As Much As 60% of leading United States bush funds currently hold Bitcoin ETFs, a sharp rise because May. This change highlights increasing institutional fostering as even more typical financiers are attracted to crypto.

The January choice by the United States Stocks and Exchange Compensation (SEC) to accept Bitcoin (BTC) ETFs noted a turning point, supplying institutional financiers with straight accessibility to the crypto market.

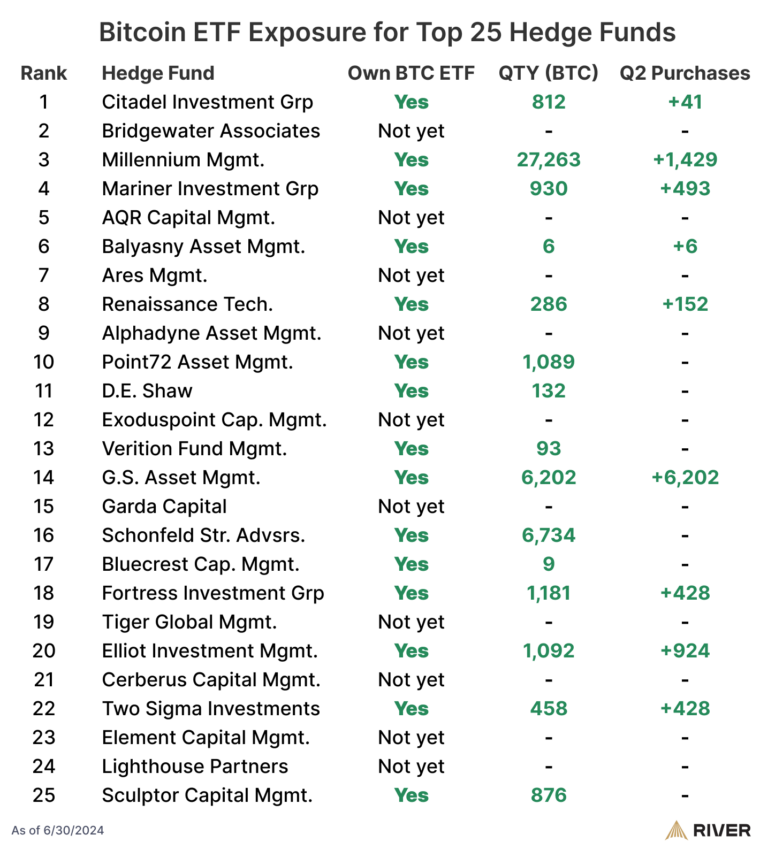

Bush Finances Crowding to Bitcoin ETFs

Sam Baker, a study expert at BTC-focused company River, keeps in mind that 60% of the biggest United States bush funds currently hold Bitcoin ETFs. None of these funds offered throughout Q2, with several remaining to boost their holdings.

Castle Investments, Centuries Administration, Sailor Financial Investment, and Citadel Financial investment are amongst the companies that included even more shares in Q2. In addition, 13 out of the 25 leading signed up financial investment experts (RIAs) in the United States currently have Bitcoin direct exposure with ETFs.

Furthermore, some, such as Cambridge Associates, Hightower Advisors, Moneta Team, and Cresset Property Administration, are gradually boosting their appropriations.

Find Out More: Just how To Profession a Bitcoin ETF: A Step-by-Step Strategy

Better, big establishments with over $1 billion in possessions under monitoring (AUM) have actually remained to boost their Bitcoin direct exposure. In Q2 alone, the variety of signed up financial investment experts (RIAs) with a Bitcoin appropriation expanded by 18%.

At the same time, the variety of hedge funds holding Bitcoin enhanced by 46%, showing the expanding self-confidence in Bitcoin amongst significant economic gamers.

For hedge funds, the rise to 60% notes a remarkable rise, up 8% because Might. As reported by BeInCrypto, around 52% of hedge funds had actually purchased Bitcoin ETFs since Might, designating approximately 2.1% of their profiles to BTC. This indicates increasing institutional excitement for Bitcoin.

Undoubtedly, establishments have actually taken advantage of the current market modification, getting the dip and revealing continual passion. According to funding compounder HODL15Capital, BTC ETF circulations have actually been net positive in 8 of the last 10 days.

In the middle of this expanding passion, BlackRock’s Bitcoin holdings are coming close to 350,000 BTC, ranking simply behind pseudonymous Bitcoin designer Satoshi Nakamoto and Binance. In a similar way, various other companies like Bitwise, Ark Investments, and Valkyrie Investments are proactively discovering growth possibilities.

Find Out More: Bitcoin (BTC) Cost Forecast 2024/2025/2030

Regardless of the duty of ETFs in including authenticity to crypto, some suggest that these economic tools avoid Satoshi’s vision. The problem is that as institutional risks expand, power changes back right into the hands of big entities, opposing crypto’s decentralized principles. This might cause Bitcoin and various other cryptocurrencies trading even more like typical supplies under Wall surface Road’s impact, thinning down the core concepts of decentralization.

” I still desire Bitcoin never ever obtained an ETF. It relocates slower than many supplies and has actually shed its interest trade. We changed amazing volatility with uninteresting security, simply what the fits and establishments desired,” said one customer on X.

Please Note

In adherence to the Trust fund Task standards, BeInCrypto is devoted to impartial, clear coverage. This newspaper article intends to give precise, prompt info. Nonetheless, visitors are suggested to validate truths individually and speak with a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.