PlanB, the pseudonymous maker of the Bitcoin (BTC) stock-to-flow design, shared a graph on X, recommending that the property’s rate might enhance fourfold from present degrees.

Bitcoin presently trades at $60,676, adhering to a 4% boost in the last 24 hr Yet will BTC’s rate get to $240,000 by the end of the booming market?

Bitcoin Eyes a Repeat of 2017 and 2021

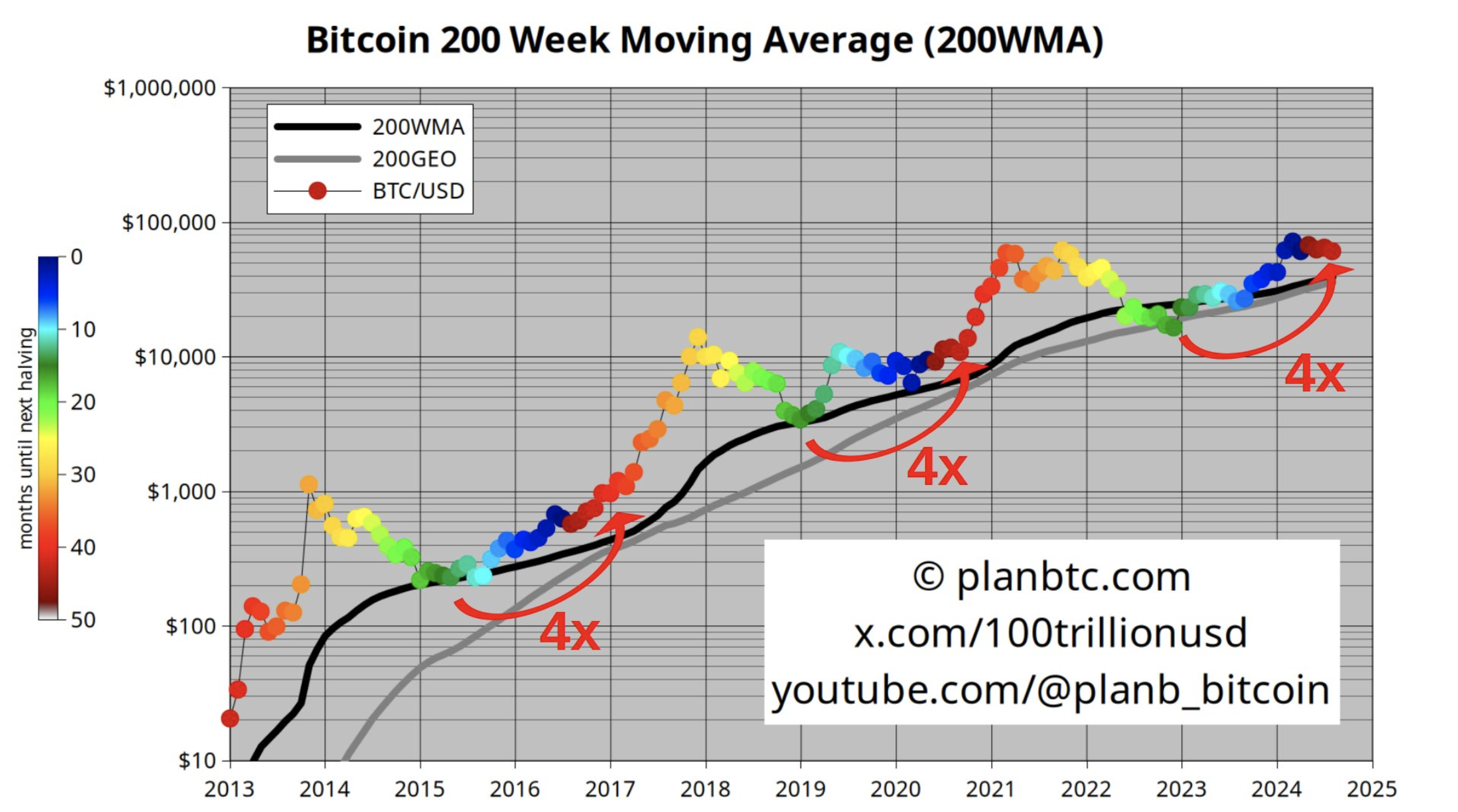

PlanB lately uploaded on X, highlighting exactly how Bitcoin’s rate has actually traditionally raised fourfold whenever it went across over the 200-week Relocating Ordinary (MA). The 200 MA is a widely-used technological evaluation device that assists recognize long-lasting fads for cryptocurrencies.

