The cost of Injective (INJ) has actually climbed by 4.55% in the last 24-hour, complying with the combination of the Layer-1 blockchain by the Telegram-based job Toncoin (HEAP).

While the cost rise recommends a favorable market feedback to this growth, on-chain evaluation shows that INJ might maintain its higher energy. Right here’s why.

Injective Readies to Damage the Market Wall Surface

Previously today, BeInCrypto reported the combination, which will certainly see individuals connect INJ symbols to the lot blockchain and the other way around. Prior to the statement, INJ altered hands at $17.97.

Already, INJ is trading at $18.90 and might be positioned to retest $20 or greater. According to IntoTheBlock, the In/Out of Cash Around Rate (IOMAP) sign sustains this opportunity.

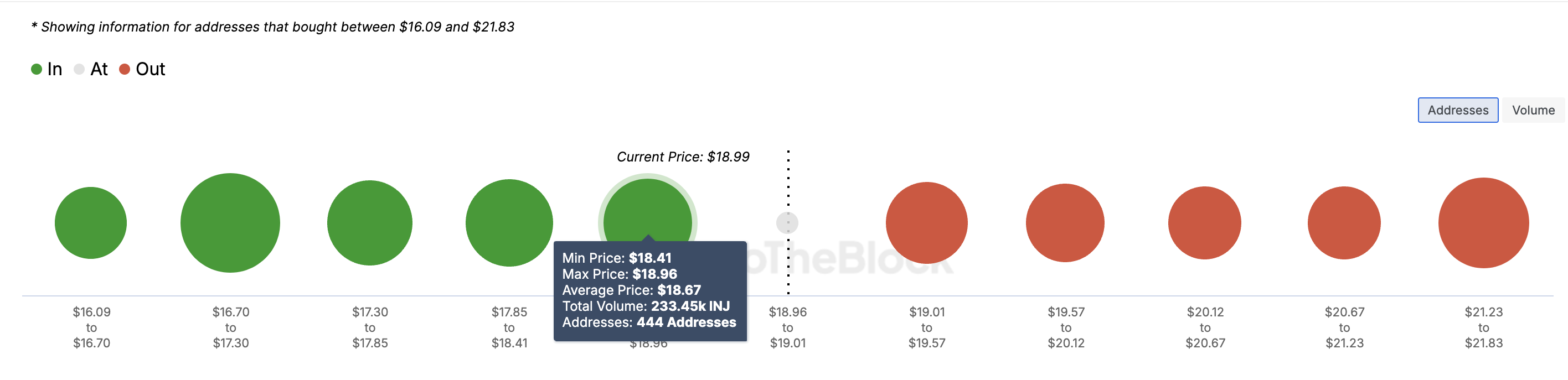

The IOMAP contrasts the token’s present cost with the ordinary acquisition price to identify if addresses remain in the cash, from it, or at breakeven. This category assists recognize locations of solid assistance or resistance.

Find Out More: Just How Will Expert System (AI) Transform Crypto?

Normally, when a a great deal of addresses remains in the cash at a certain cost variety, assistance is more powerful. Alternatively, if even more addresses run out the cash at a variety, resistance has a tendency to be more powerful.

As revealed over, 360 addresses got over 71,000 INJ at around $19.30 and are presently out of the cash. On the various other hand, 444 addresses built up 233,450 symbols at around $18.67 and are currently in revenue.

This recommends solid assistance in between $18.41 and $18.96. Offered this assistance, INJ’s cost is most likely to damage previous $19.30 in the short-term.

