity. It takes into consideration all deals legitimate, packages them with each other, and sends them to the L1 blockchain.

Nevertheless, customers can test deals and send possible scams evidence as component of the positive rollup’s protection device. This brings about a hold-up in the kind of a ‘Difficulty duration.’ This describes why withdrawals from Ethereum to Base might take a couple of mins, whilst those from Base to Ethereum can take days.

Please Note

In adherence to the Trust fund Job standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to give exact, prompt details. Nevertheless, viewers are recommended to confirm realities individually and talk to a specialist prior to making any kind of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.