This indication is typically utilized to determine whether the pattern is favorable or bearish. Usually, when BTC climbs over the 200 MA, it signifies prospective rate development and recommends that the booming market is still undamaged.

Alternatively, a decrease listed below the 200 MA suggests that a lasting bull run might not yet be validated. In the graph shared by PlanB, he indicated the 2017 booming market, where at one phase, BTC dipped listed below $4,000, showing exactly how these activities can influence market belief.

Find Out More: 7 Ways To Endure the Crypto Bearish Market

By the top of the cycle, the rate raised to $17,760. Rapid onward to the 2020-2021 bull run, the coin was trading around $15,560 in November 2020 prior to escalating to $69,000 a year later on.

Surprisingly, at every factor in each cycle, BTC experienced a dull duration that saw the rate go through debt consolidation and modification. Yet in the long run, a significant rate pump shows up.

While background seldom duplicates itself, patterns typically rhyme. If previous fads are any type of indicator, BTC’s current rise to $73,750 might not note the top of this cycle. The booming market might still have even more area to run in advance.

No Bearish Market Right Here

If verified, this setting negates the indicators that the cycle is heading to a bearish market. Additionally, Fallback is not the just one that thinks the bearish market is not right here.

In a discussion with BeInCrypto, Lion Ardern, Head of BloFin Study & & Options, clarifies that the weak efficiency of BTC and various other cryptocurrencies does not totally presume that the booming market mores than.

