Points are obtaining silent– truly silent– elevating worries regarding whether this is still a booming market for the very unpredictable crypto ecological community. While this solution hinges on Bitcoin (BTC) efficiency and altcoin costs, historic information and current growths can anticipate the factor at which the cycle is.

In this evaluation, BeInCrypto analyzes vital on-chain metrics that recommend the advancing market began regarding 2 years back and can have gotten to 50% conclusion.

Background Reveals the Cycle Is Means Beyond Bears

The year 2022 was a specifically tough time for the crypto market, which had actually formerly grown in 2021. The sector saw significant companies like FTX, Celsius, and 3 Arrows Resources (3AC) collapse, causing prevalent insolvencies and triggering substantial decreases in cryptocurrency costs.

By November 21, 2022, Bitcoin (BTC) had actually dived to $15,409, Ethereum (ETH) was trading at $1,065, BNB at $248.60, and Solana (SOL) had actually gone down to $7.70. These degrees were the most affordable these possessions had actually seen in almost 2 years.

Offered this recession, it appears that November 2022 noted all-time low of the bearish market. The solid rate recuperation in very early 2023 sustains the concept that January was the begin of a brand-new bull cycle. Historically, crypto market cycles cover about 3 years (1,047 to 1,278 days). Based upon this duration, the existing cycle is around 640 days in, showing that the advancing market is about midway with.

Significantly, the Bitcoin halving, which usually drives huge rate boosts, happened previously this year. Remarkably, Bitcoin got to a brand-new all-time high also prior to the halving, driven mainly by the authorization of area ETFs. In spite of the current modifications and durations of loan consolidation, on-chain metrics recommend that BTC has actually not yet gotten to the height of this cycle. This leaves space for prospective additional development as the advancing market proceeds.

As seen over, the post-halving rally started in the 4th quarter (Q4) of each halving year. Hence, if we pass that reappearance, after that a significant growth can begin around October. Remarkably, CryptoQuant’s chief executive officer, Ki Youthful Ju, additionally appears to concur with the belief.

” In the last Bitcoin halving cycle, the bull rally started in Q4. Whales will not allow Q4 be burning out with a level YoY efficiency,” Youthful Ju highlighted on X.

Bitcoin, ETH, and Altcoin Costs Still Have Area to Expand

Historically, Bitcoin’s rate contends the very least increased throughout each halving year. In 2012, BTC’s rate rose by 2.52 x, complied with by a 2.26 x rise in 2016, and a 4.05 x enter 2020. At the beginning of 2024, Bitcoin was trading around $42,208. Also after getting to $73,750 in March, the information recommends the bull cycle is not yet over.

To match past cutting in half efficiencies, Bitcoin’s rate would certainly require to climb even more, targeting in between $80,000 and $85,000 prior to this cycle comes to a head. The historic patterns show space for even more development in 2024.

Currently, to various other points– beginning with ETH. Throughout the 2021 bull run, the 2nd most important cryptocurrency provided BTC a run for its cash, outmatching it for a prolonged duration.

In spite of the area Ethereum ETF authorization, ETH hasn’t mirrored its efficiency from 3 years back. On June 20, Ethereum’s supremacy was 18.80%. Already, it has actually gone down to 15%, signaling that the altcoin has yet to reproduce its remarkable 2021 run.

Find Out More: Bitcoin Halving Background: Every Little Thing You Required To Know

Bitcoin supremacy, on the various other hand, mores than 57%. In addition, ETH’s underwhelming efficiency has actually additionally been credited to the hold-up in this cycle’s altcoin period.

It deserves keeping in mind that the cryptocurrency’s rally was among the significant aspects that drove several various other altcoins to extraordinary optimals last time. However just recently, BNB seems the only leading altcoin from the last cycle that had actually exceeded its previous all-time high.

Meme Coins, Celebs Currently Tasted the Booming Market

While altcoins remain to underperform, 2 noteworthy occasions recommend that this advancing market may be midway with. The initial one is the extraordinary returns from meme coins. Last time, numerous meme coins on Ethereum and the Binance Smart Chain created several out-of-the-blue millionaires.

This moment, the blockchains providing such appear to be Solana and, most just recently, Justin Sun-led Tron. 2nd on the listing is the participation of celebs. In 2021, celebrities like Logan Paul, Paris Hilton, and Snoop Dogg, to name a few, acquired right into the NFT buzz.

At The Same Time, the NFT trend seems over, however celebs have actually additionally been entailed with the marketplace. Individuals like Andrew Tate and Iggy Azalea have actually released dad and mom meme coins, specifically.

