The cryptocurrency market has actually seen substantial adjustments, leading numerous experts to warn versus purchasing altcoins.

Historically, booming market have actually seen Bitcoin and Ethereum climb initially, complied with by altcoins. Nonetheless, existing problems recommend a change in this pattern.

Why Purchasing Altcoins Currently Is Risky

Quinn Thompson, creator of the crypto bush fund Lekker Funding, advised versus purchasing altcoins currently. He indicated a number of indications of market instability, consisting of high utilize and open rate of interest, an absence of panic-driven purchasing, and stationary stablecoin supply.

He thinks the marketplace is experiencing enhanced marketing stress, specifically from financial backing funds requiring to increase funding, which results in even more marketing than purchasing. This circumstance, incorporated with reduced summertime trading quantities, makes it challenging for altcoins to obtain grip.

” I assume there is severe waterfall threat in crypto, and particularly, anticipate most altcoins to be secured back. The marketplace appears to have actually shed any type of capacity to jump, also in majors, while at the very same time, utilize and open rate of interest continues to be high,” Thompson claimed.

Thompson determined 2 key factors for his position. Initially, the effect of Bitcoin and Ethereum exchange-traded funds (ETFs) and the problem of altcoin supply rising cost of living.

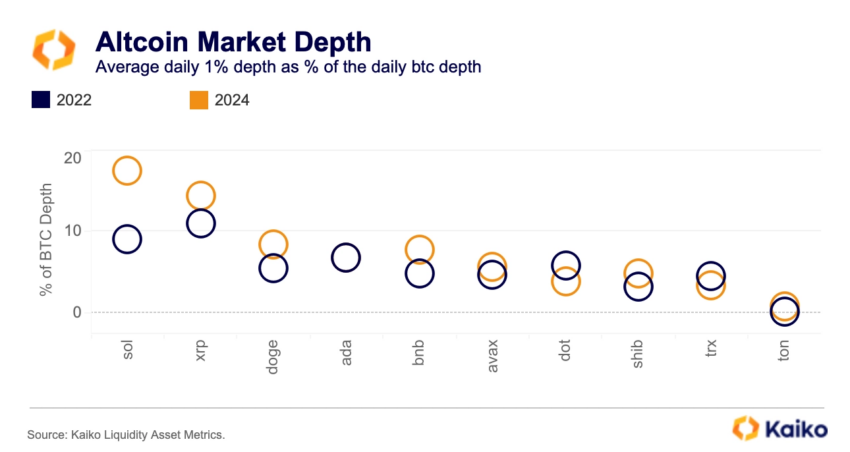

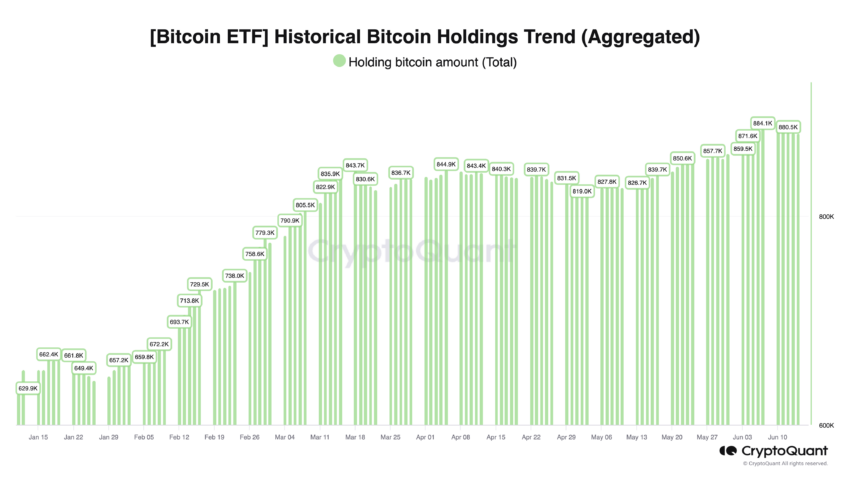

The intro of Bitcoin and Ethereum ETFs has actually altered the marketplace framework. In the past, funding would certainly move from significant cryptocurrencies like Bitcoin and Ethereum right into altcoins throughout booming market. Nonetheless, with over $50 billion currently purchased Bitcoin ETFs, these funds do not have comparable systems for purchasing altcoins.

This change has actually restricted the funding readily available to altcoins, making it harder for them to climb in worth. According to Samara Epstein Cohen, Principal Financial Investment Police Officer of ETF at BlackRock, standard market individuals significantly focus on Ethereum for tokenization, which additionally sidelines altcoins.

Learn More: Just How To Buy Real-World Crypto Possessions (RWA)?

The quick launch of brand-new altcoins has actually additionally swamped the marketplace, producing substantial inflationary stress. Lots of jobs launch big quantities of symbols boldy, causing a supply that much surpasses need.

Thompson explained that there is an absence of need to sustain the roughly $3 billion of month-to-month altcoin supply rising cost of living anticipated over the following one to 2 years. While some altcoins might still carry out well, recognizing these effective symbols will certainly be extra tough than in previous years.

” Altcoins have a consistent stream of sell stress. As we get in a currently low-volume summertime duration, the mix of substantial token supply opens and investor’ sell stress will likely be as well solid of an uphill struggle for the majority of symbols,” Thompson wrapped up.

On The Other Hand, Will certainly Clemente, founder of Reflexivity Research study, reviewed just how the marketplace has actually grown. In 2020, purchasing high-beta altcoins was a successful approach as these properties outshined Bitcoin. Nonetheless, this method is no more reliable.

Lots of altcoins have actually underperformed Bitcoin in current months, suggesting that the marketplace characteristics have actually altered.

” In 2020, you head out on the threat range, those points are mosting likely to have greater beta to Bitcoin and you simply obtain long all the software and all that things increases. We have actually not seen that this moment. A great deal of the altcoin to Bitcoin sets have actually simply been hemorrhaging out for a number of months currently and it hasn’t actually been as easy as simply acquire whatever software altcoin and you’ll surpass Bitcoin,” Clemente highlighted.

Technical expert Michaël van de Poppe highlighted that Bitcoin is near or at an all-time high, while the majority of altcoins have actually not reached their previous optimals. This inconsistency suggests an uncertainty in altcoins, which remain to have a hard time in the existing market atmosphere, recommending that the days of very easy gains from altcoins might be covered.

Learn More: 10 Finest Altcoin Exchanges In 2024

Capitalists need to understand the enhanced dangers and think about brand-new problems prior to choosing in the cryptocurrency market.

Please Note

In adherence to the Depend on Task standards, BeInCrypto is devoted to objective, clear coverage. This newspaper article intends to supply exact, prompt info. Nonetheless, visitors are recommended to validate truths individually and speak with a specialist prior to making any type of choices based upon this web content. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.