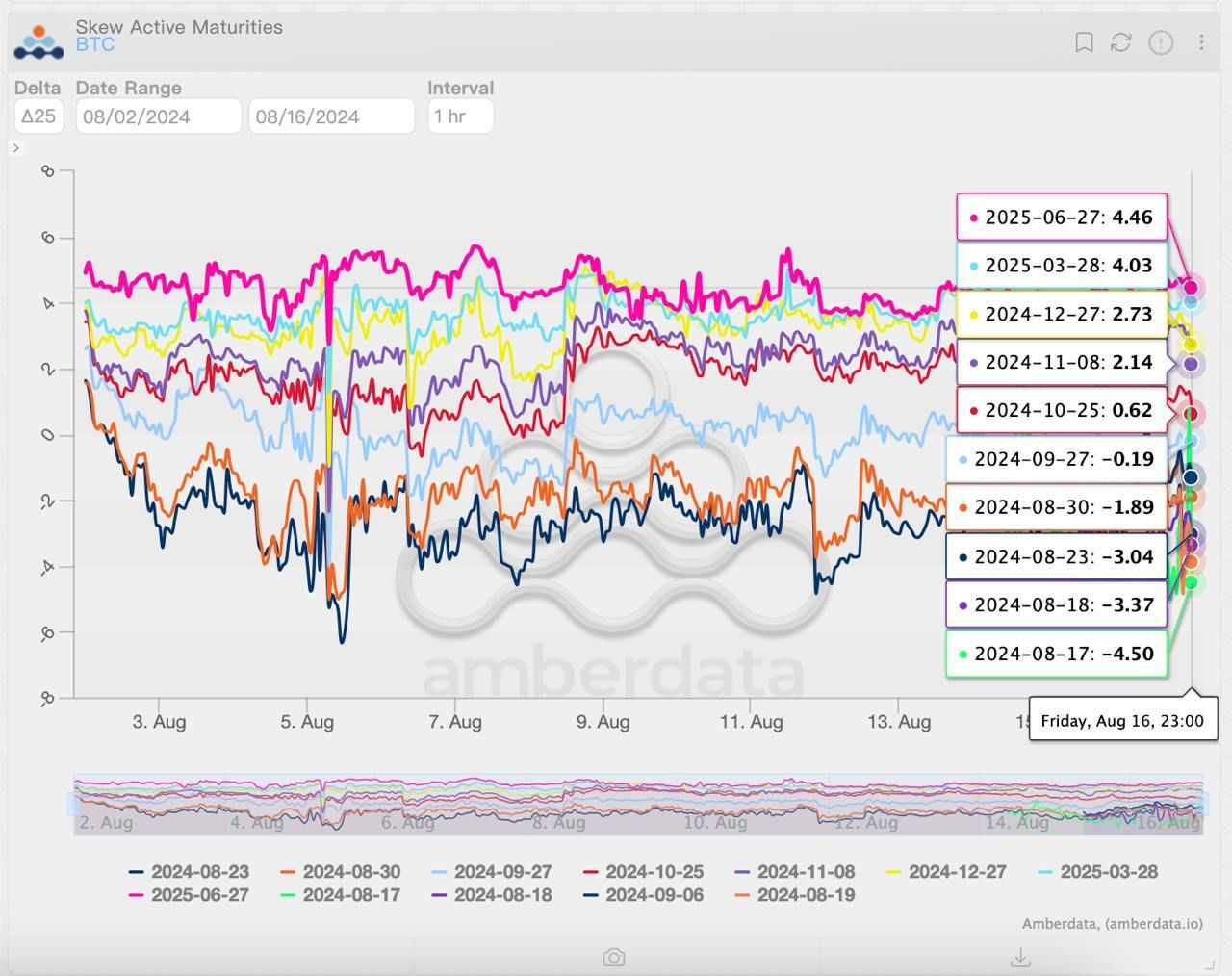

” Going by the efficiency of the choices market, investors anticipate that the bring profession take a break and liquidity alternative triggered by the rates of interest cut will certainly influence the efficiency of the crypto market in the short-term. Still, investors are normally favorable on cryptos’ tool- and long-lasting efficiency, which is totally various from the assumptions throughout the bearish market,” Ardern informed BeInCrypto

Ardern likewise included that BTC’s annualized indicated onward price is more than the safe price. In a bearish market, the price is typically reduced. This statistics typically mirrors favorable and bearish belief amongst choices investors, with the picture listed below lining up with a favorable understanding.

