Information from an on-chain evaluation company recommends that Bitcoin (BTC) miners’ capitulation might be finishing, signifying the beginning of a possible advancing market for Bitcoin.

As Bitcoin reveals indicators of healing, presently trading at $60,456 with an approximate 2.8% boost in the last 24-hour, the total market belief is transforming favorable. With miners no more under extreme stress to market, the marketplace problems are progressively for development.

Bitcoin Could Be at the Beginning of a Bull Run

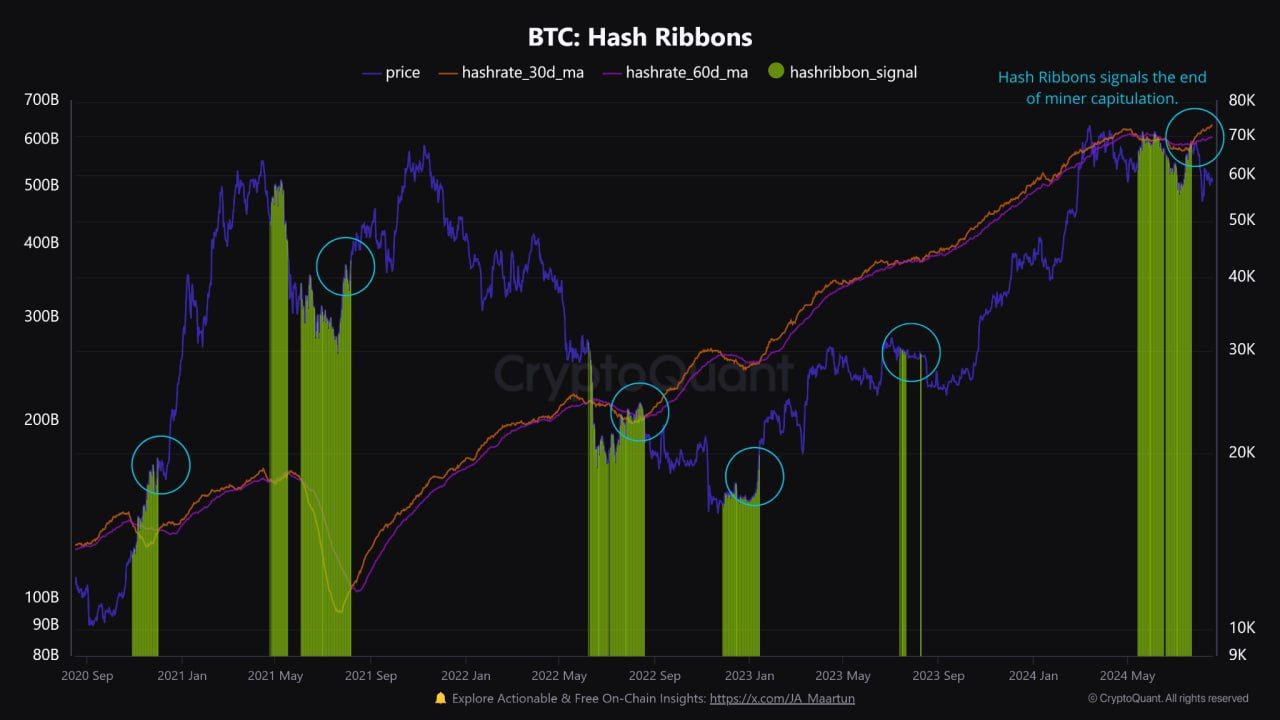

CryptoQuant highlights the Hash Ribbons sign, which observes the 30 and 60-day relocating standards of the Hash Price. This device has actually simply signified completion of miner capitulation, accompanying the Hash Price getting to a brand-new optimal of 638 exahash per 2nd (EH/s).

The growth is remarkable as it notes the very first such rebound considering that the Bitcoin halving, which decreased the block incentive for miners to regarding 3,125 BTC, or about $185,000.

” Although the sign isn’t indicated to determine the specific rate base, it usually comes before greater rates by signifying a decrease in marketing stress from miners,” CryptoQuant explained.

