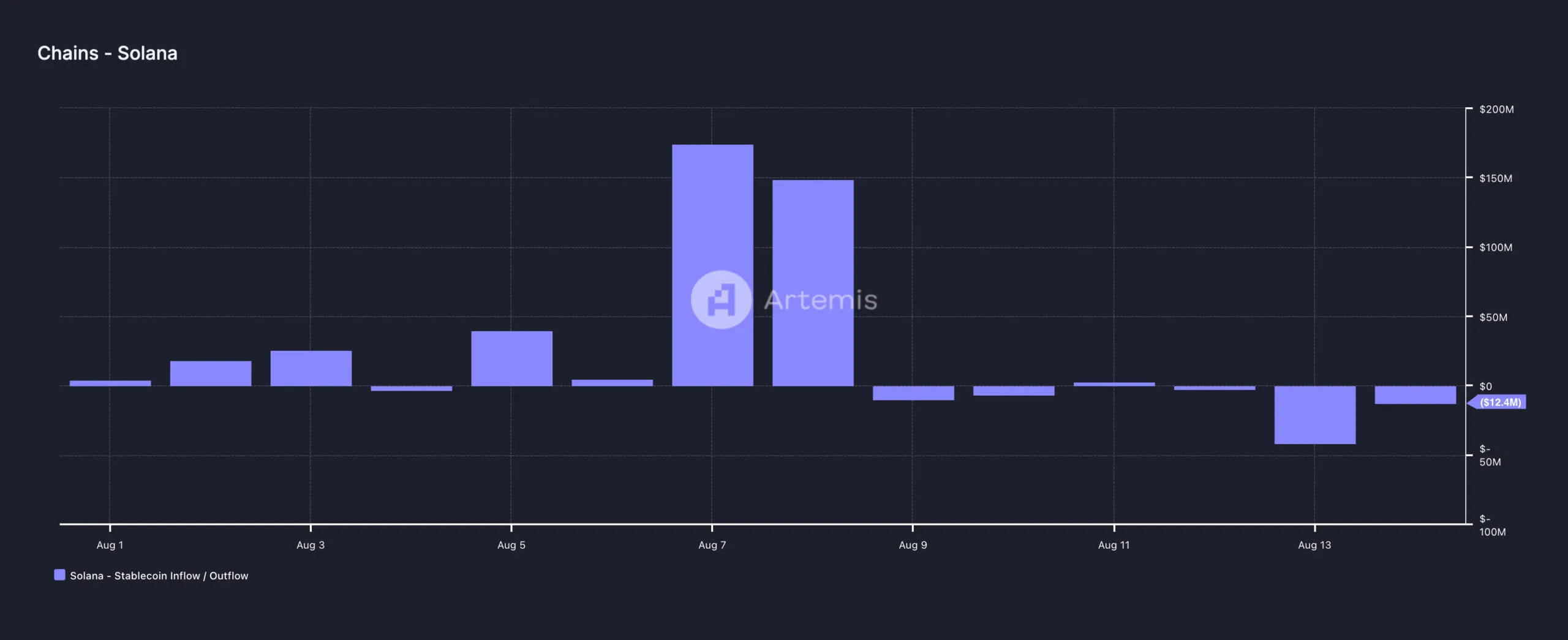

According to Artemis information, stablecoin discharge from Solana (SOL) reduced substantially from $41.20 million on August 14 to $12.40 million. This decrease can play a vital function in affecting SOL’s rate activity over the coming days.

Presently, SOL is trading at $143.36, noting an 8.82% decrease over the previous week. The decrease in discharge could aid support the rate, possibly reducing or perhaps stopping the sag if liquidity continues to be on the network.

Solana Faces Trick Transforming Factor

Stablecoin inflow or discharge usually suggests the degree of liquidity getting in or leaving a blockchain. A high quantity of stablecoins on a network normally signifies a possible rise popular for the network’s indigenous token.

As an example, on August 12, Solana saw extra stablecoin inflow than discharge, causing SOL’s rate retesting $150. Nonetheless, the list below days saw greater discharges, triggering SOL’s rate to dip as reduced as $137.97.

According to Artemis, the current decrease in stablecoin discharge can be a favorable sign for SOL. It recommends a possible change towards raised need for the cryptocurrency, which could aid support or perhaps increase its rate.

Learn More: 13 Ideal Solana (SOL) Pocketbooks To Take Into Consideration in August 2024

Besides this, Lookonchain reports that Circle provided USDC worth $250 million on Solana in the very early hours of August 16.

” Circle produced 250M USDC on Solana once more 5 hours back– an overall of 4.5 B $USDC on Solana because April 2,” the on-chain analytic deal with specified on X.