BTC Rate Forecast: The Race to the Leading Has Actually Simply Started

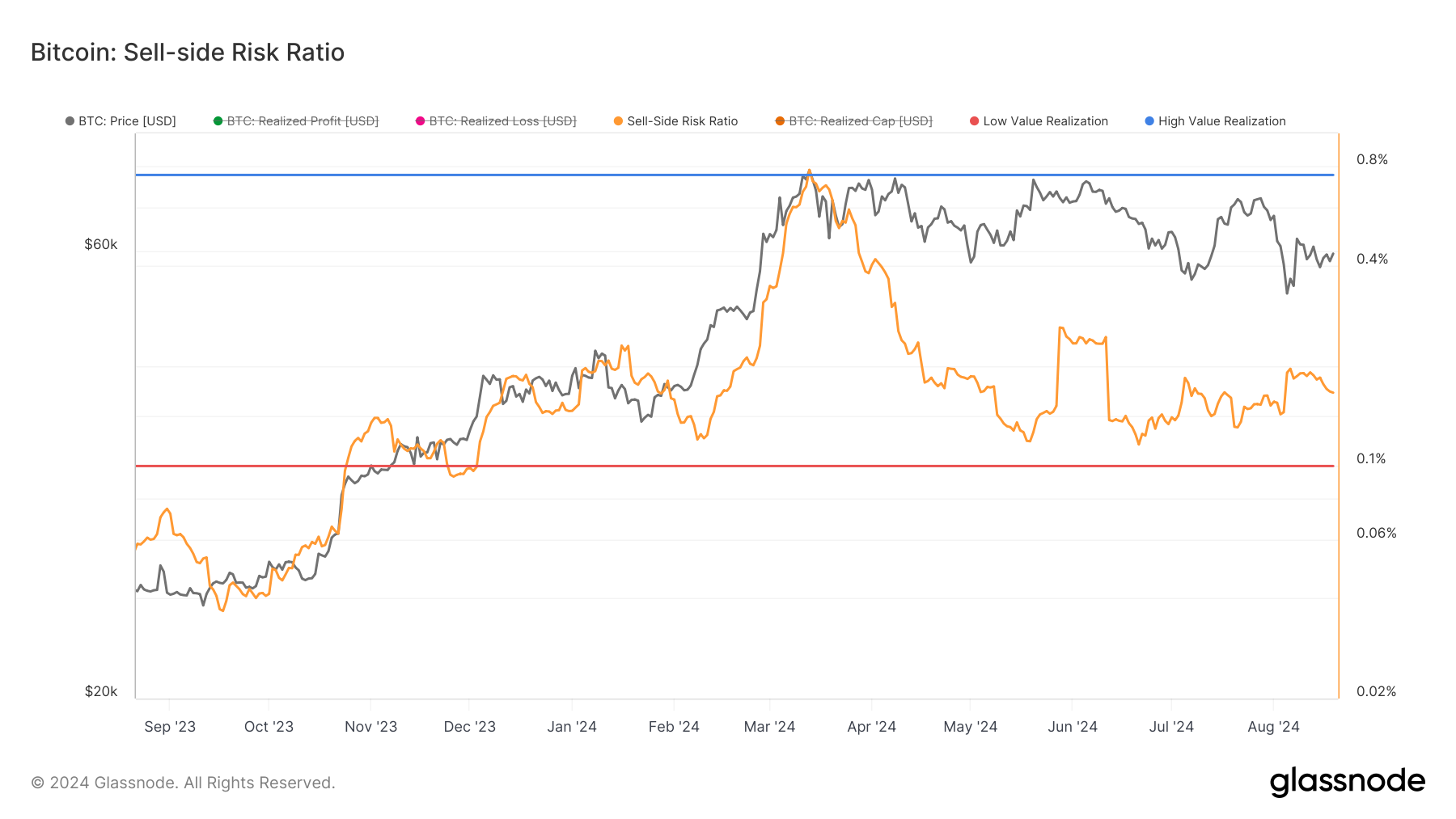

In addition, the evaluation over is sustained by the Bitcoin Sell-Side Threat Proportion. This proportion contrasts the complete worth of coins invested to the understood market capitalization.

High Sell-Side Threat Proportions generally straighten with the later phases of a booming market, showing reduced financier sentence and increased volatility. On the various other hand, a reduced proportion recommends lowered market volatility, typically seen throughout debt consolidation stages and sideways rate activities.

Such problems typically come before the beginning of a brand-new bull run. According to Glassnode, Bitcoin’s Sell-Side Threat Proportion has actually gone down to 0.16% from 0.71% in March, enhancing the sight that the present market might have extra upside capacity.

Find Out More: What Occurred at the Last Bitcoin Halving? Forecasts for 2024

Passing the regulations over and the current uneven nature of Bitcoin’s rate, the coin is close to all-time low. For this reason, while BTC might not get to $240,000 at the marketplace top, it shows up that the cycle is still in the onset of the booming market.

Nonetheless, if offering stress rises, the coin may experience one more disadvantage. If this holds true, BTC might go down listed below $60,000 once more.

Please Note

In accordance with the Trust fund Job standards, this rate evaluation write-up is for educational objectives just and need to not be thought about monetary or financial investment recommendations. BeInCrypto is devoted to exact, honest coverage, yet market problems undergo alter without notification. Constantly perform your very own study and speak with an expert prior to making any type of monetary choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.