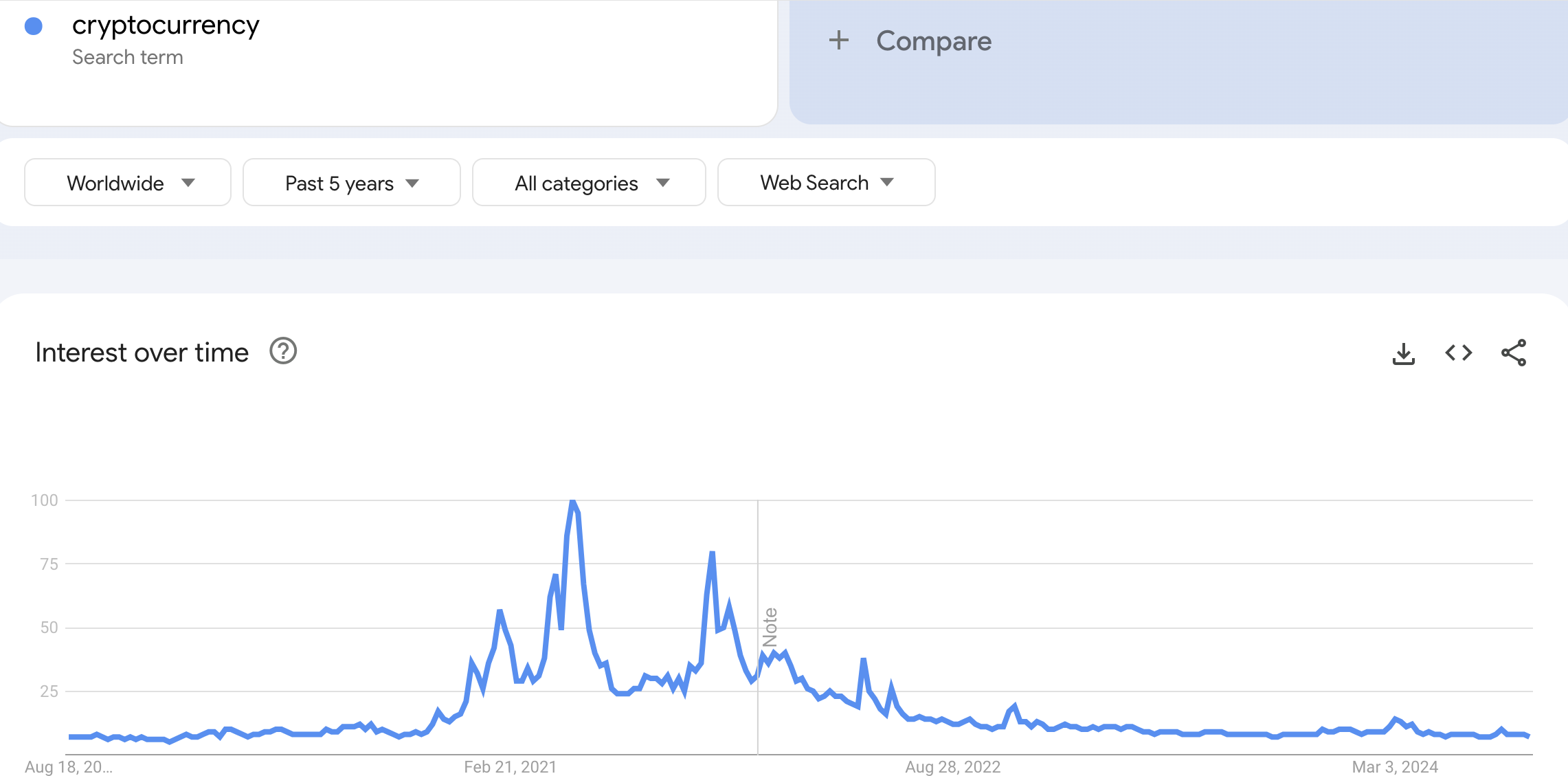

An additional statistics to take into consideration for evaluating the crypto advancing market is retail capitalist rate of interest. Whenever retail capitalist rate of interest decreases, it recommends the advancing market is recurring however hasn’t came to a head.

Google Trends information programs look for “cryptocurrency” struck their highest degree in 2021, racking up an ideal 100. Nevertheless, searches have actually been regularly lower this year, signifying minimized retail task.

A booming market usually sees a rise in retail financiers as they drive the need. The existing dip in rate of interest recommends that this cycle hasn’t reached its height yet. The absence of prevalent retail FOMO indicate much more prospective benefit as the cycle develops.