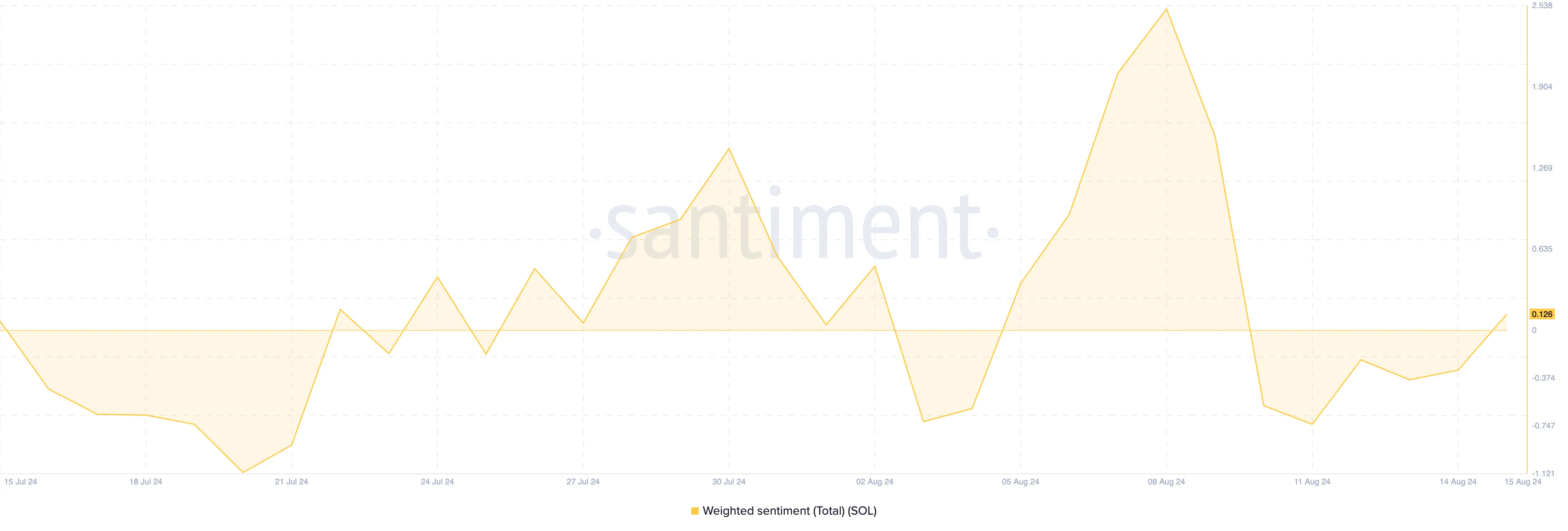

The current change in stablecoin moves appears to have actually influenced total belief around SOL. Originally, Santiment information revealed that Solana’s Weighted View had actually transformed adverse, showing expanding pessimism. Heavy View procedures whether remarks regarding a possession are mostly favorable or adverse, with an unfavorable analysis suggesting that downhearted comments exceed hopeful ones.

Nonetheless, the belief has actually because changed back right into favorable area, signifying restored temporary bullishness in the wider market. If this favorable overview proceeds, need for SOL can climb, possibly driving its rate greater.

SOL Rate Forecast: The Trip to $156 Begins

On the everyday graph, bulls seem protecting SOL from dropping listed below $140. This area is likewise a previous need area that has actually aided the token bounce. As an example, a huge selection of raised acquiring task on July 13 took place around the exact same location.

By July 21, SOL’s rate had actually gotten to $185. This does not imply that the pattern will certainly duplicate itself, however the rate is most likely to raise.

Making use of the Fibonacci retracement sign, BeInCrypto places possible assistance and resistance areas where the token might strike. From the graph below, SOL’s rate might leap to $146.05, and if acquiring stress boosts, the rate can strike $156.16.

Learn More: 6 Ideal Systems To Get Solana (SOL) in 2024

Nonetheless, an absence of need for the cryptocurrency might revoke this thesis. If this holds true, bulls might shed hold of the protection at $140, and the rate might reduce to $136.61.

Please Note

According to the Count on Job standards, this rate evaluation write-up is for educational objectives just and ought to not be thought about monetary or financial investment suggestions. BeInCrypto is dedicated to exact, objective coverage, however market problems undergo transform without notification. Constantly perform your very own research study and speak with a specialist prior to making any type of monetary choices. Please keep in mind that our Terms, Personal privacy Plan, and Please notes have actually been upgraded.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.

Ferdja Ferdja.com delivers the latest news and relevant information across various domains including politics, economics, technology, culture, and more. Stay informed with our detailed articles and in-depth analyses.