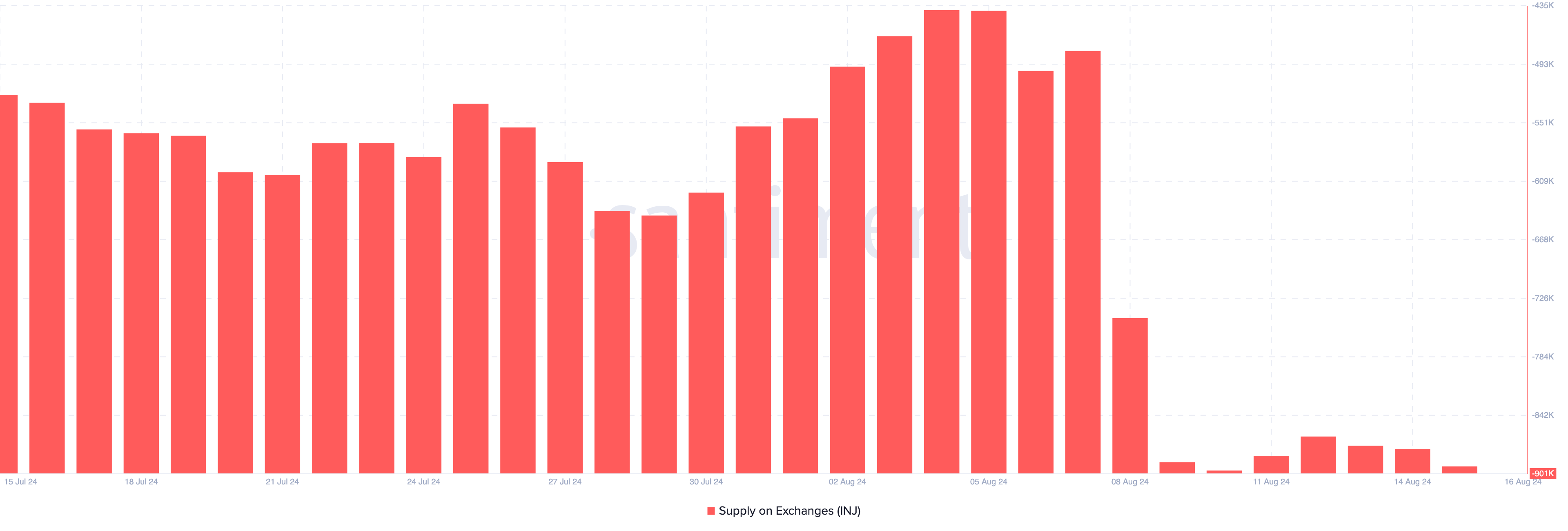

An additional statistics support this overview is INJ’s supply on exchanges. As the name recommends, this statistics tracks the variety of symbols moving in and out of crypto exchanges. When supply on exchanges rises, it shows that even more symbols are being sent out in, most likely signaling that owners are preparing to offer.

Nonetheless, at press time, on-chain information reveals that concerning 901,000 symbols have actually been taken out from exchanges. When this occurs, it suggests that owners hesitate to offer.

INJ Rate Forecast: The Token Will Not Decrease Without a Battle

Based upon the everyday graph, INJ has actually developed a dropping wedge. This favorable pattern shows up when a drop sheds energy, and customers take advantage of the fatigue to build up even more symbols.

BeInCrypto saw evidence of the boosted purchasing stress from the cash Circulation Index (MFI). In straightforward terms, the MFI utilizes the cost and quantity information to determine dealing stress.

When offering stress rises, the cash Circulation Index (MFI) analysis decreases. On the various other hand, an increase in the MFI recommends individuals are proactively acquiring, possibly driving the cost greater. For INJ, the sign presently signifies the last, showing higher stress.

Find Out More: 7 Must-Have Cryptocurrencies for Your Profile Prior To the Following Bull Run

If continual, this might press INJ’s cost to $20.22. Proceeded purchasing stress may also drive it towards the $21.67 resistance. Nonetheless, if the purchasing energy discolors, INJ might encounter a drop, possibly going down to $17.57.

Please Note

In accordance with the Count on Job standards, this cost evaluation write-up is for educational functions just and must not be thought about economic or financial investment guidance. BeInCrypto is devoted to precise, objective coverage, however market problems go through transform without notification. Constantly perform your very own study and seek advice from a specialist prior to making any kind of economic choices. Please keep in mind that our Conditions, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.