The cost of Toncoin (BUNCH), the cryptocurrency connected to the prominent messaging application Telegram, has actually been trading on a rising pattern line over the previous couple of weeks. This suggests a stable increase in the need for the altcoin.

bunch whales are enhancing their trading task, looking for to profit from the capacity for more gains.

Toncoin Obtains Whale Focus

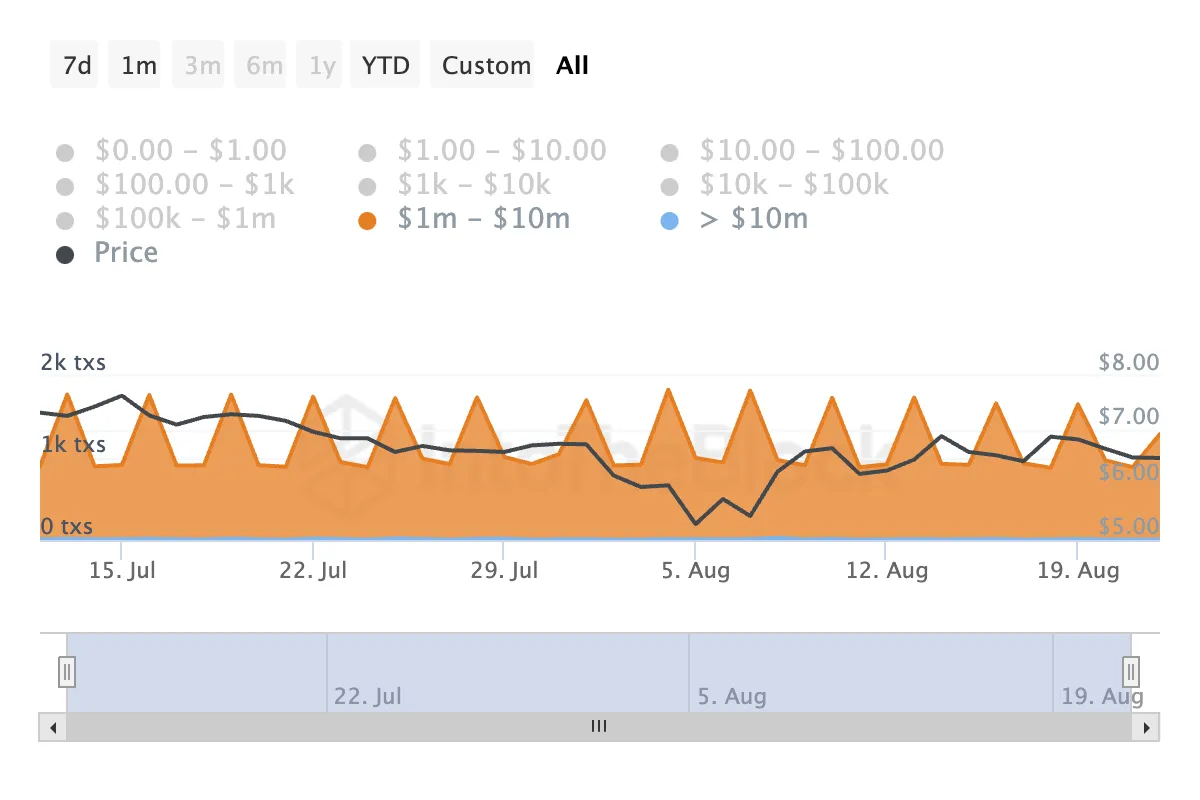

Over the previous month, on-chain information has actually disclosed an uptick in the everyday matter of big purchases entailing bunch. IntoTheBlock’s information reveals that the variety of bunch purchases worth in between $1 million and $10 million has actually increased by 46% throughout that duration.

Furthermore, bigger bunch purchases valued over $10 million have actually boosted by 50%. An increase in a possession’s big deal matter is a favorable signal. It can prolong a possession’s cost rally as soon as retail capitalists do the same and start to gather too.

In addition, bunch’s big owners’ netflow has actually risen by 431% in the previous week, validating boosted acquiring stress from whales.

Huge owners, generally capitalists managing greater than 0.1% of a possession’s distributing supply, are essential influencers in cost motions. Their netflow gauges the distinction in between the quantity of bunch they gather and the quantity they offer over a provided duration.

Find Out More: What Are Telegram Bot Coins?

When a possession’s big owner netflow spikes, it suggests that whale addresses are collecting extra symbols. This is normally a favorable signal, recommending expanding need from considerable capitalists, which can drive more cost development.

Lot Cost Forecast: Getting Task is Market-Wide

Already, bunch is trading at $6.60, with technological indications revealing solid acquiring stress. The Relocating Ordinary Convergence/Divergence (MACD) validates this favorable energy. The MACD line (blue) is presently over the signal line (orange) and is close to going across over the absolutely no line, signifying a possible extension of the higher pattern.

The MACD tracks cost patterns, instructions, and energy. When the MACD line is over the signal line, it suggests a favorable pattern driven by enhancing acquiring task. An outbreak over the absolutely no line strengthens this pattern, typically motivating investors to go long.

If this acquiring stress stays constant, bunch might see a 5% boost, bringing its cost to $6.93. Needs to the rally continue, the following target would certainly be $7.52.

Find Out More: 6 Ideal Toncoin (BUNCH) Budgets in 2024

Nonetheless, if market belief changes from favorable to bearish, the favorable forecast over sheds recognition as bunch’s cost might drop to $6.51.

Please Note

According to the Trust fund Job standards, this cost evaluation write-up is for educational objectives just and must not be taken into consideration monetary or financial investment guidance. BeInCrypto is dedicated to exact, honest coverage, yet market problems undergo transform without notification. Constantly perform your very own research study and seek advice from an expert prior to making any kind of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.