State Road has actually partnered with Swiss crypto company Taurus to release a brand-new solution that will certainly make it possible for the tokenization of real-world possessions. This calculated partnership intends to accommodate the expanding need amongst institutional financiers for electronic property solutions that mix standard and decentralized financing.

Tokenization is the procedure of transforming the possession civil liberties of standard possessions right into electronic symbols on a blockchain. Supporters suggest this procedure improves openness and safety and security, therefore streamlining trading procedures.

State Road Gets On the Tokenization of Real Life Possessions (RWA) Bandwagon

State Road, a US-based economic solutions business, currently provides crypto funds and offers bookkeeping solutions. This collaboration will certainly likewise handle safekeeping of customers’ crypto possessions and aid in developing tokenized possessions, consisting of different funds and protections.

Learn More: What is The Effect of Real Life Possession (RWA) Tokenization?

Donna Milrod, Principal Item Policeman at State Road and Head of Digital Possessions Solutions, stressed the brand-new solution’s dual-focus method.

” We require to offer our customers the capability to take care of both standard financing and electronic possessions alongside,” Milrod stated.

This solution reacts to institutional customers’ demand for trustworthy financial companions to function as custodians for their crypto holdings. It provides a much safer option to much less safe and secure crypto exchanges or budget service providers.

The intro of this solution is prompt. It lines up with the launch of numerous place Bitcoin and Ethereum exchange-traded funds this year, which have actually dramatically brought in institutional funding.

Institutional rate of interest in electronic possessions prolongs past State Road’s brand-new offerings. As an example, BlackRock released its initial tokenized fund, the BlackRock USD Institutional Digital Liquidity (BUIDL), on the Ethereum blockchain previously this year.

It has actually currently attained a market price of around $502 million. The fund stands for a considerable action in incorporating standard financing (TradFi) with decentralized financing (DeFi). It provides United States buck returns with raising rewards, indicating institutional hunger.

In A Similar Way, Franklin Templeton has actually ventured right into tokenization with its Franklin OnChain United States Federal Government Cash Fund (FOBXX), which lately broadened to the Arbitrum blockchain. This relocation becomes part of a more comprehensive technique to incorporate even more deeply with DeFi.

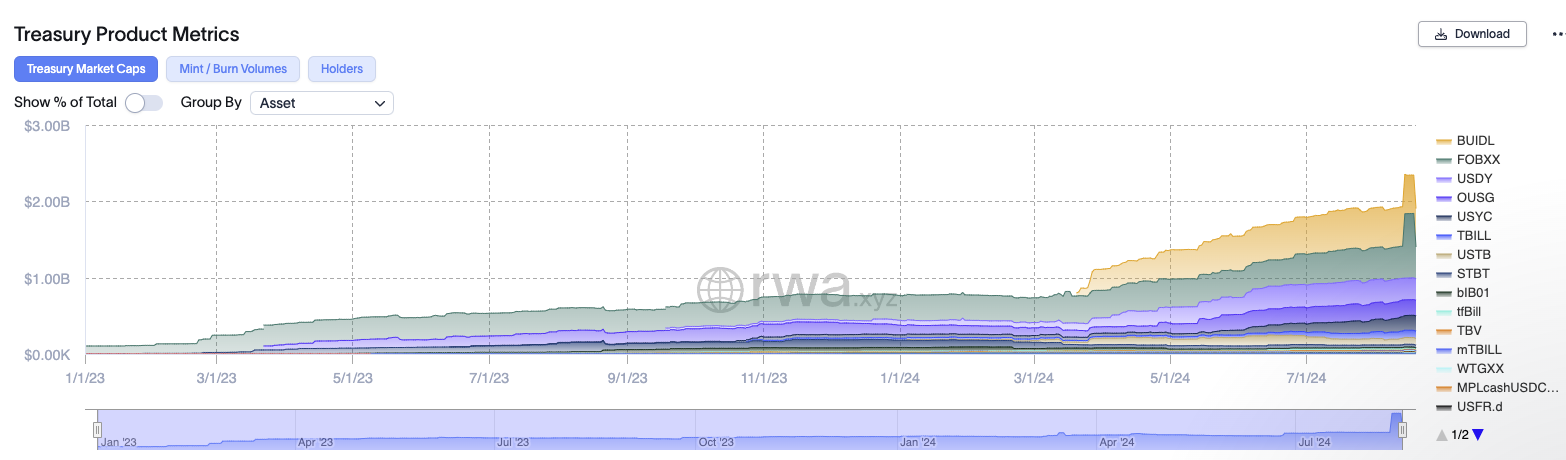

Furthermore, the tokenized United States Treasury protections market has actually likewise seen considerable development. Information from RWA.xyz suggests that this market’s complete market price broadened to $2.34 billion this year. Both BlackRock’s BUIDL and Franklin Templeton’s FOBXX are significant gamers in this field, adding extremely to the marketplace’s development.

Learn More: What is Tokenization on Blockchain?

The interest for tokenized possessions appears throughout different industries of the economic sector. According to Deloitte, the increasing returns returns from such funds show a clear choice amongst institutional financiers for items that use improved liquidity, access, and effectiveness contrasted to standard funds.

” While fund tokenization is not without its administration, lawful, and governing difficulties, it has the possible to change the form of exclusive property funds and settle the worries of regulatory authorities pertaining to such possessions. There are considerable advantages in regards to reduced expenses and greater earnings for provider and property supervisors. Capitalists discover the capability to expand their profiles and improve the liquidity of their financial investments extremely appealing”, Deloitte record read

Please Note

In adherence to the Count on Task standards, BeInCrypto is dedicated to impartial, clear coverage. This newspaper article intends to offer exact, prompt info. Nevertheless, visitors are encouraged to validate truths separately and talk to a specialist prior to making any kind of choices based upon this material. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.