Long-Term Information Reveals the Uptrend May Begin Again

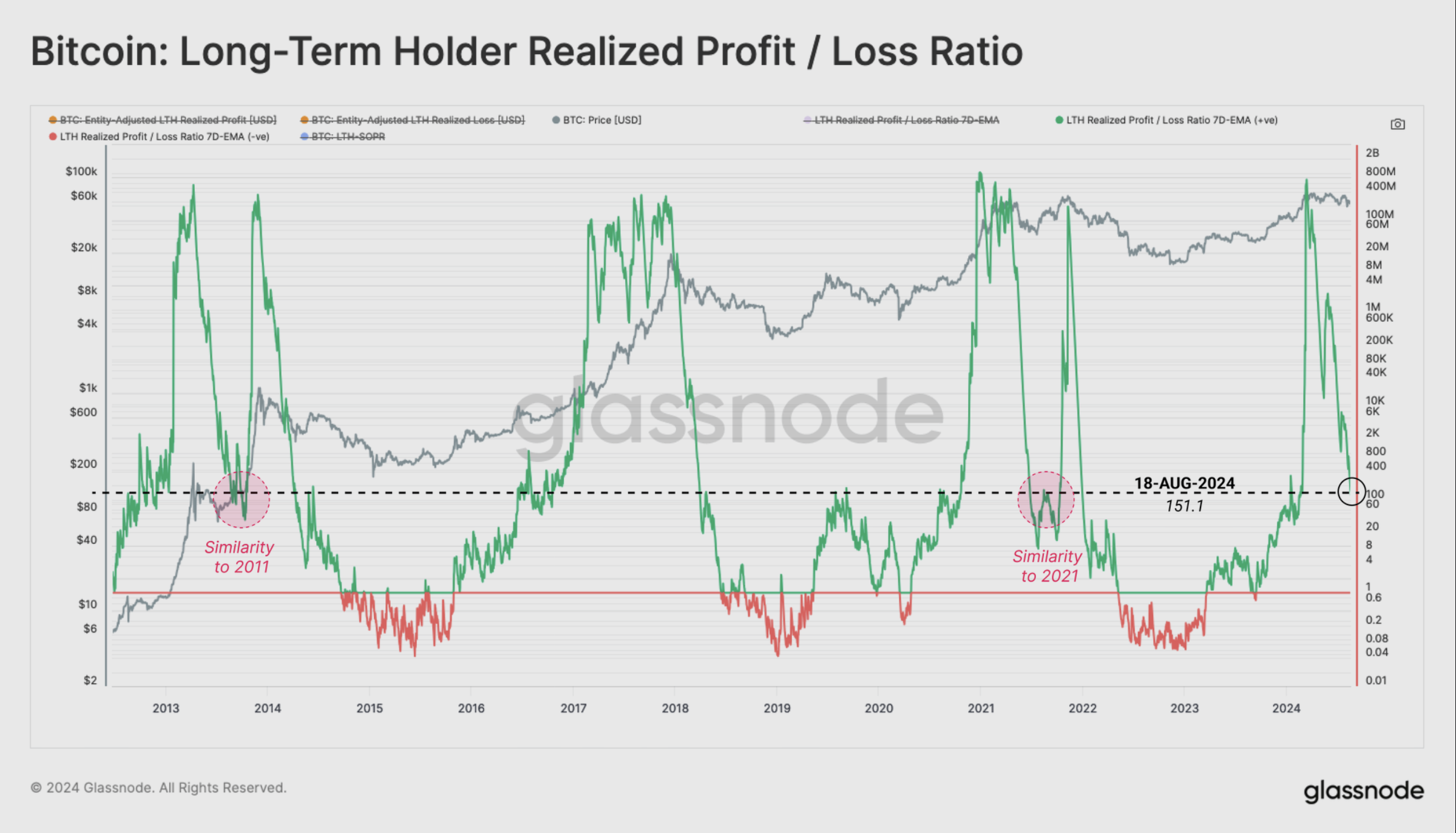

Furthermore, Glassnode-provided Long-Term Owner Understood Profit/Loss Proportion enters into play. As the name recommends, this statistics tracks the actions of lasting owners, informing if they are scheduling earnings or long-lasting losses.

Since this writing, this statistics has actually decreased from its height in March, showing that owners have actually minimized profit-taking task. This autumn resembles the 2021 cycle when Bitcoin’s rate decreased previously reactivating one more uptrend.

Find Out More: 7 Must-Have Cryptocurrencies for Your Profile Prior To the Following Bull Run

For that reason, if previous efficiencies influence future patterns, after that BTC, in addition to various other cryptos, may get to brand-new highs. The on-chain analytic system additionally concurs in its record dated August 20.

” Significantly, throughout the March 2024 ATH, this statistics got to a comparable elevation to previous market tops. In both the 2013 and 2021 cycles, the statistics decreased to comparable degrees before returning to an uptrend in rate,” Glassnode stated.

In recap, while some financiers continue to be hesitant regarding the existing market problems, numerous signs indicate this still being a booming market in spite of current volatility. The evaluation recommends that costs might remain to climb, pressing Bitcoin, Ethereum, and various other altcoins to brand-new highs and sustaining additional energy in this cycle.

Nevertheless, care is still encouraged. Increased volatility and regular drawdowns can bring about abrupt rate changes. If understood losses continue and control the marketplace, the existing cycle can change right into a bear stage.

Please Note

According to the Depend on Job standards, this rate evaluation post is for informative functions just and must not be thought about monetary or financial investment suggestions. BeInCrypto is dedicated to exact, impartial coverage, however market problems go through transform without notification. Constantly perform your very own study and seek advice from an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.