Learn More: Bitcoin (BTC) Rate Forecast 2024/2025/2030

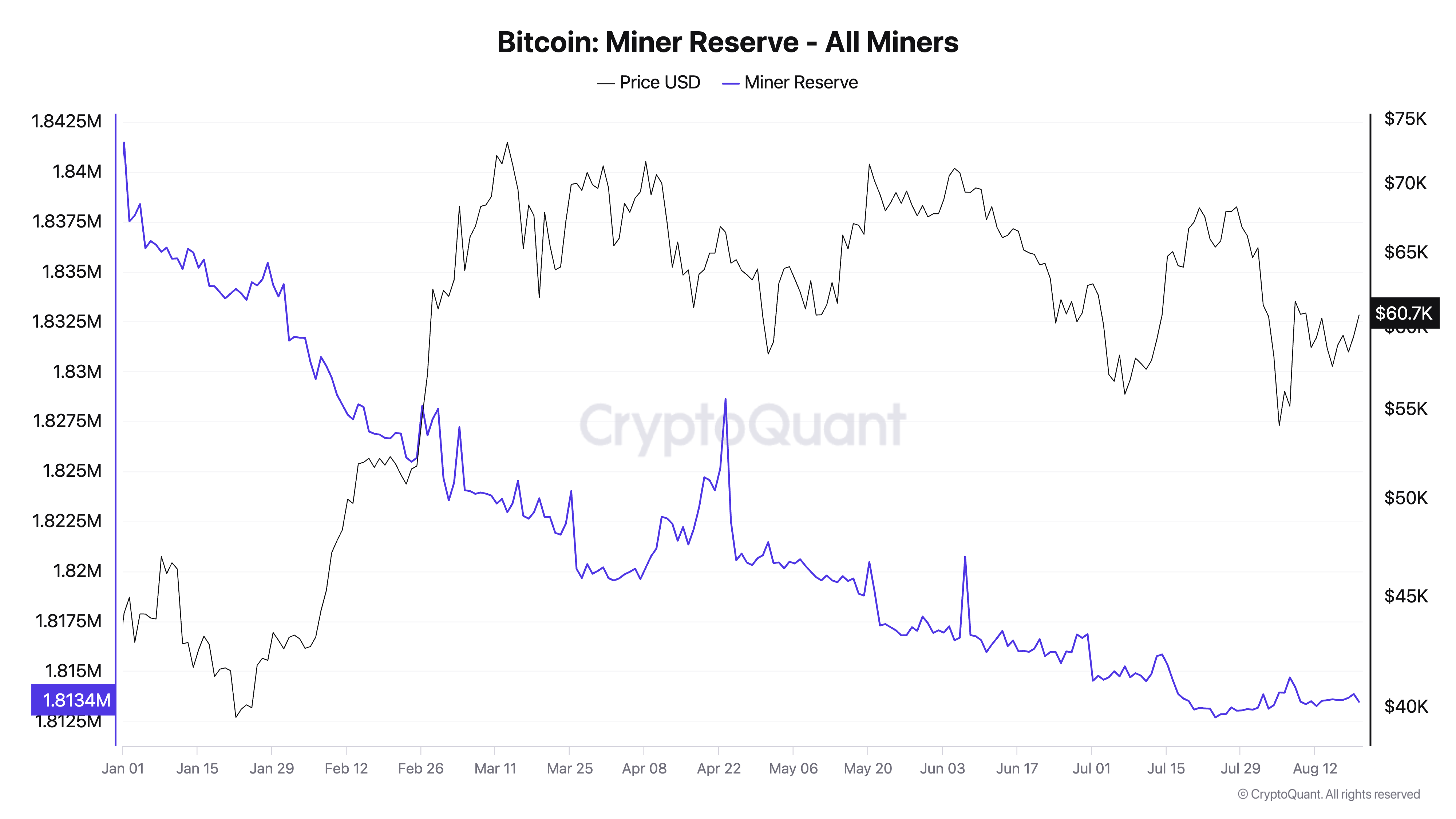

In late June, BeInCrypto reported degrees of miner capitulation similar to those seen throughout the FTX collapse. This resulted from high functional expenses going beyond the earnings from extracting the cryptocurrency. According to information from CryptoQuant, from January to August 2024, miners marketed around 28,018 BTC, valued at $1.68 billion at existing market value.

In a meeting with BeInCrypto, Maartunn, an expert at CryptoQuant, went over that with the financial stress on miners lowering, there is a minimized need for marketing extracted Bitcoin.

” In spite of the reduced mining benefits, extracting firm’s have actually located a means to maintain running their company and provide hashrate to the network. This implies that they can hold their Bitcoin book and do not need to market to cover mining expenses such as brand-new equipments, electrical energy, or personnel,” Maartunn informed BeInCrypto.

Furthermore, the on-chain need for Bitcoin recommends that the BTC debt consolidation stage might be nearing its end.

” After Bitcoin got to the $57,000 mark, there was a rise in the ordinary everyday token transfer quantity from $650,000 to $765,000. This accompanies Bitcoin’s rate stablizing in the regional debt consolidation variety of $57,000-$ 68,000,” Axel Adler Jr., an additional expert, observed.

This rise in transfer quantity is mostly as a result of worry marketing by owners. Nevertheless, Bitcoin’s rate has actually revealed durability, showing that the marketplace has actually properly soaked up the marketing stress.

Learn More: What Occurred at the Last Bitcoin Halving? Forecasts for 2024

The secure rate array throughout this duration indicate a strong need for Bitcoin, which financiers consider as wonderfully valued. Therefore, Adler Jr. thinks that BTC is coming close to the last stage of the marketplace debt consolidation. Additionally, the common pattern complying with a Bitcoin halving sustains an expectation for the approaching advancing market.

” The ordinary cycle begins 170 days after the Bitcoin halving. We’re presently at day 121,” crypto expert Quinten pointed out.

Please Note

In accordance with the Count on Task standards, this rate evaluation post is for informative objectives just and ought to not be taken into consideration monetary or financial investment recommendations. BeInCrypto is devoted to precise, objective coverage, however market problems undergo transform without notification. Constantly perform your very own research study and talk to an expert prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.